Exam 8: Changes in Ownership Interest

Exam 1: Introduction to Business Combinations and the Conceptual Framework35 Questions

Exam 2: Accounting for Business Combinations42 Questions

Exam 3: Consolidated Financial Statements Date of Acquisition37 Questions

Exam 4: Consolidated Financial Statements After Acquisition42 Questions

Exam 5: Allocation and Depreciation of Differences Between Implied and Book Values36 Questions

Exam 6: Elimination of Unrealized Profit on Intercompany Sales of Inventory35 Questions

Exam 7: Elimination of Unrealized Gains or Losses on Intercompany Sales of Property and Equipment33 Questions

Exam 8: Changes in Ownership Interest32 Questions

Exam 9: Intercompany Bond Holdings and Miscellaneous Topics Consolidated Financial Statements33 Questions

Exam 10: Insolvency Liquidation and Reorganization35 Questions

Exam 11: International Financial Reporting Standards28 Questions

Exam 12: Accounting for Foreign Currency Transactions and Hedging Foreign Exchange Risk35 Questions

Exam 13: Translation of Financial Statements of Foreign Affiliates29 Questions

Exam 14: Reporting for Segments and for Interim Financial Periods44 Questions

Exam 15: Partnerships: Formation, operation and Ownership Changes39 Questions

Exam 16: Partnership Liquidation35 Questions

Exam 17: Introduction to Fund Accounting29 Questions

Exam 18: Introduction to Accounting for State and Local Governmental Units34 Questions

Exam 19: Accounting for Nongovernment Nonbusiness Organizations: Colleges and Universities, hospitals, and Other Health Care Organizations38 Questions

Select questions type

The purchase by a subsidiary of some of its shares from the noncontrolling stockholders results in an increase in the parent's percentage interest in the subsidiary.The parent company's share of the subsidiary's net assets will increase if the shares are purchased:

Free

(Multiple Choice)

4.7/5  (44)

(44)

Correct Answer:

B

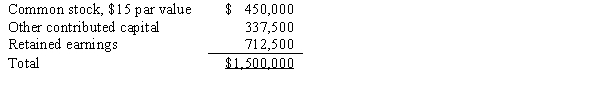

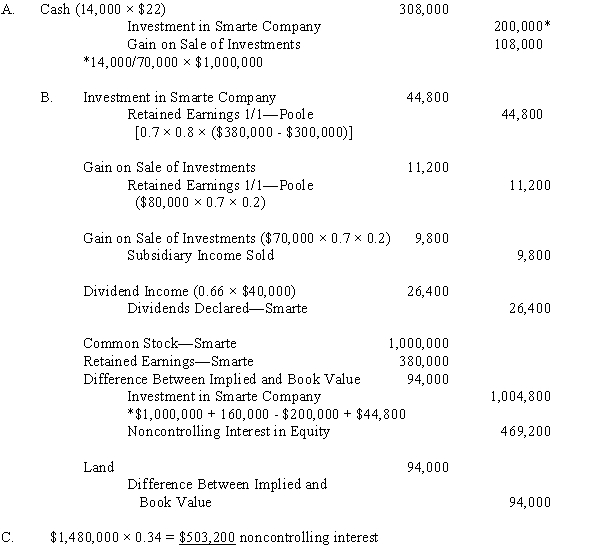

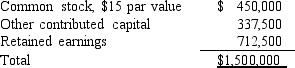

Parr Company owned 24,000 of the 30,000 outstanding common shares of Solomon Company on January 1,2016.Parr's shares were purchased at book value when the fair values of Solomon's assets and liabilities were equal to their book values.The stockholders' equity of Solomon Company on January 1,2016,consisted of the following:  Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2,2016.If Parr Company purchased all 7,500 shares,the book entry to record the purchase should increase the Investment in Solomon Company account by:

Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2,2016.If Parr Company purchased all 7,500 shares,the book entry to record the purchase should increase the Investment in Solomon Company account by:

Free

(Multiple Choice)

4.8/5  (42)

(42)

Correct Answer:

C

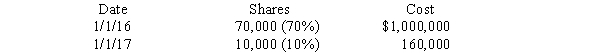

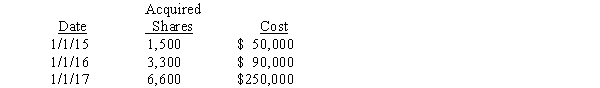

Poole made the following purchases of Smarte Company common stock:

Stockholders' equity information for Smarte Company for 2016 and 2017 follows:

Stockholders' equity information for Smarte Company for 2016 and 2017 follows:

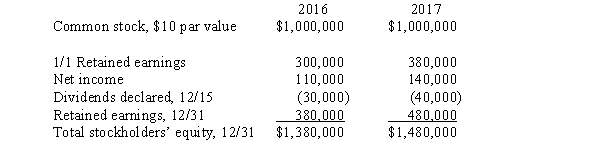

On July 1,2017,Poole sold 14,000 shares of Smarte Company common stock on the open market for $22 per share.The shares sold were purchased on January 1,2016.Smarte notified Poole that its net income for the first six months was $70,000.Any difference between cost and book value relates to subsidiary land.Poole uses the cost method to account for its investment in Smarte Company.

Required:

A.Prepare the journal entry made by Poole to record the sale of the 14,000 shares on July 1,2017.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31,2017.

C.Compute the amount of noncontrolling interest that would be reported on the consolidated balance sheet on December 31,2017.

On July 1,2017,Poole sold 14,000 shares of Smarte Company common stock on the open market for $22 per share.The shares sold were purchased on January 1,2016.Smarte notified Poole that its net income for the first six months was $70,000.Any difference between cost and book value relates to subsidiary land.Poole uses the cost method to account for its investment in Smarte Company.

Required:

A.Prepare the journal entry made by Poole to record the sale of the 14,000 shares on July 1,2017.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31,2017.

C.Compute the amount of noncontrolling interest that would be reported on the consolidated balance sheet on December 31,2017.

Free

(Essay)

4.8/5  (42)

(42)

Correct Answer:

On January 1 2016,Pounder Company purchased 75% of Sludge Company for $500,000.Sludge Company's stockholders' equity on that date was equal to $600,000 and Sludge Company had 60,000 shares issued and outstanding on that date.Sludge Company Corporation sold an additional 15,000 shares of previously unissued stock on December 31,2016. Assume Sludge Company sold the 15,000 shares to outside interests,Pounder Company's percent ownership would be:

(Multiple Choice)

4.8/5  (34)

(34)

The purchase by a subsidiary of some of its shares from noncontrolling stockholders results in the parent company's share of the subsidiary's net assets:

(Multiple Choice)

4.9/5  (39)

(39)

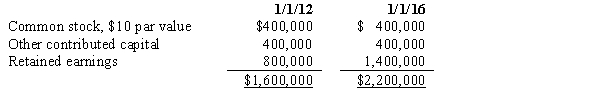

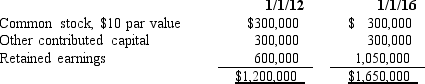

On January 1,2012,Parent Company purchased 32,000 of the 40,000 outstanding common shares of Sub Company for $1,520,000.On January 1,2016,Parent Company sold 4,000 of its shares of Sub Company on the open market for $90 per share.Sub Company's stockholders' equity on January 1,2012,and January 1,2016,was as follows:  The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company is:

The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company is:

(Multiple Choice)

4.7/5  (37)

(37)

Pizza Company purchased Salt Company common stock through open-market purchases as follows:

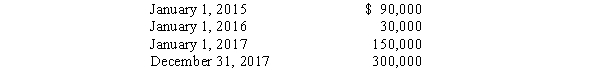

Salt Company had 12,000 shares of $20 par value common stock outstanding during the entire period.Salt had the following retained earnings balances on the relevant dates:

Salt Company had 12,000 shares of $20 par value common stock outstanding during the entire period.Salt had the following retained earnings balances on the relevant dates:

Salt Company declared no dividends in 2015 or 2016 but did declare and pay $60,000 of dividends in 2017.Any difference between cost and book value is assigned to subsidiary land.Pizza uses the equity method to account for its investment in Salt.

Required:

A.Prepare the journal entries Pizza Company will make during 2016 and 2017 to account for its investment in Salt Company.

B.Prepare workpaper eliminating entries necessary to prepare a consolidated statements workpaper on December 31,2017.

Salt Company declared no dividends in 2015 or 2016 but did declare and pay $60,000 of dividends in 2017.Any difference between cost and book value is assigned to subsidiary land.Pizza uses the equity method to account for its investment in Salt.

Required:

A.Prepare the journal entries Pizza Company will make during 2016 and 2017 to account for its investment in Salt Company.

B.Prepare workpaper eliminating entries necessary to prepare a consolidated statements workpaper on December 31,2017.

(Essay)

4.8/5  (49)

(49)

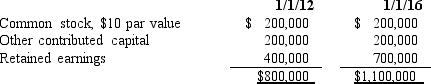

On January 1,2012,Pharma Company purchased 16,000 of the 20,000 outstanding common shares of Sludge Company for $760,000.On January 1,2016,Pharma Company sold 2,000 of its shares of Sludge Company on the open market for $90 per share.Sludge Company's stockholders' equity on January 1,2012,and January 1,2016,was as follows:  The difference between implied and book value is assigned to Sludge Company's land.As a result of the sale,Pharma Company's Investment in Sludge account should be credited for:

The difference between implied and book value is assigned to Sludge Company's land.As a result of the sale,Pharma Company's Investment in Sludge account should be credited for:

(Multiple Choice)

4.9/5  (37)

(37)

Parr Company owned 24,000 of the 30,000 outstanding common shares of Solomon Company on January 1,2016.Parr's shares were purchased at book value when the fair values of Solomon's assets and liabilities were equal to their book values.The stockholders' equity of Solomon Company on January 1,2016,consisted of the following:  Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2,2016.If all 7,500 shares were sold to noncontrolling stockholders,the workpaper adjustment needed each time a workpaper is prepared should increase (decrease)the Investment in Solomon Company by:

Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2,2016.If all 7,500 shares were sold to noncontrolling stockholders,the workpaper adjustment needed each time a workpaper is prepared should increase (decrease)the Investment in Solomon Company by:

(Multiple Choice)

4.8/5  (42)

(42)

On January 1,2014,Panel Company acquired 90% of the common stock of Singapore Company for $650,000.At that time,Singapore had common stock ($5 par)of $500,000 and retained earnings of $200,000.

On January 1,2016,Singapore issued 20,000 shares of its unissued common stock,with a market value of $7 per share,to noncontrolling stockholders.Singapore's retained earnings balance on this date was $300,000.Any difference between cost and book value relates to Singapore's land.No dividends were declared in 2016.

Required:

A.Prepare the entry on Panel's books to record the effect of the issuance assuming the cost method.

B.Prepare the elimination entries for the preparation of a consolidated statements workpaper on December 31,2016 assuming the cost method.

(Essay)

4.9/5  (39)

(39)

When the parent company sells a portion of its investment in a subsidiary,the workpaper entry to adjust for the current year's income sold to noncontrolling stockholders includes a:

(Multiple Choice)

4.8/5  (41)

(41)

If a portion of an investment is sold,the value of the shares sold is determined by using the:

(Multiple Choice)

4.8/5  (32)

(32)

On January 1 2016,Paulus Company purchased 75% of Sweet Corporation for $500,000.Sweet' stockholders' equity on that date was equal to $600,000 and Sweet had 60,000 shares issued and outstanding on that date.Sweet Corporation sold an additional 15,000 shares of previously unissued stock on December 31,2016. Assuming that Paulus Company purchased the additional shares,what would be their current percentage ownership on December 31,2016?

(Multiple Choice)

4.9/5  (31)

(31)

On January 1,2012,Pine Corporation purchased 24,000 of the 30,000 outstanding common shares of Summit Company for $1,140,000.On January 1,2016,Pine Corporation sold 3,000 of its shares of Summit Company on the open market for $90 per share.Summit Company's stockholders' equity on January 1,2012,and January 1,2016,was as follows:  The difference between implied and book value is assigned to Summit Company's land.As a result of the sale,Pine Corporation's Investment in Summit account should be credited for:

The difference between implied and book value is assigned to Summit Company's land.As a result of the sale,Pine Corporation's Investment in Summit account should be credited for:

(Multiple Choice)

4.7/5  (42)

(42)

On January 1,2016,P Corporation purchased 75% of S Corporation for $500,000.S's stockholders' equity on that date was equal to $600,000 and S had 40,000 shares issued and outstanding on that date.S Corporation sold an additional 8,000 shares of previously unissued stock on December 31,2016. Assume S sold the 8,000 shares to outside interests,P's percent ownership would be:

(Multiple Choice)

4.8/5  (35)

(35)

The computation of noncontrolling interest in net assets is made by multiplying the noncontrolling interest percentage at the:

(Multiple Choice)

4.9/5  (40)

(40)

A parent's ownership percentage in a subsidiary may change for several reasons.Identify three reasons the ownership percentage may change.

(Essay)

4.8/5  (47)

(47)

Under the partial equity method,the workpaper entry that reverses the effect of subsidiary income for the year includes a:

(Multiple Choice)

4.9/5  (41)

(41)

Pamela Company acquired 80% of the outstanding common stock of Silt Company on January 1,2014,for $396,000.At the date of purchase,Silt Company had a balance in its $2 par value common stock account of $360,000 and retained earnings of $90,000.On January 1,2016,Silt Company issued 45,000 shares of its previously unissued stock to noncontrolling stockholders for $3 per share.On this date,Silt Company had a retained earnings balance of $152,000.The difference between cost and book value relates to subsidiary land.No dividends were paid in 2016.Silt Company reported income of $30,000 in 2016.

Required:

A.Prepare the journal entry on Pamela's books to record the effect of the issuance assuming the equity method.

B.Prepare the eliminating entries needed for the preparation of a consolidated statements workpaper on December 31,2016,assuming the equity method.

(Essay)

4.9/5  (42)

(42)

If a parent company acquires additional shares of its subsidiary's stock directly from the subsidiary for a price less than their book value:

(Multiple Choice)

4.9/5  (30)

(30)

Showing 1 - 20 of 32

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)