Exam 6: Break-Even and Cost-Volume-Profit Analysis

Exam 1: Review of Arithmetic103 Questions

Exam 2: Review of Basic Algebra193 Questions

Exam 3: Ratio, Proportion, and Percent152 Questions

Exam 4: Linear Systems81 Questions

Exam 5: Trade Discount, Cash Discount, Markup, and Markdown119 Questions

Exam 6: Break-Even and Cost-Volume-Profit Analysis24 Questions

Exam 7: Simple Interest95 Questions

Exam 8: Simple Interest Applications63 Questions

Exam 9: Compound Interest - Future Value and Present Value123 Questions

Exam 10: Compound Interest - Further Topics53 Questions

Exam 11: Ordinary Simple Annuities76 Questions

Exam 12: Ordinary General Annuities74 Questions

Exam 13: Annuities Due, Deferred Annuities, and Perpetuities132 Questions

Exam 14: Amortization of Loans, Including Residential Mortgages59 Questions

Exam 15: Bond Valuation and Sinking Funds81 Questions

Exam 16: Investment Decision Applications56 Questions

Select questions type

A company has variable costs that are 3/8 the value of their sales revenues. Total net income for the most recent period was a profit of $123 400 and sales were $400 000. The company has started a new marketing campaign that they hope will increase sales, but it will require additional advertising of $11 200. How many sales dollars does the company have to generate in order to remain at the same level of profitability as before the new ad campaign?

Free

(Multiple Choice)

4.8/5  (46)

(46)

Correct Answer:

D

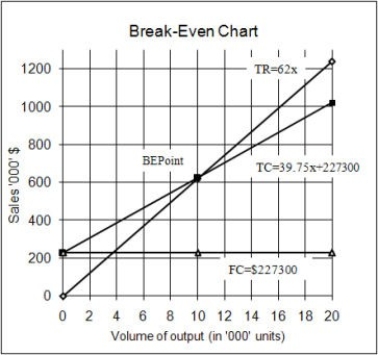

The Excellent DVD Company sells DVDs for $62 each. Manufacturing cost is $22.70 per DVD; marketing costs are $7.75 per DVD; and royalty payments are 15% of the selling price. The fixed cost of preparing the DVDs is $227 300. Capacity is 20 000 DVDs.

a) Draw a detailed break-even chart.

b) Compute the break-even point

(i) in units;

(ii) in dollars;

(iii) as a percent of capacity.

c) Determine the break-even point in units if fixed costs are increased by $3300 while manufacturing cost is reduced $1.65 per DVD.

d) Determine the break-even point in units if the selling price is increased by 10% while fixed costs are increased by $2900.

Free

(Essay)

4.9/5  (30)

(30)

Correct Answer:

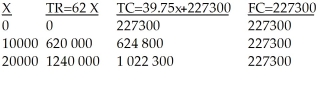

a) Let the number of DVDs be x.

Total Revenue: TR = 62x

VC = 22.70 + 7.75 + 0.15(62) = $39.75

Total cost: TC = 227 300 + 39.75x

b) VC = $39.75

b) VC = $39.75

i) TR = TC

62x = 39.75x+227 300

x=  =10215.73 = 10216 units (rounded up)

=10215.73 = 10216 units (rounded up)

ii) BE point in sales dollars $62(10216) = $633 392.

iii) BE point as a % of capacity  = 51.08%

= 51.08%

c) FC=227 300+3 300=$230 600, VC=(22.70-1.65)+7.75+0.15(62)=$38.10

62x=38.10x+230 600

x =  = 9 648.53=9 649 units.

= 9 648.53=9 649 units.

d) VC = 22.70 + 7.75 + .15(62 ∗ 1.1)=$40.68

P=1.1($62)=$68.20

68.20x=40.68x+230200

x =  =8 259.4=8 365 units

=8 259.4=8 365 units

A company has variable costs that are 4/7 the value of their sales revenues. Total net income for the most recent period was a profit of $53 770 and sales were $420 000. The company has started a new marketing campaign that they hope will increase sales, but it will require additional advertising of $6 400. How many sales dollars does the company have to generate in order to remain at the same level of profitability as before the new ad campaign?

Free

(Multiple Choice)

4.9/5  (29)

(29)

Correct Answer:

A

Olfert Greenhouses has compiled the following estimates for operations.

Sales $150 000

Fixed cost $45 200

Variable costs 67 500 112 700

Net income $37 300

Capacity is a sales volume of $175 000.

Perform a break-even analysis showing

a) an algebraic statement of

(i) the revenue function;

(ii) the cost function;

b) a detailed break-even chart.

(Essay)

4.9/5  (40)

(40)

A local health care facility has fixed costs per month of $187 400. They also have patient costs of $4.15 per day per patient for linen and cleaning, medication costs are $23.32 per patient per day and lab tests cost $75.61 per patient per day. The government is considering allowing the health care facility to charge each patient and amount to recover his or her costs and to make a "profit" of $15 000 per month. The health care facility averages 690 patients per month. The VP- Finance for the facility wants you to calculate the daily rate charge per patient. Your answer is:

(Multiple Choice)

4.8/5  (33)

(33)

A local toolmaker makes the best hammers on the market. The head of the hammer costs $12.11 and the handle costs $4.37. It takes 1.4 minutes to assemble the hammer and the hourly cost is $90.00 for assembly time. The company has fixed operating costs of $22 310 per month. They sell the hammers for three times their total variable cost. The company wants to make a monthly profit of $5000. How many hammers must they sell?

(Multiple Choice)

4.8/5  (36)

(36)

A company that makes cell phones has the following cost structure. The have fixed costs of $145 000 per period and manufacturing costs of $15.16 per cell phone. Advertising is expected to be $25 000 per period and a special promotional contest will involve providing a free case for a cost of $5.30 per cell phone. Each cell phone sells for $49.95. What is the break-even point in the number of phones?

(Multiple Choice)

5.0/5  (43)

(43)

A company has variable costs that are 1/8 the value of their sales revenues. Total net income for the most recent period was a profit of $50 400 and sales were $500 000. The company has started a new marketing campaign that they hope will increase sales, but it will require additional advertising of $15 000. How many sales dollars does the company have to generate in order to remain at the same level of profitability as before the new ad campaign?

(Multiple Choice)

4.8/5  (40)

(40)

A local college hospitality restaurant has the best meals in town. The average variable cost per meal is $10.25 and the desserts are $1.25. The restaurant has fixed operating costs of $110 500 per month. They sell the meals and desserts for three times their average variable cost per meal. The college wants to make a monthly profit of $50 000. How many meals must they sell (Round up to nearest whole meal)?

(Multiple Choice)

4.8/5  (40)

(40)

A company that makes customized pens has calculated their revenue and costs as follows for the most recent fiscal period: Sales $100 000

Costs:

Fixed Costs $???????

Variable Costs 15 000

Total Costs ???????

Net Income (Loss) $(20 000)

What are the company's fixed costs per fiscal period?

(Multiple Choice)

4.8/5  (41)

(41)

A company that makes environmental measuring devices has calculated their revenue and costs as follows for the most recent fiscal period: Sales $750 000

Costs:

Fixed Costs $200 000

Variable Costs 250 000

Total Costs 450 000

Net Income $300 000

What is the break-even point in sales dollars?

(Multiple Choice)

4.8/5  (34)

(34)

Last year a printing company had total sales of $37 500. The total of its variable costs was

$15 000, and fixed costs were $18 000.

Capacity is at sales maximum of $50 000.

a) Calculate the break-even point in

(i) dollars of sales

(ii) as a percent of capacity

b) Draw a detailed break-even chart

(Essay)

4.7/5  (44)

(44)

A pen manufacturer makes luxury pens. The pen case costs $7.26 each, the ink holder costs $1.26 each, the spring costs $.07 each and the velvet pen case costs $0.91 each. The plant has general and administrative costs of $55 000 and fixed selling expenses of $37 500. The pens sell of $39.95 each. Plant capacity is 4 000 pens per period. At what percentage of capacity is the break-even point?

(Multiple Choice)

4.9/5  (36)

(36)

A company that makes basketballs has calculated their revenue and costs as follows for the most recent fiscal period: Sales $623 000

Costs:

Fixed Costs $???????

Variable Costs 404 880

Total Costs ???????

Net Income (Loss) $(26 880)

What are the company's fixed costs per fiscal period?

(Multiple Choice)

4.9/5  (36)

(36)

A company that makes optical computer input devices has calculated their revenue and costs as follows for the most recent fiscal period: Sales $522 000

Costs:

Fixed Costs $145 000

Variable Costs 208 800

Total Costs 353 800

Net Income $168 200

What is the break-even point in sales dollars?

(Multiple Choice)

4.7/5  (42)

(42)

Priest and Sons, a local manufacturer of a product that sells for $13.50 per unit. Variable cost per unit is $7.85 and fixed cost per period is $1 220. Capacity per period is 1100 units.

Perform a break-even analysis showing

a) an algebraic statement of

(i) the revenue function;

(ii) the cost function;

(iii) calculate the break-even point in units.

b) a detailed break-even chart.

(Essay)

4.9/5  (32)

(32)

A manufacturer plans to introduce a new type of shirt based on the following information.

The selling price is $57.00; variable cost per unit is $18.00; fixed costs are $7800.00; and capacity per period is 500 units.

a) Calculate the break-even point

(i) in units

(ii) in dollars

(iii) as a percent of capacity

b) Draw a detailed break-even chart.

c) Calculate the break-even point (in units) if fixed costs are reduced to $7020.00

d) Calculate the break-even point (in dollars) if the selling price is increased to $78.00

(Essay)

4.7/5  (34)

(34)

A local restaurant has the best meals in town. The average variable cost per meal is $22.74 and the desserts are $5.24. Only half of the patrons order desserts. The restaurant has fixed operating costs of $112 714 per month. They sell the meals and desserts for four times their average variable cost per meal. The company wants to make a monthly profit of $75 000. How many meals must they sell?

(Multiple Choice)

4.8/5  (46)

(46)

The gas division of Power-U-Up plans to introduce a new gas delivery system based on the following accounting information.

Fixed costs per period are $4 236; variable cost per unit is $168;

selling price per unit is $211; and capacity per period is 450 units.

a) Draw a detailed break-even chart

b) Compute the break-even point

(i) in units;

(ii) as a percent of capacity;

(iii) in dollars.

c) Determine the break-even point as a percent of capacity

(i) if fixed costs are reduced to $3 788;

(ii) if fixed costs are increases to $5 577 and variable costs are reduced to 75% of the selling price;

(iii) if the selling price is reduced to $191.

(Essay)

4.8/5  (40)

(40)

Trevor, the new owner of the vehicle accessory shop is considering buying sets of winter tires for $299 per set and selling them at $520 each. Fixed costs related to this operation amount to $3 250 per month. It is expected that 18 sets per month could be sold. How much profit will Trevor make each month?

(Essay)

4.8/5  (41)

(41)

Showing 1 - 20 of 24

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)