Exam 23: Performance Measurement, compensation, and Multinational Considerations

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis209 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets,direct-Cost Variances,and Management Control181 Questions

Exam 8: Flexible Budgets, overhead Cost Variances, and Management Control171 Questions

Exam 9: Inventory Costing and Capacity Analysis207 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy,balanced Scorecard,and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management209 Questions

Exam 14: Cost Allocation, customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts150 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, just-In-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, transfer Pricing, and Multinational Considerations150 Questions

Exam 23: Performance Measurement, compensation, and Multinational Considerations150 Questions

Select questions type

Which of the following is true of benchmarking two managers against each other if they carry out similar operations?

(Multiple Choice)

4.9/5  (31)

(31)

Times Corporation,whose tax rate is 30%,has two sources of funds: long-term debt with a market value of $6,500,000 and an interest rate of 7%,and equity capital with a market value of $18,000,000 and a cost of equity of 11%.Times Corporation's after-tax cost of debt is ________.

(Multiple Choice)

4.8/5  (37)

(37)

An important consideration in designing compensation arrangements is the tradeoff between creating incentives and imposing risks.

(True/False)

4.9/5  (40)

(40)

Required rate of return multiplied by the investment is the weighted average cost of the investment.

(True/False)

4.9/5  (27)

(27)

"Cooking the books" means reporting of understated assets and overstated liabilities.

(True/False)

4.8/5  (32)

(32)

Current cost return on investment is a better measure of the current economic returns from an investment than historical cost return on investment.

(True/False)

4.9/5  (34)

(34)

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Revenues \ 2,300,000 Operating costs 1,700,000 Operating assets 1,100,000

Income is defined as operating income.

What is the Cyclotron Division's return on investment?

(Multiple Choice)

4.8/5  (40)

(40)

Make a list of steps of designing an accounting based performance measure.Give an example of decisions taken under each step.

(Essay)

4.9/5  (25)

(25)

Historical-cost-based accounting measures are usually inadequate for evaluating economic returns on new investments and,in some cases,create disincentives for expansion.

(True/False)

4.7/5  (43)

(43)

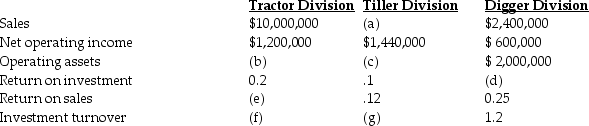

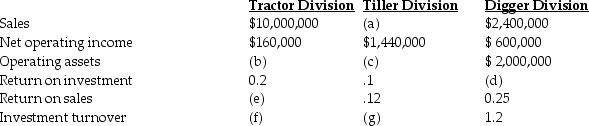

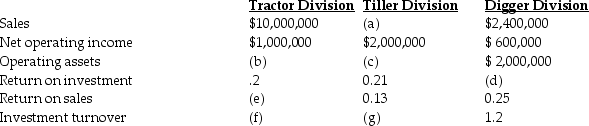

The top management at Groundsource Company,a manufacturer of lawn and garden equipment,is attempting to recover from a fire that destroyed some of their accounting records.The main computer system was also severely damaged.The following information was salvaged:

What is the Tractor Division's investment turnover?

What is the Tractor Division's investment turnover?

(Multiple Choice)

4.7/5  (39)

(39)

Which of the following is true of an executive compensation plan?

(Multiple Choice)

4.7/5  (40)

(40)

To evaluate overall performance,return on investment and residual income measures are more appropriate than return on sales.

(True/False)

4.7/5  (41)

(41)

The top management at Groundsource Company,a manufacturer of lawn and garden equipment,is attempting to recover from a fire that destroyed some of their accounting records.The main computer system was also severely damaged.The following information was salvaged:

What is the Tractor Division's return on sales?

What is the Tractor Division's return on sales?

(Multiple Choice)

4.7/5  (42)

(42)

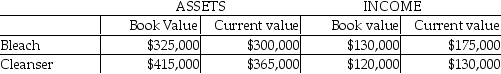

Home Decor Inc. ,manufactures home cleaning products.The company has two divisions,Bleach and Cleanser.Because of different accounting methods and inflation rates,the company is considering multiple evaluation measures.The following information is provided for 2018:

The company is currently using a 15% required rate of return.

What are Bleach's and Cleanser's return on investment based on book values,respectively?

The company is currently using a 15% required rate of return.

What are Bleach's and Cleanser's return on investment based on book values,respectively?

(Multiple Choice)

4.9/5  (33)

(33)

Megatron Corp.earned net income of 16,000 Euros in its overseas branch at France.Its headquarters is located in the U.S.The rate of conversion during set up was $1.309 / Euro.What is the value of its income in its home currency if the rate is $1.508 / Euro at the end of a financial year and the average rate being $1.410 / Euro?

(Multiple Choice)

4.8/5  (30)

(30)

Which of the following is the required rate of return used in the economic value added (EVA)calculation?

(Multiple Choice)

4.8/5  (31)

(31)

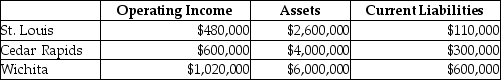

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,200,000 issued at an interest rate of 13%,and equity capital that has a market value of $4,200,000 (book value of $2,400,000).Waldorf Company has profit centers in the following locations with the following operating incomes,total assets,and current liabilities.The cost of equity capital is 13%,while the tax rate is 35%.

What is the EVA® for St.Louis? (Round intermediary calculations to four decimal places. )

What is the EVA® for St.Louis? (Round intermediary calculations to four decimal places. )

(Multiple Choice)

4.8/5  (30)

(30)

The top management at Groundsource Company,a manufacturer of lawn and garden equipment,is attempting to recover from a fire that destroyed some of their accounting records.The main computer system was also severely damaged.The following information was salvaged:

What is the value of the operating assets belonging to the Tiller Division?

What is the value of the operating assets belonging to the Tiller Division?

(Multiple Choice)

4.9/5  (33)

(33)

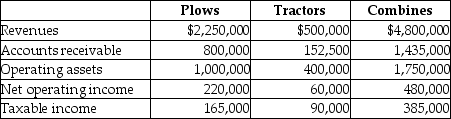

Moto Corp allows its divisions to operate as autonomous units.The operating data for 2015 follow:

Required:

a.Compute the investment turnover for each division.

b.Compute the return on sales for each division.

c.Compute the return on investment for each division.

d.Which division manager is doing best? Why?

e.What other factors should be included when evaluating the managers?

For parts (b)and (c)income is defined as operating income.

Required:

a.Compute the investment turnover for each division.

b.Compute the return on sales for each division.

c.Compute the return on investment for each division.

d.Which division manager is doing best? Why?

e.What other factors should be included when evaluating the managers?

For parts (b)and (c)income is defined as operating income.

(Essay)

4.8/5  (42)

(42)

Showing 101 - 120 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)