Exam 17: Activity Resource Usage Model and Tactical Decision Making

Exam 1: Introduction to Cost Management115 Questions

Exam 2: Basic Cost Management Concepts161 Questions

Exam 3: Cost Behavior132 Questions

Exam 4: Activity-Based Costing154 Questions

Exam 5: Product and Service Costing: Job-Order System102 Questions

Exam 6: Process Costing137 Questions

Exam 7: Allocating Costs of Support Departments and Joint Products143 Questions

Exam 8: Budgeting for Planning and Control167 Questions

Exam 9: Standard Costing: a Functional-Based Control Approach86 Questions

Exam 10: Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer Pricing110 Questions

Exam 11: Strategic Cost Management121 Questions

Exam 12: Activity-Based Management116 Questions

Exam 13: The Balanced Scorecard: Strategic-Based Control92 Questions

Exam 14: Quality and Environmental Cost Management157 Questions

Exam 15: Lean Accounting and Productivity Measurement137 Questions

Exam 16: Cost-Volume-Profit Analysis108 Questions

Exam 17: Activity Resource Usage Model and Tactical Decision Making98 Questions

Exam 18: Pricing and Profitability Analysis102 Questions

Exam 19: Capital Investment97 Questions

Exam 20: Inventory Management: Economic Order Quantity, Jit, and the Theory of Constraints98 Questions

Select questions type

In the activity resource model, flexible resources are

Free

(Multiple Choice)

4.9/5  (40)

(40)

Correct Answer:

B

Which of the following items would be classified as committed resources (long-term)?

Free

(Multiple Choice)

4.7/5  (38)

(38)

Correct Answer:

D

The U.S.government has set up foreign trade zones (FTZ) that

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

A

In order for costs or benefits to be relevant, what must be true?

(Multiple Choice)

4.8/5  (41)

(41)

A decision to make a component internally versus through a supplier is a

(Multiple Choice)

4.9/5  (31)

(31)

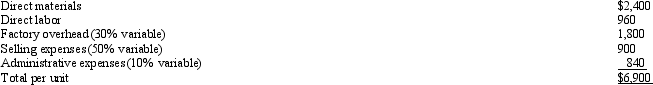

Gundy Company manufactures a product with the following costs per unit at the expected production of 30,000 units:  The company has the capacity to produce 40,000 units.The product regularly sells for $40.A wholesaler has offered to pay $32 a unit for 2,000 units.

If the firm is at capacity and the special order is accepted, the effect on operating income would be

The company has the capacity to produce 40,000 units.The product regularly sells for $40.A wholesaler has offered to pay $32 a unit for 2,000 units.

If the firm is at capacity and the special order is accepted, the effect on operating income would be

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following costs is NOT relevant for special decisions?

(Multiple Choice)

4.7/5  (43)

(43)

Which of the following statement is true concerning the nature of tactical decisions?

(Multiple Choice)

4.8/5  (28)

(28)

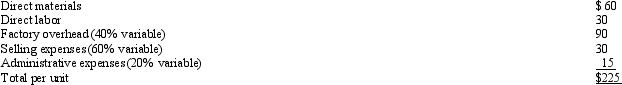

Rippey Corporation manufactures a single product with the following unit costs for 5,000 units:

Recently, a company approached Rippey Corporation about buying 1,000 units for $225.Currently, the models are sold to dealers for $412.50.Rippey's capacity is sufficient to produce the extra 1,000 units.No additional selling expenses would be incurred on the special order.

Required:

Recently, a company approached Rippey Corporation about buying 1,000 units for $225.Currently, the models are sold to dealers for $412.50.Rippey's capacity is sufficient to produce the extra 1,000 units.No additional selling expenses would be incurred on the special order.

Required:

(Essay)

4.8/5  (35)

(35)

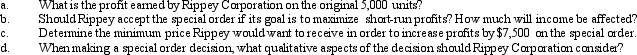

Miller Company produces speakers for home stereo units.The speakers are sold to retail stores for $30.Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

-

An Atlanta wholesaler has proposed to place a special one-time order for 7,000 units at a special price of $25.20 per unit.The wholesaler would pay all distribution costs, but there would be additional fixed selling and administrative costs of $6,000.In addition, assume that overtime production is not possible and that all other information remains the same as the original data.What is the effect on profits if the special order is accepted?

The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

-

An Atlanta wholesaler has proposed to place a special one-time order for 7,000 units at a special price of $25.20 per unit.The wholesaler would pay all distribution costs, but there would be additional fixed selling and administrative costs of $6,000.In addition, assume that overtime production is not possible and that all other information remains the same as the original data.What is the effect on profits if the special order is accepted?

(Multiple Choice)

4.8/5  (36)

(36)

For flexible resources, which of the following statements is true?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following is NOT a way that companies might reduce tariffs?

(Multiple Choice)

4.9/5  (34)

(34)

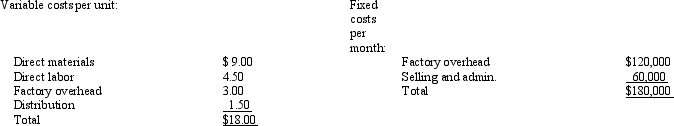

The following information relates to a product produced by Creamer Company:  Fixed selling costs are $500,000 per year, and variable selling costs are $12 per unit sold.Although production capacity is 600,000 units per year, the company expects to produce only 400,000 units next year.The product normally sells for $120 each.A customer has offered to buy 60,000 units for $90 each.

If the firm produces the special order, the effect on income would be a

Fixed selling costs are $500,000 per year, and variable selling costs are $12 per unit sold.Although production capacity is 600,000 units per year, the company expects to produce only 400,000 units next year.The product normally sells for $120 each.A customer has offered to buy 60,000 units for $90 each.

If the firm produces the special order, the effect on income would be a

(Multiple Choice)

4.8/5  (35)

(35)

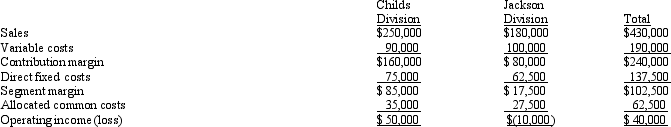

The operations of Smits Corporation are divided into the Childs Division and the Jackson Division.Projections for the next year are as follows:  Operating income for Smits Corporation as a whole if the Jackson Division were dropped would be

Operating income for Smits Corporation as a whole if the Jackson Division were dropped would be

(Multiple Choice)

4.9/5  (39)

(39)

How is understanding of committed resources and flexible resources important to the activity resource usage model? How does this relate to relevance?

(Essay)

4.9/5  (32)

(32)

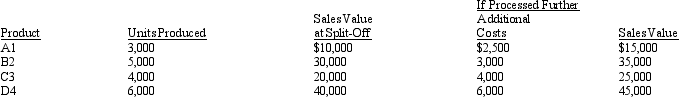

Stars Manufacturing Company produces Products A1, B2, C3, and D4 through a joint process.The joint costs amount to $200,000.  - If Product B2 is processed further, profits will

- If Product B2 is processed further, profits will

(Multiple Choice)

4.9/5  (33)

(33)

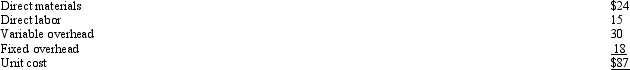

Reggie Corporation manufactures a single product with the following unit costs for 1,000 units:  Recently, a company approached Reggie Corporation about buying 100 units for $5,100 each.Currently, the models are sold to dealers for $7,800.Reggie Corporation's capacity is sufficient to produce the extra 100 units.No additional selling expenses would be incurred on the special order.

What is the profit earned by Reggie Corporation on the original 1,000 units?

Recently, a company approached Reggie Corporation about buying 100 units for $5,100 each.Currently, the models are sold to dealers for $7,800.Reggie Corporation's capacity is sufficient to produce the extra 100 units.No additional selling expenses would be incurred on the special order.

What is the profit earned by Reggie Corporation on the original 1,000 units?

(Multiple Choice)

4.7/5  (48)

(48)

_______________ is(are) the cost of acquiring activity capacity.

(Multiple Choice)

4.9/5  (36)

(36)

The use of relevant cost data to identify the alternative that provides the greatest benefit to the organization describes

(Multiple Choice)

4.7/5  (44)

(44)

Showing 1 - 20 of 98

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)