Exam 12: Differential Analysis and Product Pricing

Exam 1: The Role of Accounting in Business94 Questions

Exam 2: Basic Accounting Concepts88 Questions

Exam 3: Accrual Accounting Concepts110 Questions

Exam 4: Accounting for Merchandising Businesses142 Questions

Exam 5: Sarbanes-Oxley,internal Control,and Cash109 Questions

Exam 6: Receivables and Inventories100 Questions

Exam 7: Fixed Assets and Intangible Assets86 Questions

Exam 8: Liabilities and Stockholders Equity132 Questions

Exam 9: Financial Statement Analysis83 Questions

Exam 10: Accounting Systems for Manufacturing Businesses116 Questions

Exam 11: Cost Behavior and Cost-Volume-Profit Analysis139 Questions

Exam 12: Differential Analysis and Product Pricing102 Questions

Exam 13: Budgeting and Standard Cost Systems170 Questions

Exam 14: Performance Evaluation for Decentralized Operations137 Questions

Exam 15: Capital Investment Analysis103 Questions

Select questions type

Opportunity cost is the amount of increase or decrease in revenue that would result from the best available alternative to the proposed use of cash or its equivalent.

(True/False)

4.9/5  (29)

(29)

If the total unit cost of manufacturing Product Y is currently $40 and the total unit cost after modifying the style is estimated to be $48,the differential cost for this situation is $8.

(True/False)

5.0/5  (38)

(38)

Hill Co.can further process Product O to produce Product P.Product O is currently selling for $60 per pound and costs $42 per pound to produce.Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce.

The differential cost of producing Product P is $13 per pound.

(True/False)

4.8/5  (35)

(35)

Hill Co.can further process Product O to produce Product P.Product O is currently selling for $65 per pound and costs $42 per pound to produce.Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce.

The differential cost of producing Product P is $56 per pound.

(True/False)

4.9/5  (41)

(41)

When evaluating whether to lease or sell equipment,book value is considered to be a cost of selling the equipment.

(True/False)

4.8/5  (33)

(33)

What pricing method may be used if there are several providers in the same market and there is sufficient demand for your product?

(Multiple Choice)

4.9/5  (38)

(38)

Whiteville Co.can further process Product B to produce Product C.Product B is currently selling for $45 per pound and costs $30 per pound to produce.Product C would sell for $80 per pound and would require an additional cost of $18 per pound to produce.What is the differential cost of producing Product C?

(Multiple Choice)

4.8/5  (33)

(33)

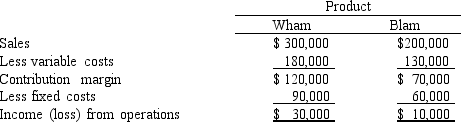

The condensed income statement for a business for the past year is as follows:

Management is considering the discontinuance of the manufacture and sale of Blam at the beginning of the current year.The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Wham.What is the amount of change in net income for the current year that will result from the discontinuance of Blam?

Management is considering the discontinuance of the manufacture and sale of Blam at the beginning of the current year.The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Wham.What is the amount of change in net income for the current year that will result from the discontinuance of Blam?

(Multiple Choice)

4.8/5  (40)

(40)

When a product or segment of a business is determined to be generating a loss,the total income from operations for the company will always increase if management eliminates the product or segment.

(True/False)

4.9/5  (43)

(43)

Defense contractors would be more likely to use which of the following cost concepts in pricing their product?

(Multiple Choice)

4.8/5  (27)

(27)

A practical approach that is frequently used by managers when setting normal long-run prices is the

(Multiple Choice)

4.9/5  (39)

(39)

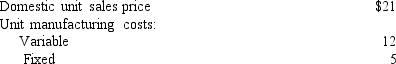

A business received an offer from an exporter for 10,000 units of product at $13.50 per unit.The acceptance of the offer will not affect normal production or domestic sales prices.

The following data are available:

What is the amount of the gain or loss from acceptance of the offer?

What is the amount of the gain or loss from acceptance of the offer?

(Multiple Choice)

4.9/5  (31)

(31)

In using the total cost concept of applying the cost-plus approach to product pricing,what is included in the markup?

(Multiple Choice)

4.9/5  (37)

(37)

Manufacturers must conform to the Robinson-Patman Act,which prohibits price discrimination within the United States unless differences in prices can be justified by different costs of serving different customers.

(True/False)

4.8/5  (41)

(41)

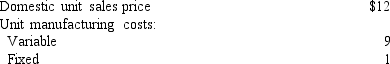

A business received an offer from an exporter for 5,000 units of product at $10 per unit.

The acceptance of the offer will not affect normal production or domestic sales prices.

The following data are available:

-What is the amount of gain or loss from acceptance of the offer?

-What is the amount of gain or loss from acceptance of the offer?

(Multiple Choice)

4.7/5  (31)

(31)

Eliminating a product or segment may have the long-term effect of reducing fixed costs.

(True/False)

4.9/5  (42)

(42)

Assume that Marlow Co.is considering disposing of equipment that cost $200,000 and has $160,000 of accumulated depreciation to date.Marlow Co.can sell the equipment through a broker for $100,000 less 5% commission.Alternatively,Minton Co.has offered to lease the equipment for five years for a total of $195,000.Marlow will incur repair,insurance,and property tax expenses estimated at $40,000.At lease-end,the equipment is expected to have no residual value.The net differential income from the lease alternative is

(Multiple Choice)

4.8/5  (30)

(30)

Product J is one of the many products manufactured and sold by Gooble Company.An income statement by product line for the past year indicated a net loss for Product J of $7,250.This net loss resulted from sales of $265,000,cost of goods sold of $186,500,and operating expenses of $85,750.It is estimated that 30% of the cost of goods sold represents fixed factory overhead costs and that 40% of the operating expense is fixed.If Product J is retained,the revenue,costs,and expenses are not expected to change significantly from those of the current year.However,because of the net loss,management is considering the elimination of the unprofitable endeavor.Because of the large number of products manufactured,the total fixed costs and expenses are not expected to decline significantly if Product J is discontinued.

Prepare a differential analysis report,dated February 8 of the current year,on the proposal to discontinue Product J.

(Essay)

4.8/5  (35)

(35)

Granger Co.can further process Product B to produce Product C.Product B is currently selling for $55 per pound and costs $42 per pound to produce.Product C would sell for

$82 per pound and would require an additional cost of $13 per pound to produce.What is

The differential revenue of producing and selling Product C?

(Multiple Choice)

4.9/5  (31)

(31)

Showing 41 - 60 of 102

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)