Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business233 Questions

Exam 2: Analyzing Transactions235 Questions

Exam 3: The Adjusting Process208 Questions

Exam 4: Completing the Accounting Cycle215 Questions

Exam 5: Accounting Systems200 Questions

Exam 6: Accounting for Merchandising Businesses232 Questions

Exam 7: Inventories204 Questions

Exam 8: Internal Control and Cash183 Questions

Exam 9: Receivables192 Questions

Exam 10: Long-Term Assets: Fixed and Intangible219 Questions

Exam 11: Current Liabilities and Payroll197 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies199 Questions

Exam 13: Corporations: Organization, stock Transactions, and Dividends215 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes177 Questions

Exam 15: Investments and Fair Value Accounting169 Questions

Exam 16: Statement of Cash Flows187 Questions

Exam 17: Financial Statement Analysis200 Questions

Select questions type

If the debit portion of an adjusting entry is to an asset account,then the credit portion must be to a liability account.

Free

(True/False)

4.8/5  (28)

(28)

Correct Answer:

False

Accumulated depreciation accounts are liability accounts.

Free

(True/False)

4.8/5  (42)

(42)

Correct Answer:

False

Accrued revenues would affect _______ on the balance sheet.

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

A

For most large businesses,the cash basis of accounting will provide accurate financial statements for user needs.

(True/False)

4.9/5  (36)

(36)

Identify the effect (a through h) that omitting each of the following items would have on the balance sheet.

-No adjustment was made for supplies used up during the month.

(Multiple Choice)

4.9/5  (41)

(41)

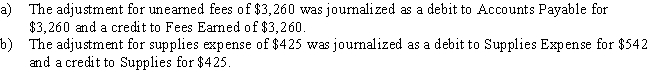

For each of the following errors,considered individually,indicate whether the error would cause the adjusted trial balance totals to be unequal.If the error would cause the adjusted trial balance total to be unequal,indicate whether the debit or credit total is higher and by how much.

(Essay)

4.8/5  (34)

(34)

Identify the effect (a through h) that omitting each of the following items would have on the balance sheet.

-Depreciation on equipment was not recorded.

(Multiple Choice)

4.8/5  (32)

(32)

Depreciation Expense is reported on the balance sheet as an addition to the related asset.

(True/False)

4.7/5  (42)

(42)

The term used to describe an expense that has not been paid and has not yet been recognized in the accounts by a routine entry is

(Multiple Choice)

4.8/5  (35)

(35)

Gracie Company made a prepaid rent payment of $2,800 on January 1.The company's monthly rent is $700.The amount of prepaid rent that would appear on the January 31 balance sheet after adjustment is

(Multiple Choice)

4.9/5  (41)

(41)

For the year ending December 31,Beard Clinical Supplies Co.mistakenly omitted adjusting entries for

(1)$9,800 of unearned revenue that was earned,

(2)earned revenue that was not billed of $10,200,and

(3)accrued wages of $7,000.Indicate the combined effect of the errors on

(a)revenues,

(b)expenses,and

(c)net income.

(Essay)

4.9/5  (36)

(36)

Which of the following is considered to be an accrued expense?

(Multiple Choice)

4.7/5  (40)

(40)

Which of the accounts below would most likely appear on an adjusted trial balance but probably would not appear on the unadjusted trial balance?

(Multiple Choice)

4.8/5  (33)

(33)

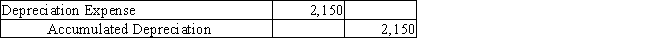

What effect will the following adjusting journal entry have on the accounting records?

(Multiple Choice)

4.9/5  (32)

(32)

Deferrals are recorded transactions that delay the recognition of an expense or revenue.

(True/False)

4.9/5  (33)

(33)

Adjustments for accruals are needed to record a revenue that has been earned or an expense that has been incurred but not recorded.

(True/False)

4.8/5  (34)

(34)

For the year ending December 31,Orion,Inc.mistakenly omitted adjusting entries for $1,500 of supplies that were used, (2)unearned revenue of $4,200 that was earned,and

(3)insurance of $5,000 that expired.For the year ending December 31,what is the effect of these errors on revenues,expenses,and net income?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 1 - 20 of 208

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)