Exam 4: Activity-Based Costing

Exam 1: Introduction to Cost Management115 Questions

Exam 2: Basic Cost Management Concepts161 Questions

Exam 3: Cost Behavior132 Questions

Exam 4: Activity-Based Costing154 Questions

Exam 5: Product and Service Costing: Job-Order System102 Questions

Exam 6: Process Costing137 Questions

Exam 7: Allocating Costs of Support Departments and Joint Products143 Questions

Exam 8: Budgeting for Planning and Control167 Questions

Exam 9: Standard Costing: a Functional-Based Control Approach86 Questions

Exam 10: Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer Pricing110 Questions

Exam 11: Strategic Cost Management121 Questions

Exam 12: Activity-Based Management116 Questions

Exam 13: The Balanced Scorecard: Strategic-Based Control92 Questions

Exam 14: Quality and Environmental Cost Management157 Questions

Exam 15: Lean Accounting and Productivity Measurement137 Questions

Exam 16: Cost-Volume-Profit Analysis108 Questions

Exam 17: Activity Resource Usage Model and Tactical Decision Making98 Questions

Exam 18: Pricing and Profitability Analysis102 Questions

Exam 19: Capital Investment97 Questions

Exam 20: Inventory Management: Economic Order Quantity, Jit, and the Theory of Constraints98 Questions

Select questions type

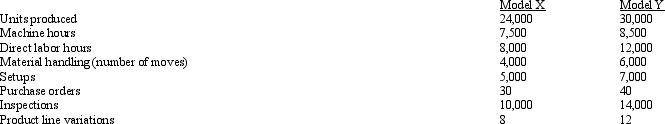

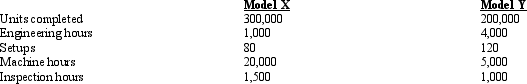

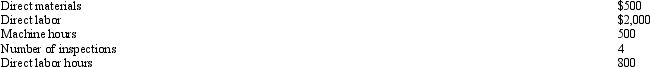

Figure 4-21 Jones Manufacturing uses an activity-based costing system.The company produces Model X and Model Y.Information relating to the two products is as follows:

The following overhead costs are reported for the following activities of the production process:

The following overhead costs are reported for the following activities of the production process:

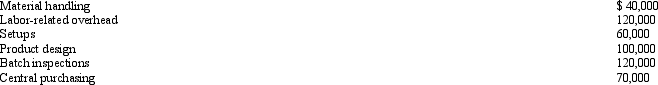

Jones manufacturing has used activity based costing to assign costs to Models X and Y as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models X and Y as given in the table below:

Jones Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-

Refer to Figure 4-21.Under this new approach using consumption ratios for labor related and machine hours, the overhead cost assigned to Model X would be? (round to 5 decimal places)

Jones Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-

Refer to Figure 4-21.Under this new approach using consumption ratios for labor related and machine hours, the overhead cost assigned to Model X would be? (round to 5 decimal places)

(Multiple Choice)

4.7/5  (37)

(37)

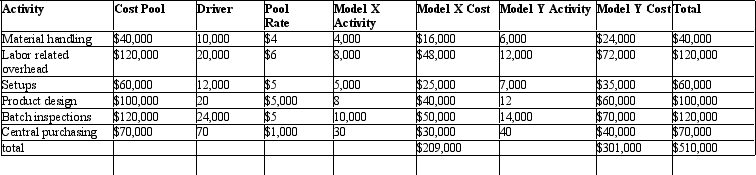

Figure 4-11 Yang Manufacturing Company manufactures two products (A and B).The overhead costs ($58,000) have been divided into three cost pools that use the following activity drivers:

-Refer to Figure 4-11.If the number of labor hours is used to assign labor costs from the cost pool, determine the amount of overhead cost to be assigned to Product A.

-Refer to Figure 4-11.If the number of labor hours is used to assign labor costs from the cost pool, determine the amount of overhead cost to be assigned to Product A.

(Multiple Choice)

4.8/5  (40)

(40)

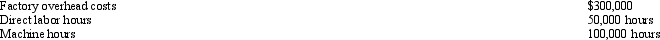

Figure 4-4 Erickson Company made the following predictions for 2011:

Job A2 (which was started and completed in May) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

-

Refer to Figure 4-4.If factory overhead is applied based on direct labor hours, the cost of Job A2 for the Erickson Company is

Job A2 (which was started and completed in May) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

-

Refer to Figure 4-4.If factory overhead is applied based on direct labor hours, the cost of Job A2 for the Erickson Company is

(Multiple Choice)

4.9/5  (28)

(28)

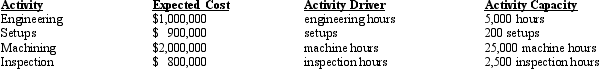

Figure 4-20 Owens Corporation produces specially machined parts.The parts are produced in batches in one continuous manufacturing process.Each part is custom produced and requires special engineering design activity (based on customer specifications).Once the design is completed, the equipment can be set up for batch production.Once the batch is completed, a sample is taken and inspected to see if the parts are within the tolerances allowed.Thus, the manufacturing process has four activities: engineering, setups, machining, and inspecting.Costs have been assigned to each activity using direct tracing and resource drivers:

Owens produces two models: Model X and Model Y.The following table shows how the two products consume activity.

Owens produces two models: Model X and Model Y.The following table shows how the two products consume activity.

-Refer to Figure 4-20.What are the global consumption ratios of X and Y respectively? (round to two decimal places)

-Refer to Figure 4-20.What are the global consumption ratios of X and Y respectively? (round to two decimal places)

(Multiple Choice)

4.9/5  (33)

(33)

If activity-based costing is used, security is an example of a

(Multiple Choice)

4.9/5  (33)

(33)

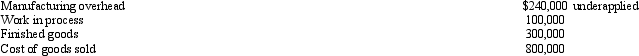

Account balances are as follows:  If underapplied or overapplied overhead is material and is allocated to Work in Process, Finished Goods, and Cost of Goods Sold (based on ending account balances), Cost of Goods Sold after adjustment would have a balance of

If underapplied or overapplied overhead is material and is allocated to Work in Process, Finished Goods, and Cost of Goods Sold (based on ending account balances), Cost of Goods Sold after adjustment would have a balance of

(Multiple Choice)

4.7/5  (42)

(42)

A department that is capital-intensive most likely would use a predetermined departmental overhead rate based on which of the following activity bases?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following quantities is an example of an activity driver in activity-based costing?

(Multiple Choice)

4.7/5  (34)

(34)

More accurate product costing information is produced by assigning costs using

(Multiple Choice)

4.8/5  (23)

(23)

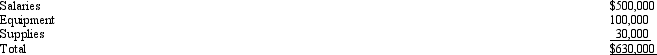

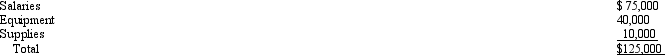

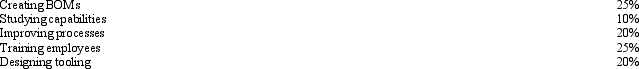

Doyle Manufacturing Company has the following activities: creating bills of materials (BOM), studying manufacturing capabilities, improving manufacturing processes, training employees, and designing tooling.The general ledger accounts reveal the following expenditures for manufacturing engineering:

The equipment is used for two activities: improving processes and designing tooling.Forty percent of the equipment's time is used for improving processes and 60 percent is used for designing tools.The salaries are for five engineers, one who earns $160,000 and four who earn $85,000 each.The $160,000 engineer spends 30 percent of his time training employees in new processes and 70 percent of his time on improving processes.One engineer spends 100 percent of her time on designing tooling and another engineer spends 100 percent of his time on improving processes.The remaining two engineers spend equal time on all activities.Supplies are consumed in the following proportions:

The equipment is used for two activities: improving processes and designing tooling.Forty percent of the equipment's time is used for improving processes and 60 percent is used for designing tools.The salaries are for five engineers, one who earns $160,000 and four who earn $85,000 each.The $160,000 engineer spends 30 percent of his time training employees in new processes and 70 percent of his time on improving processes.One engineer spends 100 percent of her time on designing tooling and another engineer spends 100 percent of his time on improving processes.The remaining two engineers spend equal time on all activities.Supplies are consumed in the following proportions:

(Essay)

4.9/5  (43)

(43)

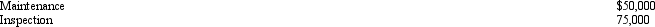

Figure 4-13 The Xiang plant has two categories of overhead: maintenance and inspection.

Costs expected for these categories for the coming year are as follows:

The plant currently applies overhead using direct labor hours and expected capacity of 50,000 direct labor hours.The following data have been assembled for use in developing a bid for a proposed job:

The plant currently applies overhead using direct labor hours and expected capacity of 50,000 direct labor hours.The following data have been assembled for use in developing a bid for a proposed job:

Total expected machine hours for all jobs during the year is 25,000, and the total expected number of inspections is 1,500.

-

Refer to Figure 4-13.Using direct labor hours to assign overhead, the total cost of the potential job would be

Total expected machine hours for all jobs during the year is 25,000, and the total expected number of inspections is 1,500.

-

Refer to Figure 4-13.Using direct labor hours to assign overhead, the total cost of the potential job would be

(Multiple Choice)

4.9/5  (39)

(39)

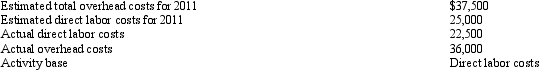

The following information pertains to Black Corporation for 2011:  What is the predetermined overhead rate for Black Corporation for 2011?

What is the predetermined overhead rate for Black Corporation for 2011?

(Multiple Choice)

4.8/5  (29)

(29)

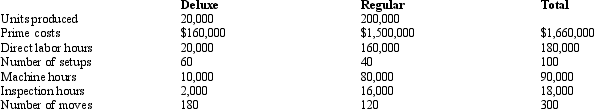

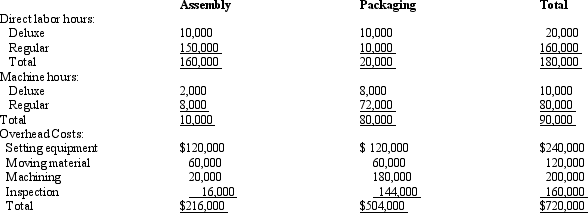

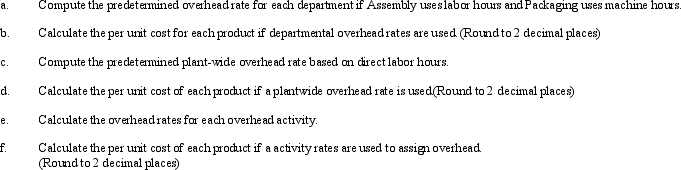

The Juneau plant produces two calculators and has two production departments: assembly and packaging.Information for the products is given below:

The following table presents activity information about the departments and products:

The following table presents activity information about the departments and products:

Required:

Required:

(Essay)

4.9/5  (39)

(39)

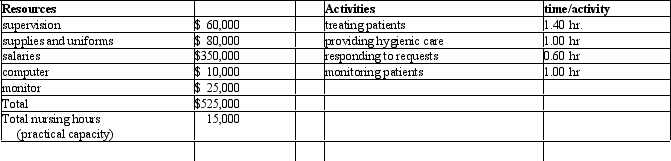

Figure 4-22 Isidora's Clinic is considering a time-driven activity based costing system.Given the following data:

-Refer to Figure 4-22.What is the capacity cost rate?

-Refer to Figure 4-22.What is the capacity cost rate?

(Multiple Choice)

4.9/5  (42)

(42)

If activity-based costing is used, insurance on the plant would be classified as a

(Multiple Choice)

4.8/5  (45)

(45)

Figure 4-17 Moss Corporation has the following activities: creating bills of materials (BOM), studying manufacturing capabilities, improving manufacturing processes, training employees, and designing tooling.The general ledger accounts reveal the following expenditures for manufacturing engineering:

The equipment is used for two activities: improving processes and designing tooling.Thirty-five percent of the equipment's time is used for improving processes and 65 percent is used for designing tools.The salaries are for two engineers.One is paid $50,000, while the other earns $25,000.The $50,000 engineer spends 40 percent of his time training employees in new processes and 60 percent of his time on improving processes.The remaining engineer spends equal time on all activities.Supplies are consumed in the following proportions:

The equipment is used for two activities: improving processes and designing tooling.Thirty-five percent of the equipment's time is used for improving processes and 65 percent is used for designing tools.The salaries are for two engineers.One is paid $50,000, while the other earns $25,000.The $50,000 engineer spends 40 percent of his time training employees in new processes and 60 percent of his time on improving processes.The remaining engineer spends equal time on all activities.Supplies are consumed in the following proportions:

-Refer to 4-17.What is the cost assigned to the designing tooling activity?

-Refer to 4-17.What is the cost assigned to the designing tooling activity?

(Multiple Choice)

4.9/5  (34)

(34)

All of the following are non-unit-based activity drivers EXCEPT

(Multiple Choice)

4.8/5  (32)

(32)

In a time-driven ABC system, once the managers determine the cost of per time unit of supplying resources to activities, the next step would be

(Multiple Choice)

4.7/5  (34)

(34)

Showing 61 - 80 of 154

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)