Exam 17: Activity Resource Usage Model and Tactical Decision Making

Exam 1: Introduction to Cost Management115 Questions

Exam 2: Basic Cost Management Concepts161 Questions

Exam 3: Cost Behavior132 Questions

Exam 4: Activity-Based Costing154 Questions

Exam 5: Product and Service Costing: Job-Order System102 Questions

Exam 6: Process Costing137 Questions

Exam 7: Allocating Costs of Support Departments and Joint Products143 Questions

Exam 8: Budgeting for Planning and Control167 Questions

Exam 9: Standard Costing: a Functional-Based Control Approach86 Questions

Exam 10: Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer Pricing110 Questions

Exam 11: Strategic Cost Management121 Questions

Exam 12: Activity-Based Management116 Questions

Exam 13: The Balanced Scorecard: Strategic-Based Control92 Questions

Exam 14: Quality and Environmental Cost Management157 Questions

Exam 15: Lean Accounting and Productivity Measurement137 Questions

Exam 16: Cost-Volume-Profit Analysis108 Questions

Exam 17: Activity Resource Usage Model and Tactical Decision Making98 Questions

Exam 18: Pricing and Profitability Analysis102 Questions

Exam 19: Capital Investment97 Questions

Exam 20: Inventory Management: Economic Order Quantity, Jit, and the Theory of Constraints98 Questions

Select questions type

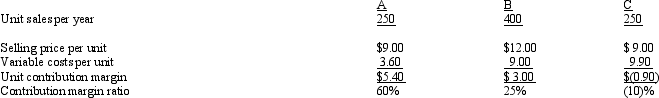

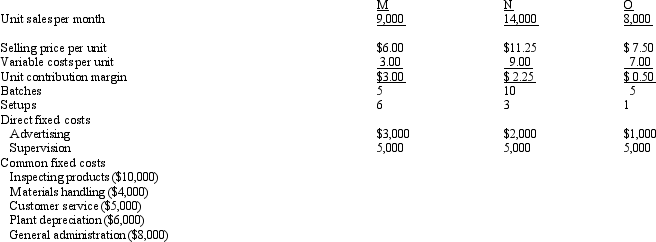

The following information pertains to Dodge Company's three products:  - Assume that product C is discontinued and the extra space is rented for $300 per month.All other information remains the same as the original data.Annual profits will

- Assume that product C is discontinued and the extra space is rented for $300 per month.All other information remains the same as the original data.Annual profits will

(Multiple Choice)

4.9/5  (51)

(51)

Salda Industries employs 500 workers in the factory.These workers produced 85,000 units in 2009.Due to a special order, the units produced in 2010 increased to 95,000 units.However, Salda produced these units without adding workers.How is that possible?

(Multiple Choice)

4.7/5  (32)

(32)

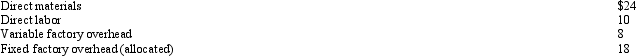

Boone Products had the following unit costs:  A one-time customer has offered to buy 1,000 units at a special price of $48 per unit.Assuming that sufficient unused production capacity exists to produce the order and no regular customers will be affected by the order, how much additional profit (loss) will be generated from the special order?

A one-time customer has offered to buy 1,000 units at a special price of $48 per unit.Assuming that sufficient unused production capacity exists to produce the order and no regular customers will be affected by the order, how much additional profit (loss) will be generated from the special order?

(Multiple Choice)

4.8/5  (38)

(38)

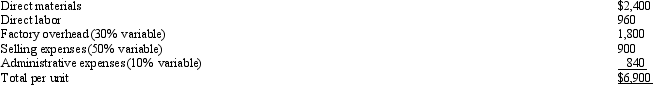

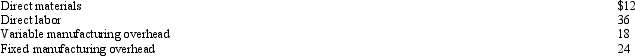

Reggie Corporation manufactures a single product with the following unit costs for 1,000 units:  Recently, a company approached Reggie Corporation about buying 100 units for $5,100 each.Currently, the models are sold to dealers for $7,800.Reggie Corporation's capacity is sufficient to produce the extra 100 units.No additional selling expenses would be incurred on the special order.

-

How much will income change if the special order is accepted?

Recently, a company approached Reggie Corporation about buying 100 units for $5,100 each.Currently, the models are sold to dealers for $7,800.Reggie Corporation's capacity is sufficient to produce the extra 100 units.No additional selling expenses would be incurred on the special order.

-

How much will income change if the special order is accepted?

(Multiple Choice)

4.7/5  (34)

(34)

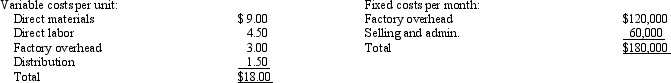

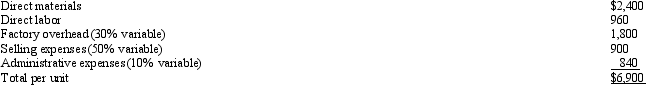

Miller Company produces speakers for home stereo units.The speakers are sold to retail stores for $30.Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

A Tennessee manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $6.00 per unit.If Miller Company accepts the offer, it will be able to reduce variable costs by 30 percent and rent unused space to an outside firm for $18,000 per year.All other information remains the same as the original data.

-What is the effect on profits if Miller Company buys from the Tennessee firm?

The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

A Tennessee manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $6.00 per unit.If Miller Company accepts the offer, it will be able to reduce variable costs by 30 percent and rent unused space to an outside firm for $18,000 per year.All other information remains the same as the original data.

-What is the effect on profits if Miller Company buys from the Tennessee firm?

(Multiple Choice)

4.7/5  (35)

(35)

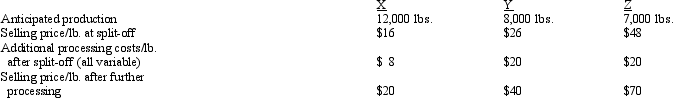

Information about three joint products follows:  The cost of the joint process is $140,000.

-

If the firm is currently processing all three products beyond split-off, the firm's income would be

The cost of the joint process is $140,000.

-

If the firm is currently processing all three products beyond split-off, the firm's income would be

(Multiple Choice)

4.8/5  (33)

(33)

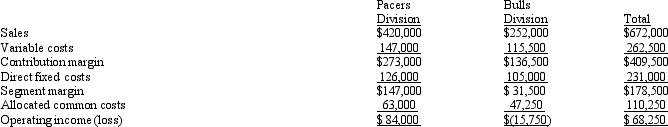

The operations of Knickers Corporation are divided into the Pacers Division and the Bulls Division.Projections for the next year are as follows:  Operating income for Knickers Corporation as a whole if the Bulls Division were dropped would be

Operating income for Knickers Corporation as a whole if the Bulls Division were dropped would be

(Multiple Choice)

4.9/5  (38)

(38)

A decision to make or eliminate an unprofitable product is a

(Multiple Choice)

4.9/5  (35)

(35)

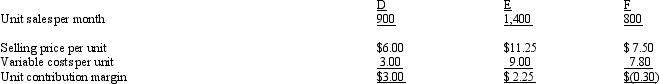

The following information pertains to Ewing Company's three products:  -Assume that product F is discontinued and the space is used to produce

-Assume that product F is discontinued and the space is used to produce

(Multiple Choice)

4.9/5  (41)

(41)

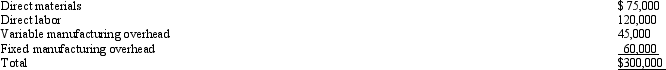

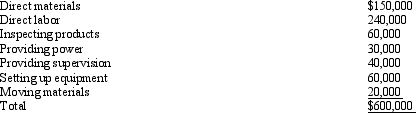

Vest Industries manufactures 40,000 components per year.The manufacturing cost of the components was determined as follows:  An outside supplier has offered to sell the component for $12.75.

Vest Industries can rent its unused manufacturing facilities for $45,000 if it purchases the component from the outside supplier.

What is the effect on income if Vest purchases the component from the outside supplier?

An outside supplier has offered to sell the component for $12.75.

Vest Industries can rent its unused manufacturing facilities for $45,000 if it purchases the component from the outside supplier.

What is the effect on income if Vest purchases the component from the outside supplier?

(Multiple Choice)

5.0/5  (40)

(40)

Which of the following statements is TRUE when making a decision between two alternatives?

(Multiple Choice)

4.8/5  (38)

(38)

Figure 17-1 The following information pertains to the EWIN Company's three products:

- Refer to Figure 17-1.The product margin for product M using functional-based costing would be

- Refer to Figure 17-1.The product margin for product M using functional-based costing would be

(Multiple Choice)

4.9/5  (36)

(36)

Qualitative factors that should be considered when evaluating a make-or-buy decision are

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following costs is NOT relevant to a special-order decision?

(Multiple Choice)

4.8/5  (39)

(39)

______________ are future costs that differ across alternatives.

(Multiple Choice)

4.7/5  (39)

(39)

Foster Industries manufactures 20,000 components per year.The manufacturing cost of the components was determined as follows:  If the component is not produced by Foster, inspection of products and provision of power costs will only be 10 percent of the production costs; moving materials costs and setting up equipment costs will only be 50 percent of the production costs; and supervision costs will amount to only 40 percent of the production amount.An outside supplier has offered to sell the component for $25.50.

What is the effect on income if Foster Industries purchases the component from the outside supplier?

If the component is not produced by Foster, inspection of products and provision of power costs will only be 10 percent of the production costs; moving materials costs and setting up equipment costs will only be 50 percent of the production costs; and supervision costs will amount to only 40 percent of the production amount.An outside supplier has offered to sell the component for $25.50.

What is the effect on income if Foster Industries purchases the component from the outside supplier?

(Multiple Choice)

4.9/5  (38)

(38)

Walton Company manufactures a product with the following costs per unit at the expected production level of 84,000 units:  The company has the capacity to produce 90,000 units.The product regularly sells for $120.

-

If a wholesaler offered to buy 4,500 units for $100 each, the effect of the special order on income would be a

The company has the capacity to produce 90,000 units.The product regularly sells for $120.

-

If a wholesaler offered to buy 4,500 units for $100 each, the effect of the special order on income would be a

(Multiple Choice)

4.7/5  (39)

(39)

Reggie Corporation manufactures a single product with the following unit costs for 1,000 units:  Recently, a company approached Reggie Corporation about buying 100 units for $5,100 each.Currently, the models are sold to dealers for $7,800.Reggie Corporation's capacity is sufficient to produce the extra 100 units.No additional selling expenses would be incurred on the special order.

-

If Reggie Corporation wants to increase its profit by $18,000 on the special order, what is the minimum price it should charge per unit?

Recently, a company approached Reggie Corporation about buying 100 units for $5,100 each.Currently, the models are sold to dealers for $7,800.Reggie Corporation's capacity is sufficient to produce the extra 100 units.No additional selling expenses would be incurred on the special order.

-

If Reggie Corporation wants to increase its profit by $18,000 on the special order, what is the minimum price it should charge per unit?

(Multiple Choice)

5.0/5  (39)

(39)

Showing 21 - 40 of 98

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)