Exam 21: Capital Budgeting and Cost Analysis

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis209 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets,direct-Cost Variances,and Management Control181 Questions

Exam 8: Flexible Budgets, overhead Cost Variances, and Management Control171 Questions

Exam 9: Inventory Costing and Capacity Analysis207 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy,balanced Scorecard,and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management209 Questions

Exam 14: Cost Allocation, customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts150 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, just-In-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, transfer Pricing, and Multinational Considerations150 Questions

Exam 23: Performance Measurement, compensation, and Multinational Considerations150 Questions

Select questions type

Which of the following projects is rejected on the basis of net present value method?

(Multiple Choice)

4.9/5  (31)

(31)

The Ambitz Corporation has an annual cash inflow from operations from its investment in a capital asset of $44,000 (excluding the deprecation)each year for seven years.The corporation's income tax rate is 35%.Calculate the total after-tax cash inflow from operations for seven years.

(Multiple Choice)

4.9/5  (29)

(29)

Which of the following is a stage of the capital budgeting process that forecasts all potential cash flows attributable to the alternative projects?

(Multiple Choice)

4.9/5  (40)

(40)

Discounted cash flow methods do not consider the present value of the cash flows after the recovery of the initial investment.

(True/False)

4.9/5  (35)

(35)

In calculating the net initial investment cash flows,any increase in working capital required for the project should be included.

(True/False)

5.0/5  (34)

(34)

Depreciation is usually NOT considered an operating cash flow in capital budgeting because ________.

(Multiple Choice)

4.7/5  (39)

(39)

Depreciation results in income tax cash savings that are equal to the depreciation expense multiplied by the company's income tax rate.

(True/False)

4.9/5  (38)

(38)

The net present value (NPV)method calculates the expected monetary gain or loss from a project by discounting all expected future cash inflows and outflows back to the present point in time using the required rate of return.

(True/False)

4.9/5  (32)

(32)

While calculating terminal recovery of working capital there are no tax consequences as there is no gain or loss on working capital.

(True/False)

5.0/5  (31)

(31)

The net present value method can be used in situations where the required rate of return varies over the life of the project.

(True/False)

4.8/5  (25)

(25)

Deducting depreciation from operating cash flows would result in counting the initial investment twice in a discounted cash flow analysis.

(True/False)

4.7/5  (25)

(25)

Concose Park Department is considering a new capital investment.The cost of the machine is $280,000.The annual cost savings if the new machine is acquired will be $165,000.The machine will have a 3-year life and the terminal disposal value is expected to be $35,000.There are no tax consequences related to this decision.If Concose Park Department has a required rate of return of 14%,which of the following is closest to the present value of the project?

(Multiple Choice)

4.7/5  (32)

(32)

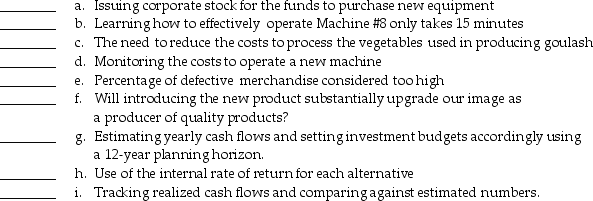

Match each one of the examples below with one of the stages of the capital budgeting decision model.

Stages:

1.Identify Projects

2.Obtain Information

3.Make Predictions

4.Make Decisions by Choosing Among Alternatives

5.Implement the Decision,Evaluate Performance,and Learn

(Essay)

4.8/5  (37)

(37)

What are the four alternative methods for evaluating capital budgeting projects? What is an advantage and disadvantage of each method?

(Essay)

4.8/5  (32)

(32)

Assume your goal in life is to retire with $2,800,000.How much would you need to save at the end of each year if interest rates average 10% and you have a 30-year work life? (Round the final answer to the nearest whole dollar. )

(Multiple Choice)

4.8/5  (31)

(31)

Malive Park Department is considering a new capital investment.The following information is available on the investment.The cost of the machine will be $179,000.The annual cost savings if the new machine is acquired will be $35,000.The machine will have a 10-year life,at which time the terminal disposal value is expected to be zero.Malive Park is assuming no tax consequences.Malive Park has a 14% required rate of return.What is the payback period for the investment?

(Multiple Choice)

4.9/5  (39)

(39)

Explain capital budgeting and then briefly discuss each of the five stages of a capital budgeting project?

(Essay)

4.8/5  (32)

(32)

Difend Cleaners has been considering the purchase of an industrial dry-cleaning machine.The existing machine is operable for three more years and will have a zero disposal price.If the machine is disposed now,it may be sold for $100,000.The new machine will cost $430,000 and an additional cash investment in working capital of $100,000 will be required.The new machine will reduce the average amount of time required to wash clothing and will decrease labor costs.The investment is expected to net $140,000 in additional cash inflows during the first year of acquisition and $270,000 each additional year of use.The new machine has a three-year life,and zero disposal value.These cash flows will generally occur throughout the year and are recognized at the end of each year.Income taxes are not considered in this problem.The working capital investment will not be recovered at the end of the asset's life.

What is the net present value of the investment,assuming the required rate of return is 9%? Would the company want to purchase the new machine?

(Multiple Choice)

4.8/5  (30)

(30)

Capital budgeting is both a decision making and control tool.Which of the following is an example of capital budgeting as a control tool?

(Multiple Choice)

4.8/5  (31)

(31)

Showing 21 - 40 of 151

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)