Exam 15: Allocation of Support-Department Costs, common Costs, and Revenues

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis209 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets,direct-Cost Variances,and Management Control181 Questions

Exam 8: Flexible Budgets, overhead Cost Variances, and Management Control171 Questions

Exam 9: Inventory Costing and Capacity Analysis207 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy,balanced Scorecard,and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management209 Questions

Exam 14: Cost Allocation, customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts150 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, just-In-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, transfer Pricing, and Multinational Considerations150 Questions

Exam 23: Performance Measurement, compensation, and Multinational Considerations150 Questions

Select questions type

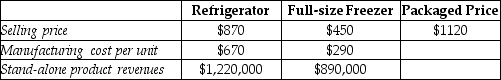

Electro Corp sells a refrigerator and a freezer as a single package for $1120.Other data are in the chart below.

Using the stand-alone method with stand-alone product revenues as the weight for revenue allocation,what amount will be allocated to the refrigerator? (Do not round any intermediary calculations. )

Using the stand-alone method with stand-alone product revenues as the weight for revenue allocation,what amount will be allocated to the refrigerator? (Do not round any intermediary calculations. )

(Multiple Choice)

4.9/5  (44)

(44)

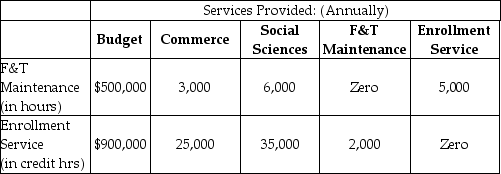

Marshall University offers only high-tech graduate-level programs.Marshall has two principal operating departments,Commerce and Social Sciences,and two support departments,Facility and Technology Maintenance and Enrollment Services.The base used to allocate facility and technology maintenance is budgeted total maintenance hours.The base used to allocate enrollment services is number of credit hours for a department.The Facility and Technology Maintenance budget is $500,000,while the Enrollment Services budget is $900,000.The following chart summarizes budgeted amounts and allocation-base amounts used by each department:

Required:

Prepare a schedule which allocates service department costs using the step-down method with the sequence of allocation based on the highest-percentage support concept.Compute the total amount of support costs allocated to each of the two principal operating departments,Commerce and Social Sciences.

Required:

Prepare a schedule which allocates service department costs using the step-down method with the sequence of allocation based on the highest-percentage support concept.Compute the total amount of support costs allocated to each of the two principal operating departments,Commerce and Social Sciences.

(Essay)

4.8/5  (46)

(46)

Which of the following methods ranks individual products in a bundle for revenue allocation?

(Multiple Choice)

4.9/5  (31)

(31)

Craylon Corp sells two products X and Y.X sells for $200 and Y sells for $160.Both X and Y sell for $310 as a bundle.What is the revenue allocated to product Y,if product X is termed as the primary product in the bundle?

(Multiple Choice)

5.0/5  (43)

(43)

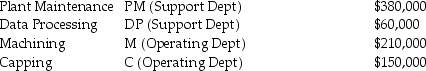

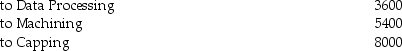

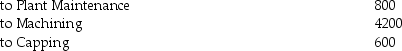

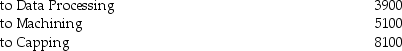

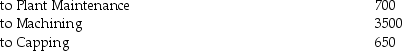

Alfred,owner of Hi-Tech Fiberglass Fabricators,Inc. ,is interested in using the reciprocal allocation method.The following data from operations were collected for analysis:

Budgeted manufacturing overhead costs:

Services furnished:

By Plant Maintenance (budgeted labor-hours):

Services furnished:

By Plant Maintenance (budgeted labor-hours):

By Data Processing (budgeted computer time):

By Data Processing (budgeted computer time):

What is the complete reciprocated cost of the Plant Maintenance Department? (Do not round any intermediary calculations. )

What is the complete reciprocated cost of the Plant Maintenance Department? (Do not round any intermediary calculations. )

(Multiple Choice)

4.8/5  (45)

(45)

The dual-rate cost-allocation method provides better information for decision making than the single-rate method as it differentiates between fixed and variable costs and its allocation.

(True/False)

4.8/5  (41)

(41)

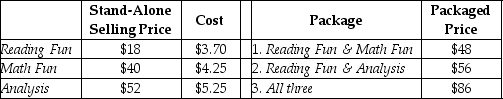

Buzz's Educational Software Outlet sells two or more of the video games as a single package.Managers are keenly interested in individual product-profitability figures.Information pertaining to three bundled products and the stand-alone prices is as follows:

Using the stand-alone method with selling price as the weight for revenue allocation,what amount of revenue will be allocated to Reading Fun in the first package (Reading Fun & Math Fun)? (Do not round any intermediary calculations. )

Using the stand-alone method with selling price as the weight for revenue allocation,what amount of revenue will be allocated to Reading Fun in the first package (Reading Fun & Math Fun)? (Do not round any intermediary calculations. )

(Multiple Choice)

4.7/5  (34)

(34)

Describe and discuss the two methods of allocating revenues of a bundled package to the individual products in that package.Describe any special problems associated with the method.

(Essay)

4.8/5  (28)

(28)

Harbor Corp currently leases a corporate suite in an office building for a cost of $360,000 a year.Only 80% of the corporate suite is currently being used.A start-up business has proposed a plan that would use the other 20% of the suite and increase the overall costs of maintaining the space by $20,484.If the incremental method were used,what amount of cost would be allocated to the start-up business?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following best describes the stand-alone revenue-allocation method?

(Multiple Choice)

4.8/5  (35)

(35)

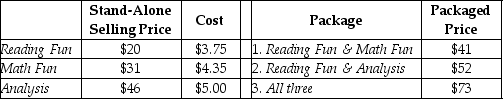

Buzz's Educational Software Outlet sells two or more of the video games as a single package.Managers are keenly interested in individual product-profitability figures.Information pertaining to three bundled products and the stand-alone prices is as follows:

Using the stand-alone method with selling price as the weight for revenue allocation,what amount of revenue will be allocated to Math Fun in the package that contains all three products? (Do not round any intermediary calculations. )

Using the stand-alone method with selling price as the weight for revenue allocation,what amount of revenue will be allocated to Math Fun in the package that contains all three products? (Do not round any intermediary calculations. )

(Multiple Choice)

4.9/5  (38)

(38)

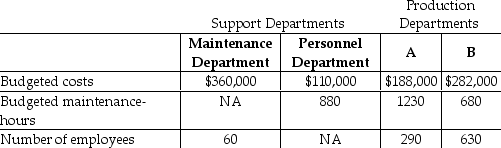

Hanung Corp has two service departments,Maintenance and Personnel.Maintenance Department costs of $360,000 are allocated on the basis of budgeted maintenance-hours.Personnel Department costs of $110,000 are allocated based on the number of employees.The costs of operating departments A and B are $188,000 and $282,000,respectively.Data on budgeted maintenance-hours and number of employees are as follows:

Using the direct method,what amount of Maintenance Department costs will be allocated to Department B? (Do not round any intermediary calculations. )

Using the direct method,what amount of Maintenance Department costs will be allocated to Department B? (Do not round any intermediary calculations. )

(Multiple Choice)

4.8/5  (33)

(33)

An alternative way to implement the reciprocal method is to formula and use linear equations.

(True/False)

4.8/5  (42)

(42)

The dual-rate cost-allocation method classifies costs in each cost pool into a ________.

(Multiple Choice)

4.8/5  (46)

(46)

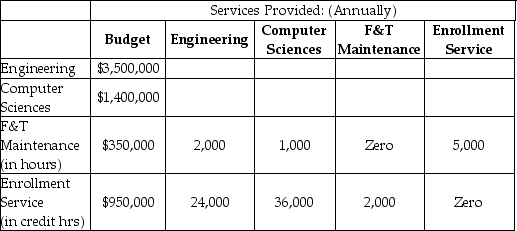

Gotham University offers only high-tech graduate-level programs.Gotham has two principal operating departments,Engineering and Computer Sciences,and two support departments,Facility and Technology Maintenance and Enrollment Services.The base used to allocate facility and technology maintenance is budgeted total maintenance hours.The base used to allocate enrollment services is number of credit hours for a department.The Facility and Technology Maintenance budget is $350,000,while the Enrollment Services budget is $950,000.The following chart summarizes budgeted amounts and allocation-base amounts used by each department:

Required:

a.Set up algebraic equations in linear equation form for each activity.

b.Determine total costs for each department by solving the equations from part (a)using the reciprocal method.

Required:

a.Set up algebraic equations in linear equation form for each activity.

b.Determine total costs for each department by solving the equations from part (a)using the reciprocal method.

(Essay)

4.9/5  (34)

(34)

Which of the following is one of the methods of allocating support department costs to operating departments that partially recognizes mutual service provided among all support departments?

(Multiple Choice)

4.8/5  (33)

(33)

Allocating common costs can best be achieved by using the stand-alone cost-allocation method.

(True/False)

4.8/5  (35)

(35)

Which of the following is an example of an allowable cost considered by U.S.government contract?

(Multiple Choice)

4.8/5  (30)

(30)

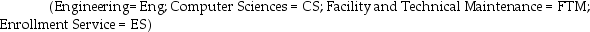

Foodiez Inn is a fast-food restaurant that sells burgers and hot dogs in a 1980s environment.The fixed operating costs of the company are $10,000 per month.The controlling shareholder,interested in product profitability and pricing,wants all costs allocated to either the burgers or the hot dogs.The following information is provided for the operations of the company:

Required:

a.What amount of fixed operating costs is assigned to the burgers and hot dogs when actual sales are used as the allocation base for January? For February?

b.Hot dog sales for January and February remained constant.Did the amount of fixed operating costs allocated to hot dogs also remain constant for January and February? Explain why or why not.Comment on any other observations.

Required:

a.What amount of fixed operating costs is assigned to the burgers and hot dogs when actual sales are used as the allocation base for January? For February?

b.Hot dog sales for January and February remained constant.Did the amount of fixed operating costs allocated to hot dogs also remain constant for January and February? Explain why or why not.Comment on any other observations.

(Essay)

4.8/5  (34)

(34)

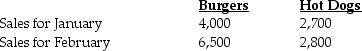

Alfred,owner of Hi-Tech Fiberglass Fabricators,Inc. ,is interested in using the reciprocal allocation method.The following data from operations were collected for analysis:

Budgeted manufacturing overhead costs:

Services furnished:

By Plant Maintenance (budgeted labor-hours):

Services furnished:

By Plant Maintenance (budgeted labor-hours):

By Data Processing (budgeted computer time):

By Data Processing (budgeted computer time):

Which of the following linear equations represents the complete reciprocated cost of the Data Processing Department?

Which of the following linear equations represents the complete reciprocated cost of the Data Processing Department?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 41 - 60 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)