Exam 2: Cost Behavior, operating Leverage, and Profitability Analysis

Exam 1: Management Accounting and Corporate Governance148 Questions

Exam 2: Cost Behavior, operating Leverage, and Profitability Analysis153 Questions

Exam 3: Analysis of Cost, volume, and Pricing to Increase Profitability149 Questions

Exam 4: Cost Accumulation,tracing,and Allocation159 Questions

Exam 5: Cost Management in an Automated Business Environment: ABC, ABM, and TQM154 Questions

Exam 6: Relevant Information for Special Decisions153 Questions

Exam 7: Planning for Profit and Cost Control152 Questions

Exam 8: Performance Evaluation156 Questions

Exam 9: Responsibility Accounting146 Questions

Exam 10: Planning for Capital Investments156 Questions

Exam 11: Product Costing in Service and Manufacturing Entities149 Questions

Exam 12: Job-Order, process, and Hybrid Costing Systems148 Questions

Exam 13: Financial Statement Analysis155 Questions

Exam 14: Statement of Cash Flows149 Questions

Select questions type

Wu Company incurred $40,000 of fixed cost and $50,000 of variable cost when 4,000 units of product were made and sold. If the company's volume increases to 5,000 units,the total cost per unit will be:

(Multiple Choice)

4.9/5  (40)

(40)

Pickard Company pays its sales staff a base salary of $4,500 a month plus a $3.00 commission for each product sold.If a salesperson sells 800 units of product in January,the employee would be paid:

(Multiple Choice)

5.0/5  (40)

(40)

The manager of Kenton Company stated that 45% of its total costs were fixed.The manager was describing the company's:

(Multiple Choice)

4.8/5  (48)

(48)

Select the incorrect statement regarding fixed and variable costs.

(Multiple Choice)

5.0/5  (38)

(38)

Which of the following items would not be found on a contribution format income statement?

(Multiple Choice)

4.7/5  (36)

(36)

The results below represent what form of cost behavior? Year 1 Year 2 Units 4,500 4,800 Total Cost \ 11,250 \ 12,000

(Multiple Choice)

5.0/5  (39)

(39)

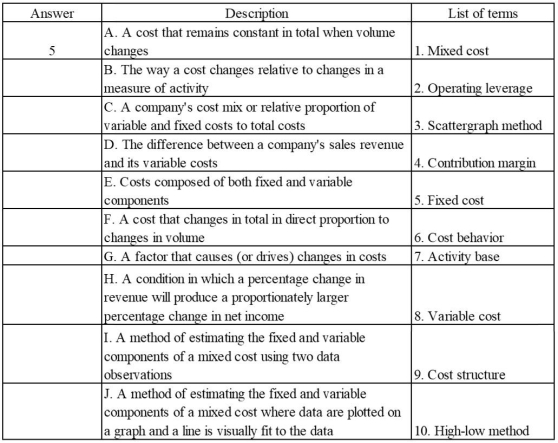

Select the term from the list provided that best matches each of the following descriptions.The first is done for you.

(Essay)

4.8/5  (35)

(35)

The magnitude of operating leverage for Blue Ridge Corporation is 3.5 when sales are $200,000 and net income is $36,000.If sales decrease by 6%,net income is expected to decrease by what amount?

(Multiple Choice)

4.9/5  (40)

(40)

Within the relevant range,the fixed cost per unit can be expected to decrease with increases in volume.

(True/False)

4.9/5  (46)

(46)

Yankee Tours provide seven-day guided tours along the New England coast.The company pays its guides a total of $100,000 per year.The average cost of supplies,lodging,and food per customer is $500.The company expects a total of 500 customers during the period January through June,and a total of 1,500 customers from July through December.Yankee wants to earn $100 income per customer.For promotional reasons the company desires to charge the same price throughout the year.Based on this information,what is the correct price per customer? (Round your answer to the nearest dollar.)

(Multiple Choice)

4.9/5  (42)

(42)

Maryland Novelties Company produces and sells souvenir products.Monthly income statements for two activity levels are provided below:

Unit volumes 20,000 units 30,000 units Revenue \ 150,000 \ 225,000 Less cost of goods sold 60,000 90,000 Gross margin \ 90,000 \ 135,000 Less operating expenses Salaries and commissions 20,000 25,000 Advertising expenses 30,000 30,000 Administrative expenses 12,500 12,500 Total operating expenses 62,500 67,500 Net income \ 27,500 \ 67,500 Required:

1)Identify the mixed expense(s).

2)Use the high-low method to separate the mixed costs into variable and fixed components.

3)Prepare a contribution margin income statement at the 20,000-unit level.

(Essay)

4.8/5  (39)

(39)

Which of the following costs typically include both fixed and variable components?

(Multiple Choice)

4.9/5  (31)

(31)

Showing 141 - 153 of 153

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)