Exam 6: Self-Employed Business Income Line 12 of Form 1040 and Schedule C

Exam 1: Introduction to Taxation, the Income Tax Formula, and Form 1040ez139 Questions

Exam 2: Expanded Tax Formula, forms 1040a and 1040, and Basic Concepts125 Questions

Exam 3: Gross Income: Inclusions and Exclusions125 Questions

Exam 4: Adjustments for Adjusted Gross Income116 Questions

Exam 5: Itemized Deductions119 Questions

Exam 6: Self-Employed Business Income Line 12 of Form 1040 and Schedule C76 Questions

Exam 7: Capital Gains and Other Sales of Property Schedule D and Form 4797118 Questions

Exam 8: Rental Property, royalties, and Income From Flow-Through Entities Line 17, form 1040, and Schedule E119 Questions

Exam 9: Tax Credits Form 1040, lines 46 Through 54 and Lines 66a Through 73141 Questions

Exam 10: Payroll Taxes121 Questions

Exam 11: Retirement and Other Tax-Deferred Plans and Annuities124 Questions

Exam 12: Special Property Transactions75 Questions

Exam 13: At-Riskpassive Activity Loss Rules and the Individual Alternative Minimum Tax73 Questions

Exam 14: Partnership Taxation74 Questions

Exam 15: Corporate Taxation127 Questions

Select questions type

In July 2016,Cassie purchases equipment for $55,000 to be used in her business.Assuming Cassie has a small net loss from her business prior to the deduction,what is the maximum amount of cost recovery Cassie can deduct?

(Multiple Choice)

4.9/5  (38)

(38)

For an expense to be necessary,it must be essential to the taxpayer's business.

(True/False)

5.0/5  (36)

(36)

Sandy is the owner of ABC Loan Company.On June 2,2015,ABC loaned Randy $80,000.In 2016,Randy filed for bankruptcy.At that time,the bankruptcy court indicated that Randy's creditors could expect to receive 30 cents on the dollar.In August 2017 final settlement was made,and ABC received $20,000.ABC's policy is to deduct losses as soon as permitted.How much loss can ABC deduct and in which year?

(Essay)

4.8/5  (38)

(38)

Under MACRS,the half-year convention is used for all real property.

(True/False)

4.8/5  (38)

(38)

Which of the following is incorrect regarding luxury automobile limitations?

(Multiple Choice)

4.8/5  (33)

(33)

Alice is a high school teacher who enjoys knitting.She knits scarves and sweaters and sells them in a local boutique.Alice spends 10 to 15 hours a week knitting the scarves and sweaters.Alice had sales of $6,000 and expenses of $10,000 related to knitting and selling the goods.Alice's $10,000 of expenses consisted of $800 of interest expense and $1,600 in property taxes for her building and tools,$3,000 in supplies,and $4,600 in depreciation charges.How would Alice's income and expenses be reported on her tax return if her knitting activity is characterized as a hobby?

(Essay)

5.0/5  (43)

(43)

Education expenses are deductible if the education maintains or improves existing skills or if the education helps the taxpayer qualify for a new trade or business.

(True/False)

4.7/5  (32)

(32)

If an activity is characterized as a hobby,expenses are deductible only to the extent of income from the hobby,subject to certain ordering rules.

(True/False)

4.8/5  (40)

(40)

A sole proprietor's trade or business income or loss is reported on Schedule C,Form 1040.

(True/False)

4.8/5  (36)

(36)

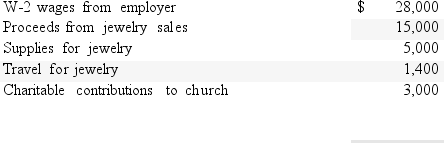

During 2016,Regina,a sole proprietor,had the following income and expenses from her home jewelry business.Regina is also employed as an office assistant at a local business:

a.What income or loss should be reported on Schedule C?

b.What is Regina's AGI?

a.What income or loss should be reported on Schedule C?

b.What is Regina's AGI?

(Essay)

4.8/5  (36)

(36)

When business property is lost in a fire,storm,shipwreck,theft,or other casualty,the taxpayer normally receives a capital loss deduction.

(True/False)

4.8/5  (33)

(33)

On November 30,2016,Constance purchased an apartment building for $750,000.Determine her cost recovery deduction for 2016 rounded to the nearest dollar.

(Multiple Choice)

4.8/5  (38)

(38)

If an activity is considered a hobby,which of the following is true?

(Multiple Choice)

4.9/5  (46)

(46)

Nancy purchased a computer on July 15,2016,for $5,000.The computer was used 70% of the time in her business and the rest of the time her children used the computer to surf the Web.In 2017,the computer was used 40% for business and 60% for personal use.What are the cost recovery deductions for 2016 and 2017? No §179 or bonus).Is there any recapture of depreciation in 2017?

(Essay)

4.8/5  (38)

(38)

Della purchased a warehouse on February 25,2016,for $350,000.$45,000 of the price was for the land.What is her cost recovery deduction for 2016 rounded to the nearest dollar?

(Multiple Choice)

4.8/5  (42)

(42)

Once the more-than-50% business-use test is met for listed property,it does not matter if the business use falls below 50% in subsequent years.

(True/False)

4.9/5  (29)

(29)

Fines paid that are ordinary and necessary in a trade or business generally are deductible.

(True/False)

4.8/5  (38)

(38)

Marion drives 20 miles a day from his first job to his second job.He worked 125 days during 2016 on both jobs.What is Marion's mileage deduction rounded to the nearest dollar assuming he uses the standard mileage rate and mileage is incurred ratably throughout the year?

(Multiple Choice)

4.8/5  (42)

(42)

Sole proprietors must pay self-employment tax on 100% of their self-employment income.

(True/False)

4.8/5  (34)

(34)

Showing 21 - 40 of 76

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)