Exam 12: Differential Analysis and Product Pricing

Exam 1: The Role of Accounting in Business94 Questions

Exam 2: Basic Accounting Concepts88 Questions

Exam 3: Accrual Accounting Concepts110 Questions

Exam 4: Accounting for Merchandising Businesses142 Questions

Exam 5: Sarbanes-Oxley,internal Control,and Cash109 Questions

Exam 6: Receivables and Inventories100 Questions

Exam 7: Fixed Assets and Intangible Assets86 Questions

Exam 8: Liabilities and Stockholders Equity132 Questions

Exam 9: Financial Statement Analysis83 Questions

Exam 10: Accounting Systems for Manufacturing Businesses116 Questions

Exam 11: Cost Behavior and Cost-Volume-Profit Analysis139 Questions

Exam 12: Differential Analysis and Product Pricing102 Questions

Exam 13: Budgeting and Standard Cost Systems170 Questions

Exam 14: Performance Evaluation for Decentralized Operations137 Questions

Exam 15: Capital Investment Analysis103 Questions

Select questions type

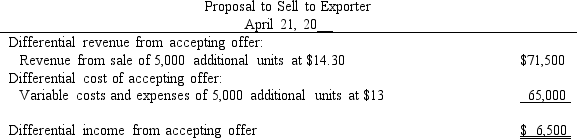

FDE Manufacturing Company has a normal plant capacity of 75,000 units per month.Because of an extra large quantity of inventory on hand,it expects to produce only 60,000 units in May.Monthly fixed costs and expenses are $150,000 ($2 per unit at normal plant capacity),and variable costs and expenses are $13 per unit.The present selling price is

$25 per unit.The company has an opportunity to sell 5,000 additional units at $14.30 per unit to an exporter who plans to market the product under its own brand name in a foreign market.The additional business is therefore not expected to affect the regular selling price or quantity of sales of FDE Manufacturing Company.

Prepare a differential analysis report,dated April 21 of the current year,on the proposal to sell at the special price.

Free

(Essay)

4.8/5  (41)

(41)

Correct Answer:

Wyandott Co.produces two products.Both products pass through a firing process that is operating at full capacity and is a production bottleneck.Product A requires 2 hours of processing and has a contribution margin per unit of $60.Product B requires 1 hour of processing and has a contribution margin of $40.Which of the following provides the most accurate assessment of the situation assuming unlimited demand for each product?

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

A

Managers who often make special pricing decisions are more likely to use which of the following cost concepts in their work?

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

C

Max,Inc.can sell a large piece of machinery for $90,000.The machinery originally cost $240,000 and has accumulated depreciation of $130,000.Max will have to pay a 5% sales commission on the sale.Rather than sell,Max is considering leasing the machine.It can be leased for 4 years for $24,000 per year.Max has estimated future operating expenses to be $3,000 per year,and Max will be responsible for those expenses.Which of the following options most accurately describes the analysis and decision for Max?

(Multiple Choice)

4.9/5  (30)

(30)

A business is considering a cash outlay of $250,000 for the purchase of land,which it intends to lease for $40,000 per year.If alternative investments are available that yield an 16% return,the opportunity cost of the purchase of the land is

(Multiple Choice)

4.8/5  (40)

(40)

In using the variable cost concept of applying the cost-plus approach to product pricing,fixed manufacturing costs and fixed selling and administrative expenses must be covered by the markup.

(True/False)

4.9/5  (35)

(35)

Differential revenue is the amount of income that would result from the best available alternative for the proposed use of cash.

(True/False)

4.9/5  (39)

(39)

The amount of increase or decrease in cost that is expected from a particular course of action as compared to an alternative is termed

(Multiple Choice)

4.7/5  (37)

(37)

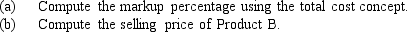

Glover Inc.manufactures Product B,incurring variable costs of $15.00 per unit and fixed costs of $70,000.Glover desires a profit equal to a 12% rate of return on assets.Assets of $785,000 are devoted to producing Product B,and 100,000 units are expected to be produced and sold.

(Essay)

4.9/5  (42)

(42)

In using the variable cost concept of applying the cost-plus approach to product pricing,variable manufacturing costs and variable selling and administrative expenses must be covered by the markup.

(True/False)

4.9/5  (36)

(36)

When choosing whether or not to replace usable fixed assets,management should consider the future costs,but not the prior costs,of continuing to use the asset versus the costs and benefits of replacement.

(True/False)

4.8/5  (32)

(32)

What pricing method is used if all costs are considered and a fair markup is added to determine the selling price?

(Multiple Choice)

4.9/5  (34)

(34)

In using the variable cost concept of applying the cost-plus approach to product pricing,what is included in the markup?

(Multiple Choice)

4.9/5  (42)

(42)

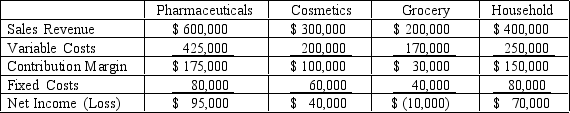

Brickman's Pharmacy sells a variety of products.The business is divided into four segments or departments for reporting purposes.The departments and their operating results are shown below:

The fixed costs consist of insurance,property taxes,interest,and other costs that will NOT be eliminated if a department is discontinued.

Brickman's management is considering eliminating the grocery department.Assuming sales in the other departments will not be affected by dropping the grocery department,what will be the effect on the company's total operating income?

The fixed costs consist of insurance,property taxes,interest,and other costs that will NOT be eliminated if a department is discontinued.

Brickman's management is considering eliminating the grocery department.Assuming sales in the other departments will not be affected by dropping the grocery department,what will be the effect on the company's total operating income?

(Essay)

4.9/5  (42)

(42)

In using the product cost concept of applying the cost-plus approach to product pricing,selling expenses,administrative expenses,and profit are covered in the markup.

(True/False)

4.9/5  (32)

(32)

When evaluating whether to lease or sell equipment,the book value of the equipment is a sunk cost and not a differential cost.

(True/False)

4.8/5  (45)

(45)

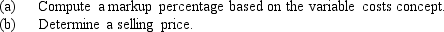

Kirk Co.manufactures mobile cellular equipment and develops a price for the product by using a variable cost concept.Kirk incurs variable costs of $1,900,000 in the production of 100,000 units.Fixed costs total $50,000.The company employs $4,725,000 of assets and wishes to earn a profit equal to a 10% rate of return on assets.

(Essay)

4.7/5  (38)

(38)

When deciding to make or buy a part needed for the manufacturing process,management needs to consider whether the plant has excess production capacity available to make the part or if current production will need to be interrupted to manufacture the part.

(True/False)

4.9/5  (27)

(27)

Showing 1 - 20 of 102

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)