Exam 4: Completing the Accounting Cycle

Exam 1: Accounting and the Business Environment246 Questions

Exam 2: Recording Business Transactions219 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Merchandising Operations301 Questions

Exam 6: Merchandise Inventory199 Questions

Exam 7: Accounting Information Systems164 Questions

Exam 8: Internal Control and Cash258 Questions

Exam 9: Receivables233 Questions

Exam 10: Plant Assets, natural Resources, and Intangibles212 Questions

Exam 11: Current Liabilities and Payroll221 Questions

Exam 12: Partnerships171 Questions

Exam 13: Corporations277 Questions

Exam 14: Long-Term Liabilities207 Questions

Exam 15: Investments193 Questions

Exam 16: The Statement of Cash Flows183 Questions

Exam 17: Financial Statement Analysis161 Questions

Select questions type

GAAP requires publicly traded companies to prepare a post-closing trial balance and publish it in their annual report.

(True/False)

4.8/5  (41)

(41)

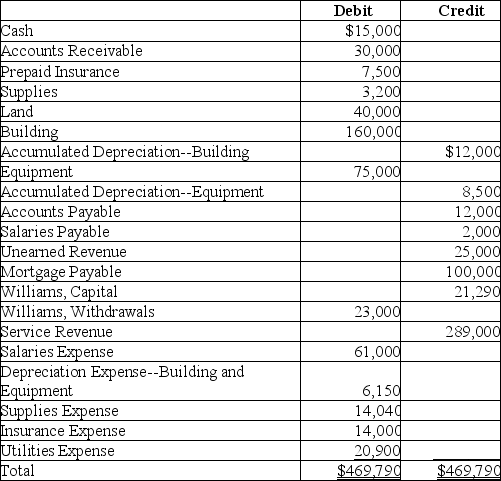

The adjusted trial balance of Williams Landscaping at December 31,2019 is as follows:

There were no new capital contributions during the year.Using the information above,prepare a post-closing trial balance for Williams Landscaping (dated December 31,2019).

There were no new capital contributions during the year.Using the information above,prepare a post-closing trial balance for Williams Landscaping (dated December 31,2019).

(Essay)

4.8/5  (32)

(32)

In an accounting cycle,which of the following steps takes place only at the end of the accounting period?

(Multiple Choice)

5.0/5  (41)

(41)

Which of the following statements concerning the worksheet is correct?

(Multiple Choice)

4.7/5  (31)

(31)

Martinville Company earned revenues of $20,000 and incurred expenses of $4,000.Martinville withdrew $3,500 for personal use.What is the balance in the Income Summary account prior to closing net income or loss to the Martinville,Capital account?

(Multiple Choice)

4.9/5  (35)

(35)

Perry Service Company had the following unadjusted balances at December 31,2018: Salaries Payable,$0;Salaries Expense,$12,000.The following transactions took place on December 31,2018:

Accrued Salaries Expense,$5,000

Closed the Salaries Expense account.

The following transaction took place on January 4,2019:

Paid salaries of $6,000.This payment included $5,000 that was accrued on December 31,2018 and $1,000 for the first few days in January 2019.

Prepare the journal entry for January 4,2019,assuming that reversing entries were not made.Omit explanation.

(Essay)

4.9/5  (38)

(38)

Regarding a classified balance sheet,which of the following statements is correct?

(Multiple Choice)

4.8/5  (33)

(33)

Net income (loss)is the difference between the total debits and the total credits in the income statement columns of the worksheet.

(True/False)

4.9/5  (41)

(41)

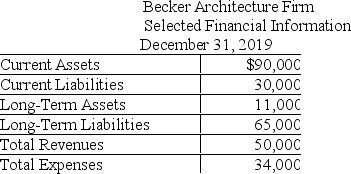

The following contains information from the records of the Becker Architecture Firm.  Which of the following statements is an accurate interpretation of the current ratio of the Becker Architecture Firm? (Round your answer to two decimal places. )

Which of the following statements is an accurate interpretation of the current ratio of the Becker Architecture Firm? (Round your answer to two decimal places. )

(Multiple Choice)

4.8/5  (39)

(39)

At the beginning of the year,the total owner's equity of Cutting Edge Technologies Company was $90,000.The revenues and expenses were $60,000 and $40,000,respectively.The owner did not make withdrawals or capital contributions during the year.The total owner's equity at the end of the year will amount to $100,000.

(True/False)

4.8/5  (38)

(38)

Why are temporary accounts not included in the post-closing trial balance?

(Essay)

5.0/5  (40)

(40)

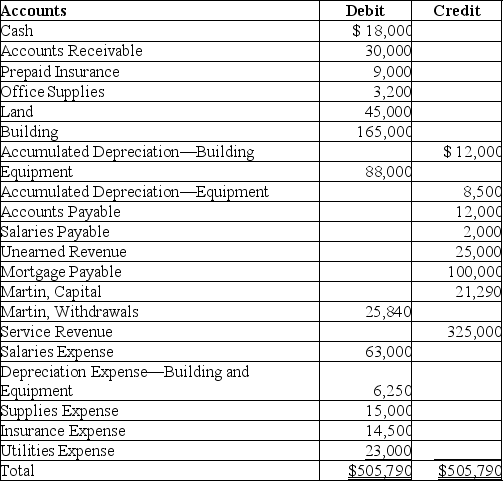

The following is the adjusted trial balance as of December 31,2019 of Martin Security Services Company:

Prepare the closing entry for revenues.Omit explanation.

Prepare the closing entry for revenues.Omit explanation.

(Essay)

4.9/5  (38)

(38)

Olsteen Company earned revenues of $61,000 and incurred expenses of $71,000.No withdrawals were taken.The owner did not make any new capital contributions during the year.The company is a sole proprietorship.Which of the following statements is correct?

(Multiple Choice)

4.8/5  (33)

(33)

As a part of the closing process,revenues and expenses may be closed to a temporary account called the Net Income (Loss).

(True/False)

4.8/5  (29)

(29)

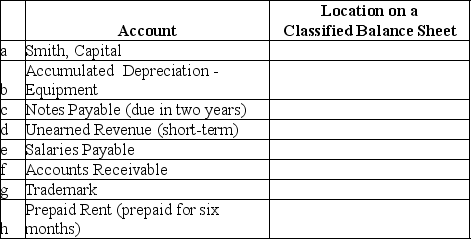

For each account listed,identify the category in which it would appear on a classified balance sheet.

(Essay)

4.9/5  (41)

(41)

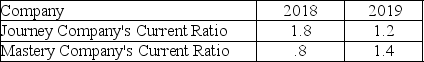

The following information is provided for Journey Company and Mastery Company.Both companies provide training materials for electricians.

a.Which company has the stronger current ratio for 2018 and 2019? Defend your answer.

b.Discuss the change in current ratio for each company.

a.Which company has the stronger current ratio for 2018 and 2019? Defend your answer.

b.Discuss the change in current ratio for each company.

(Essay)

4.9/5  (41)

(41)

Showing 121 - 140 of 208

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)