Exam 22: Performance Evaluation Using Variances From Standard Costs

Exam 1: Introduction to Accounting and Business188 Questions

Exam 2: Analyzing Transactions216 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle198 Questions

Exam 5: Accounting for Merchandising Businesses220 Questions

Exam 6: Inventories170 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash178 Questions

Exam 8: Receivables148 Questions

Exam 9: Fixed Assets and Intangible Assets177 Questions

Exam 10: Current Liabilities and Payroll174 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends172 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes186 Questions

Exam 13: Investments and Fair Value Accounting133 Questions

Exam 14: Statement of Cash Flows161 Questions

Exam 15: Financial Statement Analysis184 Questions

Exam 16: Managerial Accounting Concepts and Principles175 Questions

Exam 17: Job Order Costing176 Questions

Exam 18: Process Cost Systems177 Questions

Exam 19: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 20: Variable Costing for Management Analysis154 Questions

Exam 21: Budgeting185 Questions

Exam 22: Performance Evaluation Using Variances From Standard Costs160 Questions

Exam 23: Performance Evaluation for Decentralized Operations198 Questions

Exam 24: Differential Analysis and Product Pricing161 Questions

Exam 25: Capital Investment Analysis179 Questions

Exam 26: Cost Allocation and Activity-Based Costing111 Questions

Exam 27: Cost Management for Just-In-Time Environments122 Questions

Select questions type

A variable cost system is an accounting system where standards are set for each manufacturing cost element.

(True/False)

4.8/5  (38)

(38)

Non-financial measures are often lined to the inputs or outputs of an activity or process.

(True/False)

4.9/5  (35)

(35)

The most effective means of presenting standard factory overhead cost variance data is through a factory overhead cost variance report.

(True/False)

4.8/5  (34)

(34)

If the standard to produce a given amount of product is 2,000 units of direct materials at $12 and the actual was 1,600 units at $13, the direct materials quantity variance was $5,200 favorable.

(True/False)

4.8/5  (31)

(31)

Standard costs are divided into which of the following components?

(Multiple Choice)

4.7/5  (31)

(31)

Standard costs can be used with both the process cost and job order cost systems.

(True/False)

4.7/5  (35)

(35)

If the price paid per unit differs from the standard price per unit for direct materials, the variance is termed a:

(Multiple Choice)

4.9/5  (35)

(35)

The St. Augustine Corporation originally budgeted for $360,000 of fixed overhead at 100% production capacity. Production was budgeted to be 12,000 units. The standard hours for production were 5 hours per unit. The variable overhead rate was $3 per hour. Actual fixed overhead was $360,000 and actual variable overhead was $170,000. Actual production was 11,700 units. Compute the factory overhead controllable variance.

(Multiple Choice)

4.9/5  (42)

(42)

The formula to compute direct materials price variance is to calculate the difference between

(Multiple Choice)

4.8/5  (32)

(32)

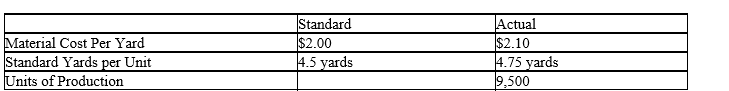

0 Calculate the Direct Materials Quantity variance using the above information:

0 Calculate the Direct Materials Quantity variance using the above information:

(Multiple Choice)

4.8/5  (34)

(34)

The variance from standard for factory overhead cost resulting from operating at a level above or below 100% of normal capacity is termed volume variance.

(True/False)

4.8/5  (30)

(30)

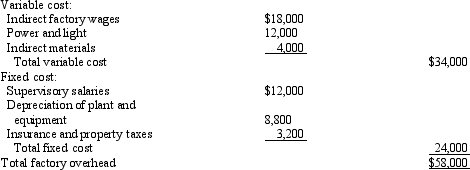

The Finishing Department of Pinnacle Manufacturing Co. prepared the following factory overhead cost budget for October of the current year, during which it expected to operate at a 100% capacity of 10,000 machine hours:

During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.

Prepare a factory overhead cost variance report for October. (The budgeted amounts for actual amount produced should be based on 9,000 machine hours.)

During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.

Prepare a factory overhead cost variance report for October. (The budgeted amounts for actual amount produced should be based on 9,000 machine hours.)

(Essay)

4.9/5  (42)

(42)

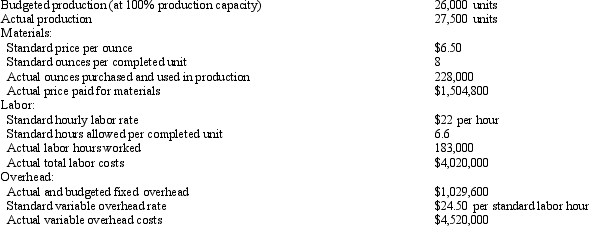

The following data is given for the Zoyza Company:  Overhead is applied on standard labor hours.

The factory overhead volume variance is:

Overhead is applied on standard labor hours.

The factory overhead volume variance is:

(Multiple Choice)

4.9/5  (34)

(34)

If the standard to produce a given amount of product is 1,000 units of direct materials at $11 and the actual was 800 units at $12, the direct materials price variance was $800 unfavorable.

(True/False)

4.7/5  (44)

(44)

Since the controllable variance measures the efficiency of using variable overhead resources, if budgeted variable overhead exceeds actual results, the variance is favorable.

(True/False)

4.7/5  (39)

(39)

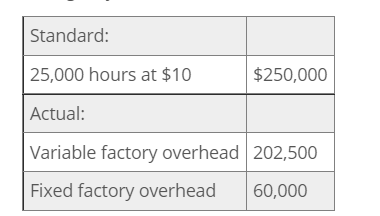

The standard factory overhead rate is $10 per direct labor hour ($8 for variable factory overhead and $2 for fixed factory overhead) based on 100% capacity of 30,000 direct labor hours. The standard cost and the actual cost of factory overhead for the production of 5,000 units during May were as follows:  0 What is the amount of the factory overhead controllable variance?

0 What is the amount of the factory overhead controllable variance?

(Multiple Choice)

4.8/5  (35)

(35)

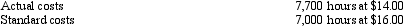

The following data relate to direct labor costs for February:  What is the direct labor time variance?

What is the direct labor time variance?

(Multiple Choice)

4.9/5  (41)

(41)

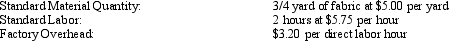

Compute the standard cost for one hat, based on the following standards for each hat:

(Essay)

4.9/5  (41)

(41)

If the standard to produce a given amount of product is 1,000 units of direct materials at $11 and the actual was 800 units at $12, the direct materials quantity variance was $1,000 unfavorable.

(True/False)

4.9/5  (50)

(50)

Showing 101 - 120 of 160

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)