Exam 5: Cost Management in an Automated Business Environment: ABC, ABM, and TQM

Exam 1: Management Accounting and Corporate Governance148 Questions

Exam 2: Cost Behavior, operating Leverage, and Profitability Analysis153 Questions

Exam 3: Analysis of Cost, volume, and Pricing to Increase Profitability149 Questions

Exam 4: Cost Accumulation,tracing,and Allocation159 Questions

Exam 5: Cost Management in an Automated Business Environment: ABC, ABM, and TQM154 Questions

Exam 6: Relevant Information for Special Decisions153 Questions

Exam 7: Planning for Profit and Cost Control152 Questions

Exam 8: Performance Evaluation156 Questions

Exam 9: Responsibility Accounting146 Questions

Exam 10: Planning for Capital Investments156 Questions

Exam 11: Product Costing in Service and Manufacturing Entities149 Questions

Exam 12: Job-Order, process, and Hybrid Costing Systems148 Questions

Exam 13: Financial Statement Analysis155 Questions

Exam 14: Statement of Cash Flows149 Questions

Select questions type

Which of the following costs would be most fairly allocated using a volume-based cost driver?

(Multiple Choice)

4.7/5  (32)

(32)

Indicate whether each of the following statements is true or false.

Use of an activity-based costing system may identify products that are overcosted or undercosted by a traditional system.______

Use of an activity-based costing system may prove to company managers that the company is incurring losses on some products they believed to be profitable.______

The starting point for target pricing is to determine the costs that are incurred in making the product.______

Use of a traditional product costing system may put a company at a competitive advantage by overcosting some products.______

Activity-based costing results could lead managers of a company to decide to eliminate some products.______

(Essay)

4.9/5  (32)

(32)

All of the following are categories of quality costs except:

(Multiple Choice)

4.9/5  (36)

(36)

Traditionally,the most popular companywide base for allocating overhead to products was:

(Multiple Choice)

4.9/5  (52)

(52)

Most firms have found that it is cost-effective to achieve a "zero defects" condition among their products and services.

(True/False)

4.8/5  (39)

(39)

Which of the following statement(s)regarding activity-based costing is (are)true? I.Use of activity-based costing improves cost tracing by using more cause-and-effect relationships to assign indirect costs to activity centers.

II)An activity-based system is characterized by multiple cost pools and multiple volume and activity cost drivers.

III)Activity-based costing can cause distortion of cost,assigning too much cost to some products and too little to others.

(Multiple Choice)

4.7/5  (38)

(38)

In an activity-based costing system,a volume-based cost driver is appropriate for product-level activities.

(True/False)

4.9/5  (42)

(42)

Which of the following is not a cost resulting from a unit-level activity?

(Multiple Choice)

4.8/5  (29)

(29)

Which of the following activity costs should usually be ignored when making a decision regarding whether to eliminate a product?

(Multiple Choice)

4.9/5  (45)

(45)

Rocoe Company produces a variety of garden tools in a highly automated manufacturing facility.The costs and cost drivers associated with four activity cost pools are given below: Product Activities: Unit Level Batch Level Level Facility Level Total cost \ 30,000 \ 12,000 \6 ,000 \3 6,000 Total cost driver 5,000 labor 240 set \% of use 36,000 units volume hours ups

Production of 10,000 units of a handheld tiller required 1,000 labor hours and 80 setups and consumed 25% of the product sustaining activities.Assuming the company uses activity-based costing,how much total overhead will be allocated to this tool?

(Multiple Choice)

4.7/5  (37)

(37)

Benitez Company makes wicker and wooden slat picnic baskets.It requires approximately one hour of labor to make one basket of either type.Wicker baskets are produced in batches of 100 units and require 0.5 machine hours per basket.Wooden slat baskets are produced in batches of 50 units and require 0.75 machine hours per basket.Setup is required for each batch.During the most recent accounting period,the company made 8,000 wicker baskets and 2,000 wooden slat baskets.Setup costs amounted to $24,000 for the baskets produced during the period.If activity-based costing is used to allocate overhead costs to the two products,the amount of setup cost assigned to the wicker baskets will be:

(Multiple Choice)

4.8/5  (37)

(37)

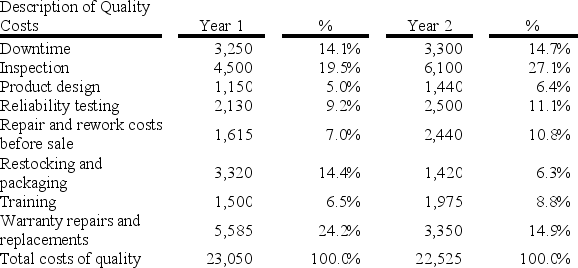

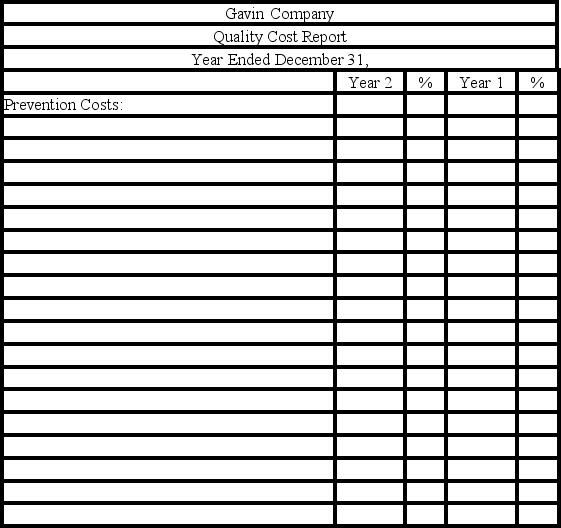

Gavin Company has asked its management accountant to prepare a cost of quality report.Management is concerned that quality costs are too high relative to the company's sales.Sales in Year 1 totaled $400,000,while sales in Year 2 were $500,000.

Required:

1)Prepare a Quality Cost Report for Gavin Company showing its quality costs as a percentage of sales.Organize the costs by type (prevention,appraisal,internal failure,and external failure)and include percentages for each individual cost as well as for the total of each category.Round your answers to three decimal places.The report has been started below:

Required:

1)Prepare a Quality Cost Report for Gavin Company showing its quality costs as a percentage of sales.Organize the costs by type (prevention,appraisal,internal failure,and external failure)and include percentages for each individual cost as well as for the total of each category.Round your answers to three decimal places.The report has been started below:

2)Evaluate Gavin Company's strategy for reducing its total costs of quality.

2)Evaluate Gavin Company's strategy for reducing its total costs of quality.

(Essay)

4.8/5  (38)

(38)

An increase in prevention costs will often reduce a firm's overall costs of quality.

(True/False)

4.9/5  (38)

(38)

A modern cost allocation process that employs multiple cost drivers is:

(Multiple Choice)

4.8/5  (42)

(42)

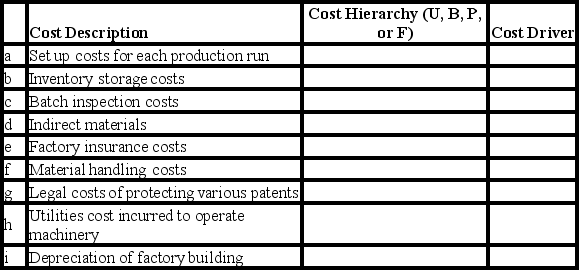

Décor Carpets incurs a variety of costs in producing several grades of carpet for the residential and commercial housing industries.The different grades and styles are manufactured in batches or production runs.The company uses activity-based costing to assign overhead costs to its different product lines.Selected costs are provided in the following table:

Required:

For each item identify the cost hierarchy and the cost driver.Use a (U)if the cost described is a unit-level cost,a (B)if a batch-level cost,a (P)if a product-level cost,or an (F)if a facility-level cost.Name a cost driver (for example,direct labor hours)that you believe might be appropriate for allocating that particular cost to units of products.

Required:

For each item identify the cost hierarchy and the cost driver.Use a (U)if the cost described is a unit-level cost,a (B)if a batch-level cost,a (P)if a product-level cost,or an (F)if a facility-level cost.Name a cost driver (for example,direct labor hours)that you believe might be appropriate for allocating that particular cost to units of products.

(Essay)

4.9/5  (34)

(34)

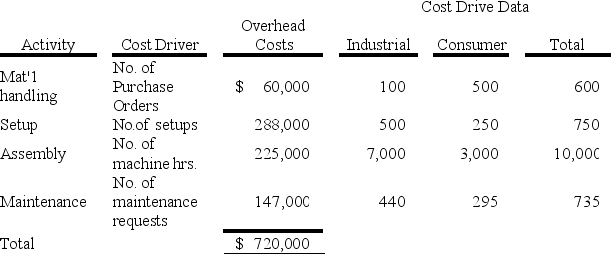

Ballantine Company manufactures two products.Currently,the company uses a traditional costing system assigning overhead based on direct labor hours.The Industrial product is more complex to produce,requiring two hours of direct labor time per unit,compared to one hour of direct labor time for the Consumer product.Given the company's total overhead costs of $720,000 and production of 1,000 Industrials and 8,000 Consumers,this results in an overhead allocation rate of $72 per direct labor hour.The following unit data are provided:

Industrial Selling price \1 ,440.00 Direct material (500.00) Direct labor (400.00) Overhead Gross profit Consumer \7 20.00 (250.00) (200.00)

Because the Industrial product is twice as profitable as the Consumer model,the sales manager wants to reduce or eliminate production of the Consumer product and devote as much capacity as possible to the Industrial product.

You are worried that the current cost accounting system may be providing inaccurate results and would like to implement an ABC system.Assume that the company's overhead costs were traced to four major activities.The amount of overhead costs traceable to each activity for the current year is provided below:

Required:

1)Compute the four activity rates that will be used to assign overhead to the products under activity-based costing:

Activity Application Rate Mat'1 handling Setup Assembly Maintenance

2)Compute the amount of overhead cost which should be assigned to Industrials and Consumers under activity-based costing.Also compute the overhead cost per unit for each product.

Activity 1,000Industrials 8,000 Consumers Mat'1 handling Setup Assembly Maintenance Total Overhead Cost Overhead cost per unit

3)Compute the total cost to manufacture one unit of each product if activity-based costing is used.

Industrials Consumers Direct materials \ 500.00 \ 250.00 Direct labor 400.00 200.00 Overhead Total cost per unit

4)Respond to the sales manager's recommendation that capacity be diverted from Consumers to Industrials.

Required:

1)Compute the four activity rates that will be used to assign overhead to the products under activity-based costing:

Activity Application Rate Mat'1 handling Setup Assembly Maintenance

2)Compute the amount of overhead cost which should be assigned to Industrials and Consumers under activity-based costing.Also compute the overhead cost per unit for each product.

Activity 1,000Industrials 8,000 Consumers Mat'1 handling Setup Assembly Maintenance Total Overhead Cost Overhead cost per unit

3)Compute the total cost to manufacture one unit of each product if activity-based costing is used.

Industrials Consumers Direct materials \ 500.00 \ 250.00 Direct labor 400.00 200.00 Overhead Total cost per unit

4)Respond to the sales manager's recommendation that capacity be diverted from Consumers to Industrials.

(Essay)

4.7/5  (32)

(32)

The goal of zero defects will generally lead to minimizing quality costs.

(True/False)

4.9/5  (46)

(46)

Showing 61 - 80 of 154

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)