Exam 2: Cost Behavior, operating Leverage, and Profitability Analysis

Exam 1: Management Accounting and Corporate Governance148 Questions

Exam 2: Cost Behavior, operating Leverage, and Profitability Analysis153 Questions

Exam 3: Analysis of Cost, volume, and Pricing to Increase Profitability149 Questions

Exam 4: Cost Accumulation,tracing,and Allocation159 Questions

Exam 5: Cost Management in an Automated Business Environment: ABC, ABM, and TQM154 Questions

Exam 6: Relevant Information for Special Decisions153 Questions

Exam 7: Planning for Profit and Cost Control152 Questions

Exam 8: Performance Evaluation156 Questions

Exam 9: Responsibility Accounting146 Questions

Exam 10: Planning for Capital Investments156 Questions

Exam 11: Product Costing in Service and Manufacturing Entities149 Questions

Exam 12: Job-Order, process, and Hybrid Costing Systems148 Questions

Exam 13: Financial Statement Analysis155 Questions

Exam 14: Statement of Cash Flows149 Questions

Select questions type

What advantages does the regression method of cost estimation offer,compared to the high-low and scattergraph methods of estimating mixed costs?

(Essay)

4.9/5  (40)

(40)

For the last two years BRC Company had net income as follows: Year 1 Year 2 Net Income \ 160,000 \ 200,000 What was the percentage change in income from Year 1 to Year 2?

(Multiple Choice)

4.8/5  (38)

(38)

Production during the current year for California Manufacturing,a producer of high security bank vaults,was at its highest point in the month of June when 80 units were produced at a total cost of $800,000.The lowest point in production was in January when only 20 units were produced at a cost of $440,000.The company is preparing a budget for the current year and needs to project expected fixed cost for the budget year.Using the high-low method,the projected amount of fixed cost per month is:

(Multiple Choice)

4.9/5  (37)

(37)

Contribution margin income statements for two competing companies are provided below:

Yin Company Yang Company Revenue \7 50,000 \7 50,000 Less variable costs 300,000 525,000 Contribution margin \4 50,000 \2 25,000 Less fixed costs 405,000 108,000 Net income \4 5,000 \4 5,000

Required:

(1)Show each company's cost structure by inserting the percentage of the company's revenue represented by each item on the contribution income statement.

(2)Compute each company's magnitude of operating leverage.

(3)Using the operating leverage measures computed in requirement 2,determine the increase in each company's net income (percentage and amount)if each company experiences a 10 percent increase in sales.

(4)Assume that sales are expected to continue to increase for the foreseeable future,which company probably has more desirable cost structure? Why?

(Essay)

4.9/5  (43)

(43)

A company with a completely fixed cost structure will have operating leverage of 1.

(True/False)

4.9/5  (40)

(40)

Former NFL coach Joe Gibbs is highly sought after as a guest speaker.His fee can run as high as $150,000 for a single two-hour appearance.Recently,he was asked to speak at a seminar offered by the National Sports in Education Foundation (NSEF).Due to the charitable nature of the organization,Mr.Gibbs offered to speak for $100,000.NSEF planned to invite 350 guests who would each make a $500 contribution to the organization.The Foundation's executive director was concerned about committing so much of the organization's cash to this one event.So instead of the $100,000 fee she countered with an offer to pay Mr.Gibbs 50% of the revenue received from the seminar and no other payments.

Required:

(a)Classify the two offers in terms of cost behavior (fixed vs.variable).

Scenario A,NSEF pays Gibbs a $100,000 fee:

Scenario B,NSEF pays Gibbs 50% of revenue:

(b)Compute the budgeted income (assuming there are no other expenses)under each of the following scenarios:

1)NSEF agrees to pay the $100,000 fee,and 350 guests actually attend the seminar; and

2)NSEF pays Mr.Gibbs 50% of revenue,and 350 guests attend the seminar.

(c)For each scenario ($100,000 fee vs.50% of revenue),compute the percentage increase in profit that would result if the Foundation is able to increase attendance by 20 percent over the original plan (to a total of 420).(Round the percentages to the nearest whole numbers.)

(d)For each scenario,compute NSEF's cost per contributor if 350 attend and if 420 contributors attend.(Round the cost per contributor to two decimal points.)

(e)Summarize the impact on risk and profits of shifting the cost structure from fixed to variable costs.

(Essay)

4.8/5  (38)

(38)

A cost that is considered variable for one activity base may be considered fixed for a different activity base.

(True/False)

4.8/5  (37)

(37)

The variable cost per unit increases in direct proportion to the activity base.

(True/False)

4.9/5  (37)

(37)

The magnitude of operating leverage for Perkins Corporation is 4.5 when sales are $100,000.If sales increase to $110,000,profits would be expected to increase by what percent?

(Multiple Choice)

4.8/5  (34)

(34)

Quick Change and Fast Change are competing oil change businesses.Both companies have 5,000 customers.The price of an oil change at both companies is $20.Quick Change pays its employees on a salary basis,and its salary expense is $40,000.Fast Change pays its employees $8 per customer served.Suppose Quick Change is able to lure 1,000 customers from Fast Change by lowering its price to $18 per vehicle.Thus,Quick Change will have 6,000 customers and Fast Change will have only 4,000 customers. Select the correct statement from the following.

(Multiple Choice)

4.9/5  (33)

(33)

A cost that contains both fixed and variable elements is referred to as a:

(Multiple Choice)

5.0/5  (36)

(36)

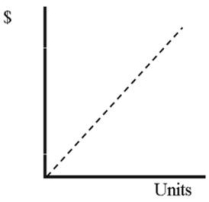

In the graph below,which depicts the relationship between units produced and total cost,the dotted line depicts which type of total cost?

(Multiple Choice)

4.9/5  (25)

(25)

Descriptions of cost behavior as fixed or variable pertain to a particular range of activity.

(True/False)

4.8/5  (32)

(32)

Assume that wages expense is a variable cost and that the relevant range is 10,000 to 15,000 labor hours.Within that range,the cost is $15 per hour.What can you assume about wages expense outside this range?

(Essay)

4.9/5  (38)

(38)

Grant Company and Lee Company compete in the same market.The following budgeted income statements illustrate their cost structures.

Grant Lee Company Company Number of customers 200 200 Sales revenue (200\times\ 150) \ 30,000 \ 30,000 Less variable costs 6,000 18,000 Contribution margin \ 24,000 \ 12,000 Less fixed costs 19,000 7,000 Net income \ 5,000 \ 5,000

Required:

(a)If Grant Company lowers its price to $135,it will lure 80 customers away from Lee Company.Prepare Grant's income statement based on 280 customers.

(b)If Lee Company lowers its price to $135 (assuming that Grant Company is still charging $150 per customer),Lee would lure 80 customers away from Grant.Prepare Lee's income statement based on 280 customers.

(c)Which of the companies would benefit more from lowering its sales price to attract more customers,and why?

(Essay)

4.9/5  (41)

(41)

The following income statements are provided for Li Company's last two years of operation: Year 1 Year 2 Number of units produced and sold 3,500 3,000 Sales revenue \ 101,500 \ 87,000 Cost of goods sold 68,000 60,000 Gross margin 33,500 27,000 General, selling, and administrative expenses 13,000 12,000 Net income \ 20,500 \ 15,000 Assuming that cost behavior did not change over the two-year period,what is the amount of the company's variable cost of goods sold per unit?

(Multiple Choice)

4.8/5  (31)

(31)

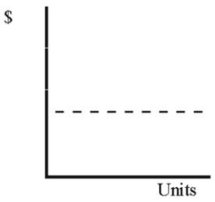

In the graph below,which depicts the relationship between units produced and total cost,the dotted line depicts which type of total cost?

(Multiple Choice)

4.8/5  (30)

(30)

Executive management at Ballard Books is very optimistic about the chain's ability to achieve significant increases in sales in each of the next five years.The company will most benefit if management creates a:

(Multiple Choice)

4.9/5  (38)

(38)

Showing 121 - 140 of 153

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)