Exam 26: Cost Allocation and Activity-Based Costing

Exam 1: Introduction to Accounting and Business188 Questions

Exam 2: Analyzing Transactions216 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle198 Questions

Exam 5: Accounting for Merchandising Businesses220 Questions

Exam 6: Inventories170 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash178 Questions

Exam 8: Receivables148 Questions

Exam 9: Fixed Assets and Intangible Assets177 Questions

Exam 10: Current Liabilities and Payroll174 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends172 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes186 Questions

Exam 13: Investments and Fair Value Accounting133 Questions

Exam 14: Statement of Cash Flows161 Questions

Exam 15: Financial Statement Analysis184 Questions

Exam 16: Managerial Accounting Concepts and Principles175 Questions

Exam 17: Job Order Costing176 Questions

Exam 18: Process Cost Systems177 Questions

Exam 19: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 20: Variable Costing for Management Analysis154 Questions

Exam 21: Budgeting185 Questions

Exam 22: Performance Evaluation Using Variances From Standard Costs160 Questions

Exam 23: Performance Evaluation for Decentralized Operations198 Questions

Exam 24: Differential Analysis and Product Pricing161 Questions

Exam 25: Capital Investment Analysis179 Questions

Exam 26: Cost Allocation and Activity-Based Costing111 Questions

Exam 27: Cost Management for Just-In-Time Environments122 Questions

Select questions type

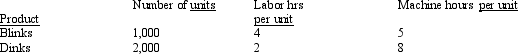

The Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

The Ramapo Company uses a single overhead rate to apply all overhead costs based on labor hours. What is the overhead cost per unit for Dinks?

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

The Ramapo Company uses a single overhead rate to apply all overhead costs based on labor hours. What is the overhead cost per unit for Dinks?

(Multiple Choice)

4.7/5  (36)

(36)

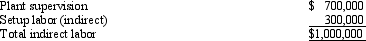

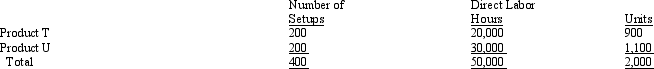

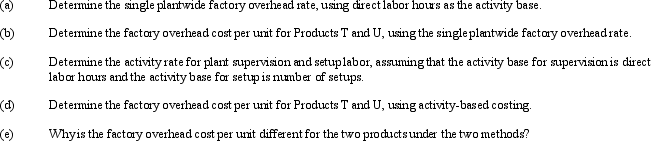

Tulip Company produces two products, T and U. The indirect labor costs include the following two items:

The following activity-base usage and unit production information is available for the two products:

The following activity-base usage and unit production information is available for the two products:

(Essay)

4.9/5  (41)

(41)

Which of the following is not a reason for banks to use activity-based costing?

(Multiple Choice)

4.8/5  (34)

(34)

Service companies can effectively use single facility-wide overhead costing to compute product (service) costs.

(True/False)

4.8/5  (30)

(30)

The Kaumajet Factory produces two products - table lamps and desk lamps. It has two separate departments - finishing and production. The overhead budget for the finishing department is $550,000, using 500,000 direct labor hours. The overhead budget for the production department is $400,000 using 80,000 direct labor hours. If the budget estimates that a table lamp will require 2 hours of finishing and 1 hours of production, what is the total amount of factory overhead to be allocated to table lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours, if 75,000 units are produced?

(Multiple Choice)

4.9/5  (43)

(43)

Managers depend on accurate factory overhead allocation to make decisions regarding product mix and product price.

(True/False)

4.9/5  (35)

(35)

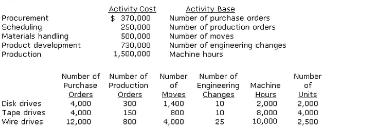

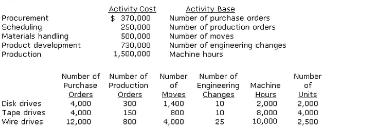

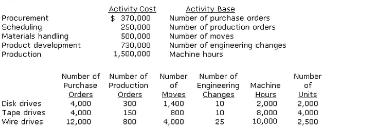

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity-based cost for each wire drive unit.

Determine the activity-based cost for each wire drive unit.

(Multiple Choice)

4.9/5  (31)

(31)

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity rate for materials handling per move.

Determine the activity rate for materials handling per move.

(Multiple Choice)

4.9/5  (44)

(44)

Everest Co. uses a plantwide factory overhead rate based on direct labor hours. Overhead costs would be overcharged to which of the following departments?

(Multiple Choice)

4.9/5  (45)

(45)

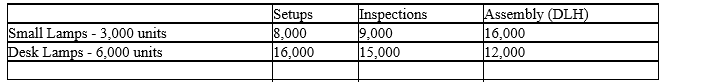

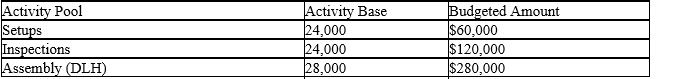

The Dawson Company manufactures small lamps and desk lamps. The following shows the activities per product and the total overhead information:

Calculate the total factory overhead to be charged to desk lamps.

Calculate the total factory overhead to be charged to desk lamps.

(Multiple Choice)

4.8/5  (42)

(42)

Zorn Co. budgeted $600,000 of factory overhead cost for the coming year. Its plantwide allocation base, machine hours, is budgeted at 100,000 hours. Budgeted units to be produced are 200,000 units. Zorn's plantwide factory overhead rate is $6.00 per unit.

(True/False)

4.9/5  (35)

(35)

Tibet Company sells glasses, fine china, and everyday dinnerware. They use activity-based costing to determine the cost of the shipping and handling activity. The shipping and handling activity has an activity rate of $7 per pound. A box of glasses weighs 2 lbs, the box of china weighs 4 lbs, and a box of everyday dinnerware weighs 6 lbs. (a) Determine the shipping and handling activity for each product and (b) determine the total shipping and receiving costs for the china if 3,500 boxes are shipped.

(Essay)

4.8/5  (23)

(23)

Scoresby Co. uses 3 machine hours and 1 direct labor hour to produce Product X. It uses 4 machine hours and 8 direct labor hours to produce Product Y. Scoresby's Assembly and Finishing Departments have factory overhead rates of $240 per machine hour and $160 per direct labor hour, respectively. How much overhead cost will be charged to the two products?

(Multiple Choice)

4.9/5  (35)

(35)

If selling and administrative expenses are allocated to different products, they should be reported as a

(Multiple Choice)

4.8/5  (38)

(38)

The total factory overhead for Big Light Company is budgeted for the year at $403,750. Big Light manufactures two different products - night lights and desk lamps. Night lights is budgeted for 30,000 units. Each night light requires 1/2 hour of direct labor. Desk lamps is budgeted for 40,000 units. Each desk lamp requires 2 hours of direct labor. Determine (a) the total number of budgeted direct labor hours for year, (b) the single plantwide factory overhead rate using direct labor hours as the allocation base, and (c) the factory overhead allocated per unit for each product using the single plantwide factory overhead rate calculated in (b).

(Essay)

4.8/5  (33)

(33)

All of the following can be used as an allocation base for calculating factory overhead rates except:

(Multiple Choice)

4.7/5  (31)

(31)

Activity cost pools are assigned to products, using factory overhead rates for each activity.

(True/False)

4.8/5  (29)

(29)

Blackwelder Factory produces two similar products - small lamps and desk lamps. The total plant overhead budget is $640,000 with 400,000 estimated direct labor hours. It is further estimated that small lamp production will require 275,000 direct labor hours and desk lamp production will need 125,000 direct labor hours. Using the single plantwide factory overhead rate with an allocation base of direct labor hours, how much factory overhead will be allocated to the small lamp production if the actual direct hours for the period is 285,000?

(Multiple Choice)

4.8/5  (28)

(28)

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity rate for production per machine hour.

Determine the activity rate for production per machine hour.

(Multiple Choice)

4.7/5  (38)

(38)

Showing 21 - 40 of 111

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)