Exam 12: Contributed Capital

Exam 1: Uses of Accounting Information and the Financial Statements167 Questions

Exam 2: Analyzing Business Transactions189 Questions

Exam 3: Measuring Business Income171 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Financial Reporting and Analysis177 Questions

Exam 6: The Operating Cycle and Merchandising Operations145 Questions

Exam 7: Internal Control117 Questions

Exam 8: Inventories154 Questions

Exam 9: Cash and Receivables177 Questions

Exam 10: Current Liabilities and Fair Value Accounting180 Questions

Exam 11: Long Term Assets241 Questions

Exam 12: Contributed Capital189 Questions

Exam 13: Long Term Liabilities194 Questions

Exam 14: The Corporate Income Statement and the Statement of Stockholders Equity176 Questions

Exam 15: The Statement of Cash Flows149 Questions

Exam 16: Financial Performance Measurement163 Questions

Exam 17: Partnerships129 Questions

Exam 18: The Changing Business Environment-A Managers Pers130 Questions

Exam 19: Cost Concepts and Cost Allocation188 Questions

Exam 20: Costing Systems: Job Order Costing88 Questions

Exam 21: Costing Systems Process Costing136 Questions

Exam 22: Activity-Based Systems-Abm and Lean152 Questions

Exam 23: Cost Behavior Analysis166 Questions

Exam 24: The Budgeting Process116 Questions

Exam 25: Performance Management and Evaluation117 Questions

Exam 26: Standard Costing and Variance Analysis120 Questions

Exam 27: Short Run Decision Analysis90 Questions

Exam 28: Capital Investment Analysis123 Questions

Select questions type

The dividends yield is measured in terms of "times."

Free

(True/False)

4.7/5  (35)

(35)

Correct Answer:

False

Which of the following phrases is not descriptive of the corporate form of business?

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

D

Beckham Corporation has 3,000 shares of $100 par value, 7 percent cumulative preferred stock, and 10,000 shares of $10 par value common stock outstanding during its first five years of operation. Beckham Corporation paid cash dividends as follows: 2006, $10,500; 2007, $0; 2008, $65,000; 2009, $30,000; 2010, $15,000. The amount of dividends the common stockholders received during 2006 was

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

A

The following information relates to the number of common shares of the Nelly Corporation:

40,000 Authorized shares 15,000 Unissued shares 2,500 Treasury shares

Calculate the number of outstanding shares from the information given. Show your calculations.

(Essay)

4.8/5  (50)

(50)

Which of the following could be described as both an advantage and a disadvantage of incorporation?

(Multiple Choice)

4.7/5  (37)

(37)

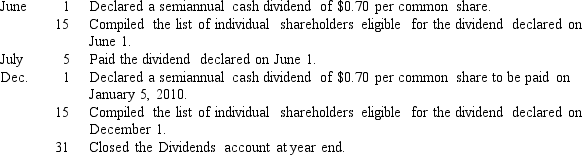

Sylmar Corporation has 30,000 shares of $100 stated value no-par common stock authorized, and 20,000 shares were outstanding during 2009. The following transactions relate to cash dividends of Sylmar Corporation for the year ended December 31, 2009. Prepare entries in journal form without explanations to record the following transactions:

(Essay)

5.0/5  (34)

(34)

Berman Corporation was organized during 2010. In organizing, the company incurred the following costs:

1. Paid the state $900 for the corporate charter and related fees of incorporation.

2. Paid the attorney $2,500 for services rendered in connection with filing incorporation papers with the state.

3. Issued 500 shares of $5 par value common stock to an accountant in exchange for accounting services valued at $3,000.

Prepare the entries in journal form necessary to record the above transactions without explanations.

(Essay)

4.8/5  (35)

(35)

The following information relates to the number of common shares of the Telly Corporation:

80,000 Authorized shares 30,000 Unissued shares 5,000 Treasury shares

Calculate the number of outstanding shares from the information given. Show your calculations.

(Essay)

4.9/5  (38)

(38)

Dividends on cumulative preferred stock do not become a liability of the corporation until they are declared by the board of directors.

(True/False)

4.8/5  (38)

(38)

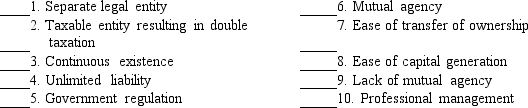

Identify (by code letter) each of the following characteristics as being an advantage of (A), a disadvantage of (D), or not applicable to (N) the corporate form of business.

(Essay)

4.8/5  (35)

(35)

Duncan Corporation has 2,000 shares of $100 par value, 6 percent cumulative preferred stock and 20,000 shares of $10 par value common stock outstanding. In its first four years of operation, Duncan Corporation paid cash dividends as follows: 2007, $15,000; 2008, $0; 2009, $20,000; 2010, $25,000. Calculate the total cash dividends received by owners of preferred and common stock in each year.

(Essay)

4.8/5  (35)

(35)

The limited liability of a stockholder can be viewed as both an advantage and a disadvantage.

(True/False)

5.0/5  (31)

(31)

The board of directors of Irondale Corporation declared a cash dividend of $2.50 per share on 57,000 shares of common stock on June 14, 2010. The dividend is to be paid on July 15, 2010, to shareholders of record on July 1, 2010. The effects of the entry to record the declaration of the dividend on June 14, 2010 , are to

(Multiple Choice)

4.9/5  (33)

(33)

If a corporation has issued common stock at various prices that exceed par value, legal capital will be made up of the

(Multiple Choice)

4.8/5  (37)

(37)

Showing 1 - 20 of 189

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)