Exam 8: Rental Property, royalties, and Income From Flow-Through Entities Line 17, form 1040, and Schedule E

Exam 1: Introduction to Taxation, the Income Tax Formula, and Form 1040ez139 Questions

Exam 2: Expanded Tax Formula, forms 1040a and 1040, and Basic Concepts125 Questions

Exam 3: Gross Income: Inclusions and Exclusions125 Questions

Exam 4: Adjustments for Adjusted Gross Income116 Questions

Exam 5: Itemized Deductions119 Questions

Exam 6: Self-Employed Business Income Line 12 of Form 1040 and Schedule C76 Questions

Exam 7: Capital Gains and Other Sales of Property Schedule D and Form 4797118 Questions

Exam 8: Rental Property, royalties, and Income From Flow-Through Entities Line 17, form 1040, and Schedule E119 Questions

Exam 9: Tax Credits Form 1040, lines 46 Through 54 and Lines 66a Through 73141 Questions

Exam 10: Payroll Taxes121 Questions

Exam 11: Retirement and Other Tax-Deferred Plans and Annuities124 Questions

Exam 12: Special Property Transactions75 Questions

Exam 13: At-Riskpassive Activity Loss Rules and the Individual Alternative Minimum Tax73 Questions

Exam 14: Partnership Taxation74 Questions

Exam 15: Corporate Taxation127 Questions

Select questions type

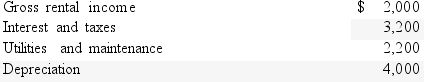

In the current year,Marnie rented her vacation home for 75 days,used it for personal reasons for 22 days,and left it vacant for the remainder of the year.Her income and expenses are as follows:  What is Marnie's net income or loss from the activity? Use the Tax Court method.Round your answer to the nearest whole dollar)

What is Marnie's net income or loss from the activity? Use the Tax Court method.Round your answer to the nearest whole dollar)

(Multiple Choice)

5.0/5  (40)

(40)

Rental properties that are also used as vacation homes fall under one of three categories: 1)primarily rental,2)primarily personal,and 3)personal/rental.

(True/False)

4.8/5  (29)

(29)

Lori and Donald own a condominium in Colorado Springs,Colorado,that they rent out part of the time and use during the summer.The rental property is classified as personal/rental property and their personal use is determined to be 75% based on the IRS method).They had the following income and expenses for the year before any allocation):  How much net loss should Lori and Donald report for their condominium on their tax return this year?

How much net loss should Lori and Donald report for their condominium on their tax return this year?

(Multiple Choice)

4.8/5  (48)

(48)

A property rented for less than 15 days and used for personal use the remainder of the year,should have the rental income reported on Schedule E.

(True/False)

4.9/5  (35)

(35)

In the case of a primarily personal property,a taxpayer may report a net loss as long as the correct allocation method was used.

(True/False)

4.7/5  (27)

(27)

Jamison owns a rental cabin in Mammoth,and travels there for maintenance three times a year,between January and June.The round trip to Mammoth from San Diego where Jamison lives,is approximately 405 miles.How much travel costs can Jamison deduct per year related to his rental cabin? Round your answer to the nearest whole number)

(Multiple Choice)

5.0/5  (31)

(31)

Capital improvements on rental properties may be deducted in the current year.

(True/False)

4.9/5  (40)

(40)

There are two methods available to taxpayers to allocate expenses between personal and rental use of properties.

(True/False)

4.8/5  (41)

(41)

If a taxpayer materially participates in a real estate activity as a real estate professional,the income and expenses of the activity should be reported on:

(Multiple Choice)

4.8/5  (43)

(43)

Jeremiah is a full-time professor of psychology at the University of Washington and an author of a psychology textbook.The royalty income he receives from the publisher should be reported on:

(Multiple Choice)

4.8/5  (41)

(41)

If a tenant provides service for the rental property in lieu of rental payment,the fair market value of the service is considered rental income and must be reported as income.

(True/False)

4.8/5  (42)

(42)

Richard owns a cabin in Utah that he rented for $4,000 for 21 days.He lived there for a total of 120 days.The expenses for the home included $8,000 in mortgage interest,$1,200 in property taxes, $1,300 in maintenance and utilities,and $3,500 in depreciation.How much net income or loss from the Utah home would Richard report for the current year use the IRS method)? Round your answer to the nearest whole number)

(Multiple Choice)

4.8/5  (39)

(39)

Reggie and Bebe own an apartment building in Portland,Oregon,with 8 identical units.They live in one and rent the remaining units.Their rental income for the year was $45,000.They incurred the following expenses for the entire building:  What amount of net income should Reggie and Bebe report for the current year for this rental? Round your answer to the nearest whole dollar)

What amount of net income should Reggie and Bebe report for the current year for this rental? Round your answer to the nearest whole dollar)

(Multiple Choice)

4.8/5  (32)

(32)

What are the rules concerning the deductibility of travel as it relates to rental properties? How are travel expenses to and from rental properties calculated?

(Essay)

4.7/5  (36)

(36)

Mario owns a home in Park City,Utah,that he rented for $1,600 for three weeks during the summer.He lived there for a total of 120 days and the rest of the year the house was vacant.The expenses for the home included $6,000 in mortgage interest,$900 in property taxes,$1,300 in maintenance and utilities,and $3,500 in depreciation.How much net rental income or loss from the Park City home would Mario report for the current year? Use the IRS method for allocating expenses.

(Multiple Choice)

4.9/5  (35)

(35)

What criteria determine a personal and rental use property as personal/rental? How is net income or loss treated for tax purposes for a personal/rental property?

(Essay)

4.8/5  (31)

(31)

On June 1st of the current year,Kayla and Ralph purchased a rental beach house for $700,000.Of that amount,$400,000 was for the land value.How much depreciation deduction can they take in the current year? You may need to refer to the depreciation tables.)

(Multiple Choice)

4.9/5  (34)

(34)

Owen and Jessica own and operate an S corporation.Each is a 50% owner.The business reports the following results: Business revenue $ 225,000

Business expenses 88,000

Investment expenses 16,000

How do Owen and Jessica report these items for tax purposes?

(Multiple Choice)

4.8/5  (36)

(36)

When reporting the income and expenses of a rental property,what determines the use of the Schedule C versus the Schedule E?

(Essay)

4.8/5  (32)

(32)

Showing 41 - 60 of 119

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)