Exam 22: Management Control Systems, transfer Pricing, and Multinational Considerations

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis209 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets,direct-Cost Variances,and Management Control181 Questions

Exam 8: Flexible Budgets, overhead Cost Variances, and Management Control171 Questions

Exam 9: Inventory Costing and Capacity Analysis207 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy,balanced Scorecard,and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management209 Questions

Exam 14: Cost Allocation, customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts150 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, just-In-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, transfer Pricing, and Multinational Considerations150 Questions

Exam 23: Performance Measurement, compensation, and Multinational Considerations150 Questions

Select questions type

When an industry has excess capacity,market prices may drop well below their historical average.If this drop is temporary,it is called ________.

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following is a disadvantage of using negotiated transfer price?

(Multiple Choice)

4.8/5  (36)

(36)

A perfectly competitive market exists when which of the following conditions are present?

(Multiple Choice)

4.9/5  (27)

(27)

Super Shoes Company manufactures sneakers.The Athletic Division sells its socks for $18 a pair to outsiders.Sneakers have manufacturing costs of $6.00 each for variable and $6.00 for fixed.The division's total fixed manufacturing costs are $315,000 at the normal volume of 70,000 units.

The European Division has offered to buy 15,000 Sneakers at the full cost of $12.The Athletic Division has excess capacity and the 15,000 units can be produced without interfering with the current outside sales of 70,000.The 85,000 volume is within the division's relevant operating range.

Explain whether the Athletic Division should accept the offer.

(Essay)

4.7/5  (44)

(44)

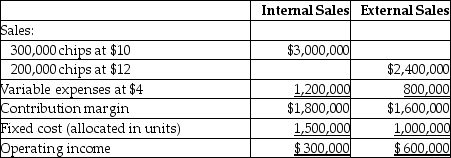

The Microchip Division of Silicon Computers produces computer chips that are sold to the Personal Computer Division and to outsiders.Operating data for the Microchip Division for 20X5 are as follows:

The Personal Computer Division has just received an offer from an outside supplier to furnish chips at $8.90 each.The manager of Microchip Division is not willing to meet the $8.90 price.She argues that it costs her $9.00 to produce and sell each chip.Sales to outside customers are at a maximum of 200,000 chips.

Required:

a.Verify the Microchip Division's $9.00 unit cost figure.

b.Should the Microchip Division meet the outside price of $8.90? Explain.

c.Could the $8.60 price be met and still show a profit for the Microchip Division sales to the Personal Computer Division? Show computations.

The Personal Computer Division has just received an offer from an outside supplier to furnish chips at $8.90 each.The manager of Microchip Division is not willing to meet the $8.90 price.She argues that it costs her $9.00 to produce and sell each chip.Sales to outside customers are at a maximum of 200,000 chips.

Required:

a.Verify the Microchip Division's $9.00 unit cost figure.

b.Should the Microchip Division meet the outside price of $8.90? Explain.

c.Could the $8.60 price be met and still show a profit for the Microchip Division sales to the Personal Computer Division? Show computations.

(Essay)

5.0/5  (33)

(33)

Incongruent decision making occurs when individuals and groups work toward achieving the organization's goals even if departmental performance is adversely affected.

(True/False)

4.8/5  (39)

(39)

In comparing the three basic approaches to transfer pricing,which of the following statements would be true?

(Multiple Choice)

4.9/5  (21)

(21)

Which of the following is a drawback of decentralizing a multinational company?

(Multiple Choice)

4.9/5  (40)

(40)

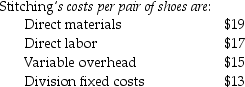

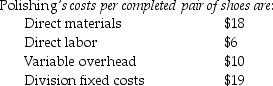

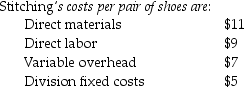

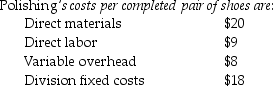

Branded Shoe Company manufactures only one type of shoe and has two divisions,the Stitching Division and the Polishing Division.The Stitching Division manufactures shoes for the Polishing Division,which completes the shoes and sells them to retailers.The Stitching Division "sells" shoes to the Polishing Division.The market price for the Polishing Division to purchase a pair of shoes is $42.(Ignore changes in inventory. )The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-101,000 units.The fixed costs for the Polishing Division are assumed to be $23 per pair at 101,000 units.

If the Polishing Division sells 101,000 pairs of shoes at a price of $180 a pair to customers,what is the operating income of both divisions together?

If the Polishing Division sells 101,000 pairs of shoes at a price of $180 a pair to customers,what is the operating income of both divisions together?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following is an advantage of decentralization?

(Multiple Choice)

4.8/5  (38)

(38)

An organization should design its management control system independently of its strategies,so that the system is not affected by change of strategies in future.

(True/False)

4.8/5  (25)

(25)

In a profit center,the manager is accountable for investments,revenues,and costs.

(True/False)

4.8/5  (28)

(28)

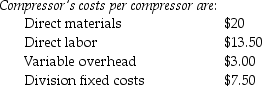

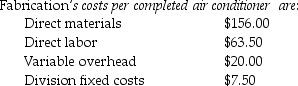

Plish Company manufactures only one type of washing machine and has two divisions,the Compressor Division,and the Fabrication Division.The Compressor Division manufactures compressors for the Fabrication Division,which completes the washing machine and sells it to retailers.The Compressor Division "sells" compressors to the Fabrication Division.The market price for the Fabrication Division to purchase a compressor is $56.00.(Ignore changes in inventory. )The fixed costs for the Compressor Division are assumed to be the same over the range of 11,000-16,000 units.The fixed costs for the Fabrication Division are assumed to be $8.50 per unit at 16,000 units.

What is the transfer price per compressor from the Compressor Division to the Fabrication Division if the method used to place a value on each compressor is 115% of variable costs?

What is the transfer price per compressor from the Compressor Division to the Fabrication Division if the method used to place a value on each compressor is 115% of variable costs?

(Multiple Choice)

4.8/5  (35)

(35)

Soft Cushion Company is highly decentralized.Each division is empowered to make its own sales decisions.The Assembly Division can purchase stuffing,a key component,from the Production Division or from external suppliers.The Production Division has been the major supplier of stuffing in recent years.The Assembly Division has announced that two external suppliers will be used to purchase the stuffing at $40 per pound for the next year.The Production Division recently increased its unit price to $58.The manager of the Production Division presented the following information - variable cost $40 and fixed cost $8 -to top management in order to attempt to force the Assembly Division to purchase the stuffing internally.The Assembly Division purchases 20,600 pounds of stuffing per month.

What would be the monthly operating advantage (disadvantage)of purchasing the goods internally,assuming the external supplier increased its price to $82 per pound and the Production Division is able to utilize the facilities for other operations,resulting in a monthly cash-operating savings of $34 per pound?

(Multiple Choice)

4.8/5  (31)

(31)

Branded Shoe Company manufactures only one type of shoe and has two divisions,the Stitching Division and the Polishing Division.The Stitching Division manufactures shoes for the Polishing Division,which completes the shoes and sells them to retailers.The Stitching Division "sells" shoes to the Polishing Division.The market price for the Polishing Division to purchase a pair of shoes is $48.(Ignore changes in inventory. )The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-101,000 units.The fixed costs for the Polishing Division are assumed to be $17 per pair at 101,000 units.

What is the market-based transfer price per pair of shoes from the Stitching Division to the Polishing Division?

What is the market-based transfer price per pair of shoes from the Stitching Division to the Polishing Division?

(Multiple Choice)

4.8/5  (35)

(35)

Management control systems utilize information gathered within a company and from external sources so as to aid management with their planning and control decision making.

(True/False)

4.8/5  (38)

(38)

Line managers supervising individual refineries are concerned with ________.

(Multiple Choice)

4.8/5  (41)

(41)

Showing 41 - 60 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)