Exam 8: Internal Control and Cash

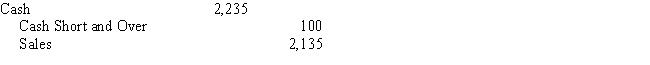

Consider the following journal entry made by Jones Company for one day's sales of a single cashier.What might have happened to create this amount of Cash Short and Over difference? Give three possible reasons for this difference.

There are many possibilities,but the most likely culprits are as follows:

1.The beginning change fund in the drawer was not considered.

2.A collection of an accounts receivable could have not been recorded,makingthe cash "heavy" to sales.

3.A customer may have used a debit card and requested $100 cash back thatwas not given to the customer

(expect a call from the customer).

4.A sale for the exact amount of $100 was not recorded into the sales of thecash register.However,this is a VERY improbable occurrence.

5.A void could have taken place and the cash not refunded or possibly notremoved.In this case,you would certainly investigate the voided items and theactions of the cashier as well as the history of cash reconciliations for thiscashier.

The petty cash fund eliminates the need for a bank checking account.

False

All bank memos reported on the bank reconciliation require entries in the company's accounts.

True

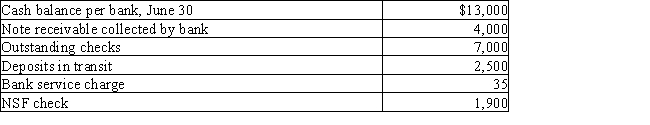

Jamison Company gathered the following reconciling information in preparing its June bank reconciliation:  Using the above information,determine the cash balance per books (before adjustments)for Jamison Company.

Using the above information,determine the cash balance per books (before adjustments)for Jamison Company.

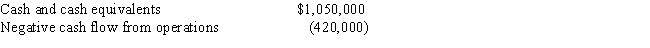

Farm Store,Inc.reported the following data in its December 31 annual report.  Required

(a)What is the company's "cash burn" per month?

(b)What is the company's ratio of cash to monthly cash expenses?

(c)Interpret the ratio you computed in part

b. What are the implications for Farm Store, Inc.?

Required

(a)What is the company's "cash burn" per month?

(b)What is the company's ratio of cash to monthly cash expenses?

(c)Interpret the ratio you computed in part

b. What are the implications for Farm Store, Inc.?

Bank customers are considered creditors of the bank so the bank shows their accounts with credit balances on the bank's records.

The following procedures were recently implemented at Health Station,Inc.For each procedure,indicate whether the internal control over cash represents

(1)a strength or

(2)a weakness.If it is a weakness,explain why.

(a)All mail is opened by the mail clerk,who forwards all cash remittances to the cashier.The cashier prepares alisting of the cash receipts and forwards a copy of the list to the accounts receivable clerk forrecording in the accounts.

(b)The accounts payable clerk prepares a voucher for each disbursement.The voucher along with the supportingdocumentation is forwarded to the treasurer's office for approval.

(c)At the end of each day,all cash receipts are placed in the bank's night depository.

(d)The bank reconciliation is prepared by the cashier,who works under the supervision of the treasurer.

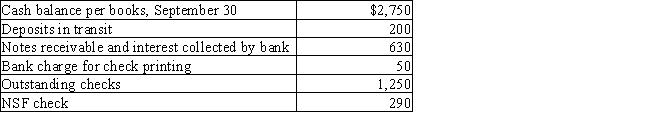

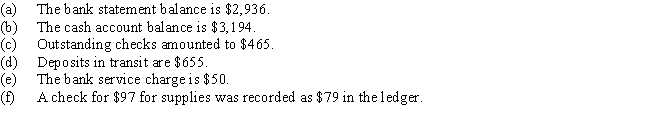

Gunnar Company gathered the following reconciling information in preparing its September bank reconciliation.Calculate the adjusted cash balance per books on September 30.

Accompanying the bank statement was a debit memo for an NSF check received from a customer.This item would be included on the bank reconciliation as a (n)

Accompanying the bank statement was a credit memo for a short-term note collected by the bank for the customer.What entry is required in the company's accounts?

Using the following information,prepare a bank reconciliation for Candace Co.for May 31:

The amount of deposits in transit is included on the bank reconciliation as a (n)

The actual cash received during the week ended October 31 for cash sales was $23,447,and the amount indicated by the cash register total was $23,457.Journalize the entry to record the cash receipts and cash sales.

Accompanying the bank statement was a debit memo for bank service charges.On the bank reconciliation,the item is a (n)

The bank often informs the company of bank service charges by including a credit memo with the monthly bank statement.

You began your new job as the accountant for Morton Company.You were surprised to find that the company had a $2,000 petty cash fund,which sits in the break room.The president of the company told you: "Our petty cash system here works quite smoothly.Since everyone is honest here,everyone has access to the fund for incidentals that might pop up in the course of the business day.Most of these situations don't have any receipts tied to them,so I just put the money back in the fund when my secretary tells me that we have run out of petty cash and we debit the amount to Miscellaneous Expense."Required

(a)Should you implement some controls on petty cash? Why?

(b)If so,what controls could be used for petty cash?

In establishing a petty cash fund,a check is written for the amount of the fund and is recorded as a debit to Accounts Payable and a credit to Petty Cash.

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)