Exam 7: Fixed Assets and Intangible Assets

Exam 1: The Role of Accounting in Business94 Questions

Exam 2: Basic Accounting Concepts88 Questions

Exam 3: Accrual Accounting Concepts110 Questions

Exam 4: Accounting for Merchandising Businesses142 Questions

Exam 5: Sarbanes-Oxley,internal Control,and Cash109 Questions

Exam 6: Receivables and Inventories100 Questions

Exam 7: Fixed Assets and Intangible Assets86 Questions

Exam 8: Liabilities and Stockholders Equity132 Questions

Exam 9: Financial Statement Analysis83 Questions

Exam 10: Accounting Systems for Manufacturing Businesses116 Questions

Exam 11: Cost Behavior and Cost-Volume-Profit Analysis139 Questions

Exam 12: Differential Analysis and Product Pricing102 Questions

Exam 13: Budgeting and Standard Cost Systems170 Questions

Exam 14: Performance Evaluation for Decentralized Operations137 Questions

Exam 15: Capital Investment Analysis103 Questions

Select questions type

A fixed asset with a cost of $30,000 and accumulated depreciation of $25,000 is sold for $3,500.What is the amount of the gain or loss on disposal of the fixed asset?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following expenditures would NOT be included in the cost of an asset?

(Multiple Choice)

4.8/5  (34)

(34)

If a fixed asset is sold and the book value is less than cash received,the company must

(Multiple Choice)

4.8/5  (34)

(34)

Amortization refers to the systematic transfer of fixed assets to expense accounts.

(True/False)

4.7/5  (27)

(27)

The amount of depreciation expense for the first full year of use of a fixed asset costing $95,000,with an estimated residual value of $5,000 and a useful life of 5 years,is $18,000 by the straight-line method.

(True/False)

4.9/5  (30)

(30)

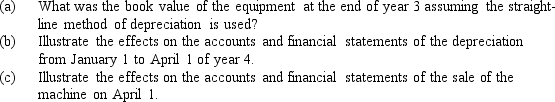

A machine with a useful life of 6 years and a residual value of $3,000 was purchased at the beginning of year 1 for $30,000.The machine was sold for $15,000 on April 1 in year 4.

(Essay)

5.0/5  (38)

(38)

Expenditures that add to the utility of fixed assets for more than one accounting period are

(Multiple Choice)

4.9/5  (38)

(38)

A company sold office furniture costing $16,500 with accumulated depreciation of $14,000 for $1,800 cash.The entry to record the sale would include

(Multiple Choice)

4.9/5  (29)

(29)

A company acquired a truck for $79,000 at the beginning of the fiscal year.It has a useful life of 5 years and a residual value of $9,000.The company uses the straight-line method of depreciation.After owning the truck for two years,the company sold it for $34,000.(a)Determine depreciation expense for each of the first two years,and (b)determine the gain or loss resulting from the sale.

(Essay)

4.8/5  (36)

(36)

A company purchased a photocopy machine for $16,000.It has a useful life of 4 years and a residual value of $1,000.Compute depreciation for the second year under each of the following methods: (a)straight-line and (b)double-declining-balance.

(Essay)

4.8/5  (36)

(36)

Physical depreciation occurs when a fixed asset is no longer able to provide services at the level for which it was intended.

(True/False)

4.9/5  (47)

(47)

A company made some expensive repairs to equipment and buildings during the past year.(a)What criteria is used in determining whether the repairs are capital expenditures or revenue expenditures,and (b)what is the effect on the company's financial statements if they are incorrectly recorded as capital expenditures?

(Essay)

4.9/5  (34)

(34)

On September 1,a machine with a useful life of 8 years and a residual value of $3,000 was purchased for $47,000.What is depreciation expense in the year of purchase under straight-line depreciation assuming a December 31 year-end?

(Multiple Choice)

4.7/5  (31)

(31)

Equipment was purchased for $30,000.It has a useful life of 5 years and a residual value of $4,000.What is depreciation expense for year two under the double-declining-balance method?

(Multiple Choice)

4.8/5  (25)

(25)

The exclusive right to use a certain name or symbol is called a

(Multiple Choice)

4.9/5  (39)

(39)

An estimate of the amount that an asset can be sold for at the end of its useful life is called book value.

(True/False)

4.9/5  (38)

(38)

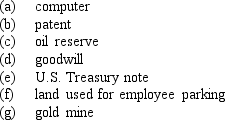

Identify the following as a Fixed Asset (FA),Intangible Asset (IA),Natural Resource (NR),or None of these (N).

(Essay)

4.8/5  (31)

(31)

Showing 41 - 60 of 86

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)