Exam 15: Allocation of Support-Department Costs, common Costs, and Revenues

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis209 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets,direct-Cost Variances,and Management Control181 Questions

Exam 8: Flexible Budgets, overhead Cost Variances, and Management Control171 Questions

Exam 9: Inventory Costing and Capacity Analysis207 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy,balanced Scorecard,and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management209 Questions

Exam 14: Cost Allocation, customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts150 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, just-In-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, transfer Pricing, and Multinational Considerations150 Questions

Exam 23: Performance Measurement, compensation, and Multinational Considerations150 Questions

Select questions type

The direct method is conceptually the most precise method because it considers the mutual services provided among all support departments.

(True/False)

4.9/5  (34)

(34)

Contract disputes regarding cost allocation can be reduced by defining which of the following?

(Multiple Choice)

4.9/5  (29)

(29)

Illumination Corporation operates one central plant that has two divisions,the Flashlight Division and the Night Light Division.The following data apply to the coming budget year:

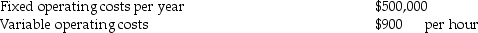

Budgeted costs of operating the plant for 2000 to 3000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year:

Assume that practical capacity is used to calculate the allocation rates.

Actual usage for the year by the Flashlight Division was 1500 hours and by the Night Light Division was 800 hours.If a single-rate cost-allocation method is used,what amount of cost will be allocated to the Flashlight Division? Assume actual usage is used to allocate operating costs.

Assume that practical capacity is used to calculate the allocation rates.

Actual usage for the year by the Flashlight Division was 1500 hours and by the Night Light Division was 800 hours.If a single-rate cost-allocation method is used,what amount of cost will be allocated to the Flashlight Division? Assume actual usage is used to allocate operating costs.

(Multiple Choice)

4.7/5  (32)

(32)

The best method to determining weights for the stand-alone revenue-allocation method is ________.

(Multiple Choice)

4.9/5  (43)

(43)

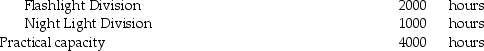

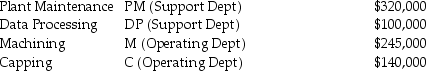

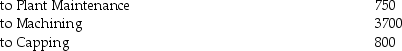

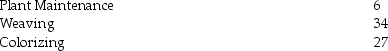

Alfred,owner of Hi-Tech Fiberglass Fabricators,Inc. ,is interested in using the reciprocal allocation method.The following data from operations were collected for analysis:

Budgeted manufacturing overhead costs:

Services furnished:

By Plant Maintenance (budgeted labor-hours):

Services furnished:

By Plant Maintenance (budgeted labor-hours):

By Data Processing (budgeted computer time):

By Data Processing (budgeted computer time):

What is the complete reciprocated cost of the Data Processing Department? (Do not round any intermediary calculations. )

What is the complete reciprocated cost of the Data Processing Department? (Do not round any intermediary calculations. )

(Multiple Choice)

4.7/5  (38)

(38)

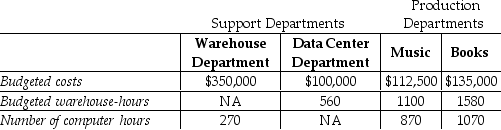

Goldfarb's Book and Music Store has two service departments,Warehouse and Data Center.Warehouse Department costs of $350,000 are allocated on the basis of budgeted warehouse-hours.Data Center Department costs of $100,000 are allocated based on the number of computer log-on hours.The costs of operating departments Music and Books are $112,500 and $135,000,respectively.Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the direct method,what amount of Warehouse Department costs will be allocated to Department Books? (Do not round any intermediary calculations. )

Using the direct method,what amount of Warehouse Department costs will be allocated to Department Books? (Do not round any intermediary calculations. )

(Multiple Choice)

5.0/5  (27)

(27)

Corny Solutions processes various corn related food items.One of its facilities located in Iowa,performs some initial processing of corn on the cob once it arrives from the corn fields.The corn from that facility will be further processed elsewhere into corn for popping and corn meal.The costs incurred at the Iowa plant would be considered ________.

(Multiple Choice)

4.8/5  (30)

(30)

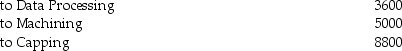

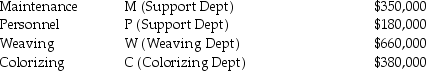

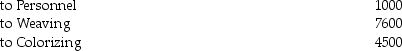

Hugo,owner of Automated Fabric,Inc. ,is interested in using the reciprocal allocation method.The following data from operations were collected for analysis:

Budgeted manufacturing overhead costs:

Services furnished:

By Maintenance (budgeted labor-hours):

Services furnished:

By Maintenance (budgeted labor-hours):

By Personnel (Number of employees serviced):

By Personnel (Number of employees serviced):

What is the complete reciprocated cost of the Personnel Department? (Do not round any intermediary calculations. )

What is the complete reciprocated cost of the Personnel Department? (Do not round any intermediary calculations. )

(Multiple Choice)

4.7/5  (42)

(42)

Which of the following would be the case under the stand-alone method of allocating common costs?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following is an advantage of using practical capacity to allocate costs?

(Multiple Choice)

4.7/5  (37)

(37)

The stand-alone cost allocation method ranks the individual users of a cost object in order of users most responsible for a common cost and then uses these rankings to allocate the costs among the users.

(True/False)

4.8/5  (37)

(37)

The single cost-allocation method makes no distinction between fixed and variable costs.

(True/False)

4.9/5  (36)

(36)

The Maintenance Department has been servicing Gizmo Production for four years.Beginning next year,the company is adding a Scrap-Processing Department to recycle the materials from Gizmo Production.As a result,maintenance costs are expected to increase from $460,000 per year to $525,000 per year.The Scrap-Processing Department will use 25% of the maintenance efforts.

Required:

a.Using the stand-alone cost-allocation method,identify the amount of maintenance cost that will be allocated to Gizmo Production and the Scrap-Processing Department next year.

b.Using the incremental cost-allocation method,identify the amount of maintenance cost that will be allocated to Gizmo Production and the Scrap-Processing Department next year.

(Essay)

4.9/5  (42)

(42)

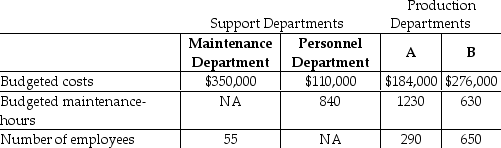

Hanung Corp has two service departments,Maintenance and Personnel.Maintenance Department costs of $350,000 are allocated on the basis of budgeted maintenance-hours.Personnel Department costs of $110,000 are allocated based on the number of employees.The costs of operating departments A and B are $184,000 and $276,000,respectively.Data on budgeted maintenance-hours and number of employees are as follows:

Using the step-down method,what amount of Maintenance Department cost will be allocated to Department A if the service department with the highest percentage of interdepartmental support service is allocated first? (Do not round any intermediary calculations. )

Using the step-down method,what amount of Maintenance Department cost will be allocated to Department A if the service department with the highest percentage of interdepartmental support service is allocated first? (Do not round any intermediary calculations. )

(Multiple Choice)

4.8/5  (28)

(28)

When actual cost-allocation rates are used,managers of the supplier division are motivated to improve efficiency.

(True/False)

4.8/5  (34)

(34)

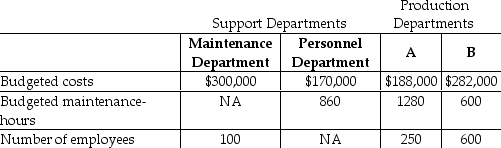

Hanung Corp has two service departments,Maintenance and Personnel.Maintenance Department costs of $300,000 are allocated on the basis of budgeted maintenance-hours.Personnel Department costs of $170,000 are allocated based on the number of employees.The costs of operating departments A and B are $188,000 and $282,000,respectively.Data on budgeted maintenance-hours and number of employees are as follows:

Using the direct method,what amount of Personnel Department costs will be allocated to Department B? (Do not round any intermediary calculations. )

Using the direct method,what amount of Personnel Department costs will be allocated to Department B? (Do not round any intermediary calculations. )

(Multiple Choice)

4.8/5  (33)

(33)

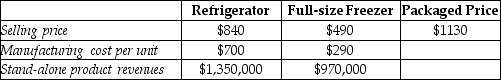

Electro Corp sells a refrigerator and a freezer as a single package for $1130.Other data are in the chart below.

Using the stand-alone method with selling price as the weight for revenue allocation,what amount will be allocated to the refrigerator? (Do not round any intermediary calculations. )

Using the stand-alone method with selling price as the weight for revenue allocation,what amount will be allocated to the refrigerator? (Do not round any intermediary calculations. )

(Multiple Choice)

4.8/5  (39)

(39)

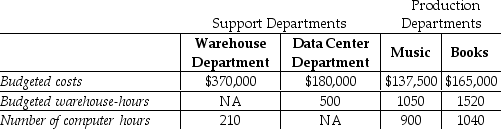

Goldfarb's Book and Music Store has two service departments,Warehouse and Data Center.Warehouse Department costs of $370,000 are allocated on the basis of budgeted warehouse-hours.Data Center Department costs of $180,000 are allocated based on the number of computer log-on hours.The costs of operating departments Music and Books are $137,500 and $165,000,respectively.Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the direct method,what amount of Data Center Department costs will be allocated to Department Music? (Do not round any intermediary calculations. )

Using the direct method,what amount of Data Center Department costs will be allocated to Department Music? (Do not round any intermediary calculations. )

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following statements is true about the step-down method?

(Multiple Choice)

4.9/5  (32)

(32)

Showing 101 - 120 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)