Exam 16: Investment Decision Applications

Exam 1: Review of Arithmetic103 Questions

Exam 2: Review of Basic Algebra193 Questions

Exam 3: Ratio, Proportion, and Percent152 Questions

Exam 4: Linear Systems81 Questions

Exam 5: Trade Discount, Cash Discount, Markup, and Markdown119 Questions

Exam 6: Break-Even and Cost-Volume-Profit Analysis24 Questions

Exam 7: Simple Interest95 Questions

Exam 8: Simple Interest Applications63 Questions

Exam 9: Compound Interest - Future Value and Present Value123 Questions

Exam 10: Compound Interest - Further Topics53 Questions

Exam 11: Ordinary Simple Annuities76 Questions

Exam 12: Ordinary General Annuities74 Questions

Exam 13: Annuities Due, Deferred Annuities, and Perpetuities132 Questions

Exam 14: Amortization of Loans, Including Residential Mortgages59 Questions

Exam 15: Bond Valuation and Sinking Funds81 Questions

Exam 16: Investment Decision Applications56 Questions

Select questions type

A company is looking to invest in a very risky project. They have a required rate of return of 27% compounded annually. The project has the following cash inflows: Year 1 $17500, Year 2 $15000, Year 3 $27500. It also has the following cash outflows: Immediately -$10000, Year 1 -$15000, Year 3 -$9500. What is the NPV?

Free

(Multiple Choice)

4.7/5  (30)

(30)

Correct Answer:

B

The introduction of a new product requires an immediate outlay of $145 000 and has a residual value of $30 000 after 10 years. The anticipated net returns from the marketing of the product are expected to be $25 500 per year for ten years. What is the rate of return on the investment (correct to the nearest tenth of a percent)?

a) Use linear interpolation to find the approximate value of the rate of return.

b) Find the answer using Cash Flow and IRR.

Free

(Essay)

4.9/5  (34)

(34)

Correct Answer:

PVOUT = 145 000 - 30 000  ;

;

PVIN = 25 500  NPV = PVIN - PVOUT

NPV = PVIN - PVOUT

Index =  ×100%; Increase/Decrease in Rate =

×100%; Increase/Decrease in Rate =  /4 rounded.

/4 rounded.

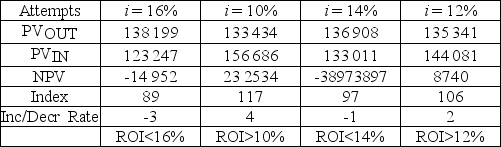

Calculations below show the attempts in approximating the ROI

Hence, 12% < ROI < 14%. Use linear approximation to find the approximate value of ROI.

Hence, 12% < ROI < 14%. Use linear approximation to find the approximate value of ROI.

d =  = 1.38%

= 1.38%

The rate of return, correct to the nearest tenth of a percent, is 13.4%

b) CF0= 145 000 ±

C01 = 25 500 F01 = 9

C02 = 55 500 F02 = 1

Compute IRR = 13.353832 = 13.4%

An expenditure may be met by outlays of $3 000 now and $1000 at the end of every six months for 5 years or by making monthly payments of $250 in advance for three years. Interest is 12% compounded annually.

Compute the present value of each alternative and determine the preferred alternative according to the discounted cash flow criterion.

Free

(Essay)

4.8/5  (35)

(35)

Correct Answer:

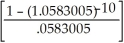

ALT. 1 p =  - 1 = .05833005

- 1 = .05833005

= 3000.00 + 1000.00  = 3000.00 + 1000.00(7.419712748) = 3000.00 +7419.71 = $10419.71=$10 420.

= 3000.00 + 1000.00(7.419712748) = 3000.00 +7419.71 = $10419.71=$10 420.

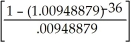

ALT. 2 p =  - 1 = .00948879

- 1 = .00948879

= 250.00  (1.00948879)

(1.00948879)

= 250.00(30.3747539)(1.009488793) = $7665.74=$7 666 BEST

You win a lottery and have a choice of taking $200 000.00 immediately or taking payments of $8000.00 at the end of every three months for ten years. Which offer is preferable if interest is 8% compounded quarterly?

(Essay)

4.8/5  (27)

(27)

Replacing old equipment at an immediate cost of $5 000 and $7 000 six years from now will result in a savings of $3000 semi-annually for ten years. At 11% compounded annually, should the old equipment be replaced?

(Essay)

4.7/5  (39)

(39)

A contract is estimated to yield net returns of $7000.00 quarterly for seven years. To secure the contract, an immediate outlay of $80 000.00 and a further outlay of $60 000.00 three years from now are required. If interest is 6% compounded quarterly, determine if the investment should be accepted or rejected.

(Essay)

4.8/5  (40)

(40)

What is the IRR for the following net annual cash flows today -$45000, Year 1 +$12000, Year 2 +$37000, Year 3 +$12000, Year 4 +$17000?

(Multiple Choice)

4.8/5  (34)

(34)

A piece of property may be acquired by making an immediate payment of $125 000 and payments of $37 500 and $50 000 three and five years from now respectively. Alternatively, the property may be purchased by making quarterly payments of $11 150 in advance for five years. Which alternative is preferable if money is worth 12.2% compounded semi-annually?

(Essay)

4.8/5  (34)

(34)

A company buys equipment for $15000 today and has annual net cash inflows of $6000 for 3 years. The discount rate is 12% compounded annually. What is the Net Present Value (NPV)?

(Multiple Choice)

4.8/5  (36)

(36)

The introduction of a new product requires an initial outlay of $610 000. The anticipated net returns from the marketing of the product are expected to be $92 300 per year for 12 years. Find the rate of return (correct to the nearest tenth of a percent).

(Essay)

4.8/5  (34)

(34)

A wireless telephone system with a disposable value of $5 000 after five years can be purchased for $15 000. Alternatively, a leasing agreement is available that requires an immediate payment of $2000 plus payments of $100.00 at the beginning of each month for five years. If money is worth 6% compounded monthly, should the telephone system be leased or purchased?

(Essay)

4.8/5  (36)

(36)

Tamia Industries plans to replace the outdated equipment that will cost the company $100 000.00 now and $60 000.00 six years from now. This replacement will result in revenues of $6000.00 at the end of each quarter for twelve years. At an interest rate of 9% compounded annually and using the Net Present Value criterion, should the company replace this equipment or not?

(Essay)

4.8/5  (32)

(32)

A project requires an initial outlay of $350 000 and a further outlay of $100 000 after one year. Net returns are $105 000 per year for five years. What is the net present value of the project at 9.9%?

(Essay)

4.8/5  (43)

(43)

A selection has to be made between two investment alternatives. The first alternative offers a net return of $47 000.00 after three years, $30 000.00 after five years and $26 000.00 after seven years. The second alternative provides a net return of $13 000.00 per year for seven years. Determine the preferred alternative according to the discounted cash flow criterion if money is worth 11%.

(Essay)

4.7/5  (40)

(40)

The SHREK Company has to make a decision about expanding its production facilities. Research indicates that the desired expansion would require an immediate outlay of $160 000 and an outlay of a further $60 000 in five years. Net returns are estimated to be $25 000 per year for the first five years and $20 000 per year for the following 9 years. Find the net present value of the project. Should the expansion project be undertaken if the required rate of return is 10% compounded annually?

(Essay)

4.8/5  (31)

(31)

A company needs to spend $15000 for each of the next three years. Net returns beginning in Year 4 are estimated at $2500 per year for ten years. The required rate of return is 9.75% compounded annually. The NPV is?

(Multiple Choice)

5.0/5  (31)

(31)

Replacing old office equipment at an immediate cost of $3 000 and $4 000 four years from now will result in savings of $400 semi-annually for ten years. Should the old equipment be replaced

a) at 8% compounded annually?

b) at 12% compounded annually?

(Essay)

4.8/5  (31)

(31)

A company has two investment choices. Alternative A requires an immediate outlay of $4000.00 and offers a return of $14 000.00 after seven years. Alternative B requires an immediate outlay of $3600.00 in return for which $500.00 will be received at the end of every six months for the next seven years. If the rate of return is 6% compounded semi-annually, determine which alternative is preferable.

(Essay)

4.8/5  (31)

(31)

A company is considering a project that will require a cost outlay of $25 000 per year for 3 years. At the end of the project the salvage value will be $15 000. The project will yield annual net returns of $17 500 for 5 years. Alternative investments are available that will yield a return of 15%. Should the company undertake the project?

(Essay)

4.9/5  (31)

(31)

Replacing old equipment at an immediate cost of $75 000 and an additional outlay of $10 000 six years from now will result in savings of $3120 per quarter for 11 years. The required rate of return is 11.4% compounded annually. Use the net present value method to determine whether the company should replace old equipment or not.

(Essay)

5.0/5  (33)

(33)

Showing 1 - 20 of 56

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)