Exam 8: Segment and Interim Reporting

Exam 1: The Equity Method of Accounting for Investments118 Questions

Exam 2: Consolidation of Financial Information123 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition122 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership51 Questions

Exam 5: Consolidated Financial Statements - Intercompany Asset Transactions114 Questions

Exam 6: Variable Interest Entities, intercompany Debt, consolidated Statement of Cash Flows, and Other Issues115 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes115 Questions

Exam 8: Segment and Interim Reporting114 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk90 Questions

Exam 10: Translation of Foreign Currency Financial Statements94 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards58 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission74 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations82 Questions

Exam 14: Partnerships: Formation and Operation79 Questions

Exam 15: Partnerships: Termination and Liquidation73 Questions

Exam 16: Accounting for State and Local Governments, Part I72 Questions

Exam 17: Accounting for State and Local Governments,part II53 Questions

Exam 18: Accounting for Not-For-Profit Organizations58 Questions

Exam 19: Accounting for Estates and Trusts74 Questions

Select questions type

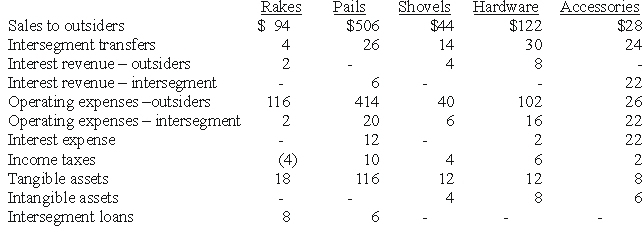

REFERENCE: Ref.08_04

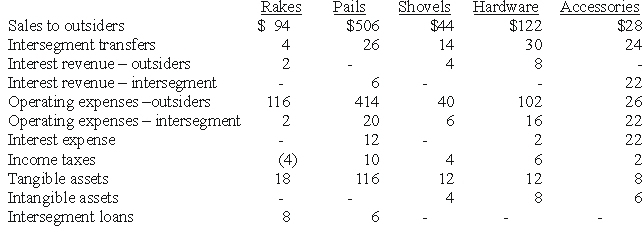

Dean Hardware,Inc.is comprised of five operating segments.Information about each of these segments is as follows (in thousands):  -Which operating segments are reportable under the revenue test?

-Which operating segments are reportable under the revenue test?

(Multiple Choice)

4.8/5  (30)

(30)

SFAS 14 required a U.S.corporation to disclose disaggregated information for

(Multiple Choice)

4.9/5  (38)

(38)

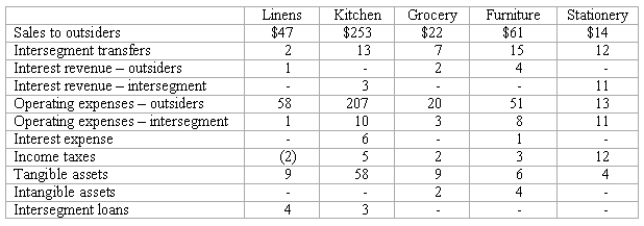

Blanton Corporation is comprised of five operating segments.Information about each of these segments is as follows (in thousands):  Required:

(a. )Which operating segments are reportable under the revenue test?

(b. )What is the total amount of revenues in applying the revenues test?

(c. )Which operating segments are reportable under the profit or loss test?

(d. )In applying the profit and loss test,what is the minimum amount an operating segment must have in order to meet the profit and loss test for a reportable segment?

(e. )Which operating segments are reportable under the asset test?

(f. )In applying the asset test,what is the minimum amount an operating segment must have in order to meet the asset test for a reportable segment?

(g. )Which operating segments are reportable?

(h. )According to the test results for reportable segments,is there a sufficient number of reported segments or should any additional segments also be disclosed? Explain the reason for your conclusion.

Required:

(a. )Which operating segments are reportable under the revenue test?

(b. )What is the total amount of revenues in applying the revenues test?

(c. )Which operating segments are reportable under the profit or loss test?

(d. )In applying the profit and loss test,what is the minimum amount an operating segment must have in order to meet the profit and loss test for a reportable segment?

(e. )Which operating segments are reportable under the asset test?

(f. )In applying the asset test,what is the minimum amount an operating segment must have in order to meet the asset test for a reportable segment?

(g. )Which operating segments are reportable?

(h. )According to the test results for reportable segments,is there a sufficient number of reported segments or should any additional segments also be disclosed? Explain the reason for your conclusion.

(Essay)

4.9/5  (37)

(37)

What general information about an operating segment needs to be disclosed per SFAS 131?

(Essay)

4.9/5  (32)

(32)

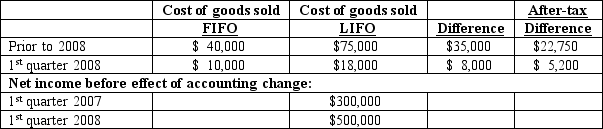

REFERENCE: Ref.08_10

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2008.Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding.The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2008,compute net income per common share.

-Assuming Baker makes the change in the first quarter of 2008,compute net income per common share.

(Multiple Choice)

4.8/5  (34)

(34)

REFERENCE: Ref.08_02

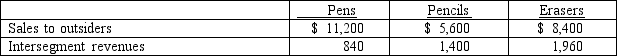

The Fratilo Co.had three operating segments with the following information:

In addition,revenues generated at corporate headquarters are $1,400.

-What is the minimum amount of revenue that each of these segments must earn to be considered separately reportable?

In addition,revenues generated at corporate headquarters are $1,400.

-What is the minimum amount of revenue that each of these segments must earn to be considered separately reportable?

(Multiple Choice)

4.7/5  (36)

(36)

REFERENCE: Ref.08_09

Provo,Inc.has an estimated annual tax rate of 35 percent in the first quarter of 2009.Pretax income for the first quarter was $300,000.At the end of the second quarter of 2009,Provo expects the annual tax rate to be 32 percent because of anticipated tax credits.Pretax income for the second quarter was $350,000.Assume no items in either quarter requiring the net-of-tax presentation.

-How much income tax expense is recognized in the second quarter of 2009?

(Multiple Choice)

4.9/5  (33)

(33)

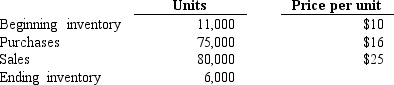

REFERENCE: Ref.08_15

The following information for Urbanski Corporation relates to the three months ending June 30,2009:

Urbanski uses the LIFO method to account for inventory,and expects at least 15,000 units to be on hand in the ending inventory at year-end.Purchases made in the last six months are expected to cost an average of $18 per unit.

-Prepare the journal entries to reflect the sales and cost of goods sold,assuming Urbanski does not expect to replace the liquidated inventory at year-end.

Urbanski uses the LIFO method to account for inventory,and expects at least 15,000 units to be on hand in the ending inventory at year-end.Purchases made in the last six months are expected to cost an average of $18 per unit.

-Prepare the journal entries to reflect the sales and cost of goods sold,assuming Urbanski does not expect to replace the liquidated inventory at year-end.

(Essay)

4.8/5  (32)

(32)

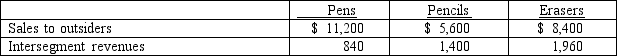

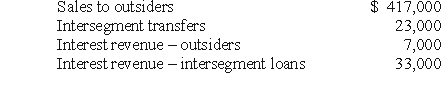

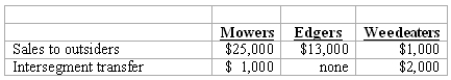

The hardware operating segment of Bloom Corporation has the following revenues for the year ended December 31,2008:  For purposes of the revenue test,what amount will be used as total revenues of the hardware operating segment?

For purposes of the revenue test,what amount will be used as total revenues of the hardware operating segment?

(Multiple Choice)

4.8/5  (45)

(45)

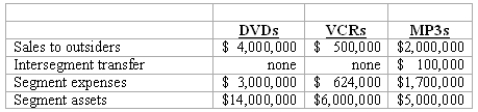

REFERENCE: Ref.08_07

Elektronix,Inc.has three operating segments with the following information:  In addition,revenues generated at corporate headquarters are $300,000,and common assets are $16,000,000.

-Which operating segments are separately reportable under the revenues test?

In addition,revenues generated at corporate headquarters are $300,000,and common assets are $16,000,000.

-Which operating segments are separately reportable under the revenues test?

(Multiple Choice)

5.0/5  (38)

(38)

Which of the following must be disclosed by a geographic segment according to SFAS 131?

(Multiple Choice)

4.8/5  (41)

(41)

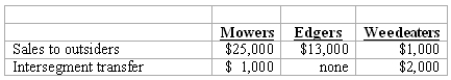

REFERENCE: Ref.08_06

Peterson Corporation has three operating segments with the following information:  In addition,revenues generated at corporate headquarters are $2,000.

-What is the minimum amount of revenue an operating segment must have to be considered a reportable segment?

In addition,revenues generated at corporate headquarters are $2,000.

-What is the minimum amount of revenue an operating segment must have to be considered a reportable segment?

(Multiple Choice)

4.8/5  (22)

(22)

What term,per SFAS 14,is used for an industry segment that makes up more than ninety percent of a company's revenues,operating profit or loss,and identifiable assets?

(Essay)

4.8/5  (28)

(28)

For purposes of the profit or loss test,segment C's operating profit or (loss)is

(Multiple Choice)

4.7/5  (36)

(36)

What revenues and expenses included in segment profit or loss need to be disclosed per SFAS 131?

(Essay)

4.7/5  (45)

(45)

REFERENCE: Ref.08_02

The Fratilo Co.had three operating segments with the following information:

In addition,revenues generated at corporate headquarters are $1,400.

-Combined segment revenues are calculated to be

In addition,revenues generated at corporate headquarters are $1,400.

-Combined segment revenues are calculated to be

(Multiple Choice)

4.8/5  (38)

(38)

REFERENCE: Ref.08_04

Dean Hardware,Inc.is comprised of five operating segments.Information about each of these segments is as follows (in thousands):  -Which operating segments are reportable under the profit or loss test?

-Which operating segments are reportable under the profit or loss test?

(Multiple Choice)

4.9/5  (41)

(41)

REFERENCE: Ref.08_06

Peterson Corporation has three operating segments with the following information:  In addition,revenues generated at corporate headquarters are $2,000.

-What amount of revenues must be generated from one customer before that party must be identified as a major customer?

In addition,revenues generated at corporate headquarters are $2,000.

-What amount of revenues must be generated from one customer before that party must be identified as a major customer?

(Multiple Choice)

4.8/5  (41)

(41)

According to SFAS 131,which of the following would be an acceptable grouping of countries for providing information by geographic area for a United States company?

(Multiple Choice)

5.0/5  (35)

(35)

Showing 21 - 40 of 114

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)