Exam 10: Static and Flexible Budgets

Exam 1: The Role of Ethical Accounting Information in Management Decision Making116 Questions

Exam 2: Cost Concepts, Behaviour, and Estimation171 Questions

Exam 3: Cost-Volume-Profit Analysis185 Questions

Exam 4: Relevant Information for Decision Making165 Questions

Exam 5: Job Costing168 Questions

Exam 6: Process Costing143 Questions

Exam 7: Activity-Based Costing and Management183 Questions

Exam 8: Measuring and Assigning Support Department Costs139 Questions

Exam 9: Joint Product and By-Product Costing142 Questions

Exam 10: Static and Flexible Budgets164 Questions

Exam 11: Standard Costs and Variance Analysis166 Questions

Exam 12: Strategic Investment Decisions136 Questions

Exam 13: Pricing Decisions127 Questions

Exam 14: Strategic Management of Costs101 Questions

Exam 15: Measuring and Assigning Costs for Income Statements158 Questions

Exam 16: Performance Evaluation and Compensation77 Questions

Exam 17: Strategic Performance Measurement138 Questions

Exam 18: Sustainability Management74 Questions

Select questions type

Flexible budgets reflect:

I. Operations for actual costs and revenues

II. Operations for costs and revenues for the volume of sales from the master budget

III. Operations for actual volume of sales with budgeted variable costs per unit and budgeted total fixed costs

(Multiple Choice)

4.8/5  (39)

(39)

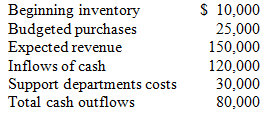

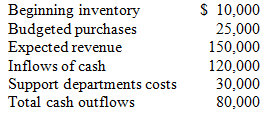

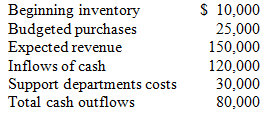

TFS Corporation, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  TFS' budgeted profit before taxes for the next fiscal year will be:

TFS' budgeted profit before taxes for the next fiscal year will be:

(Multiple Choice)

4.8/5  (40)

(40)

TFS Corporation, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  TFS' budgeted cost of goods sold for the next fiscal year will be:

TFS' budgeted cost of goods sold for the next fiscal year will be:

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following budgeting systems relies on cost pools and cost drivers?

(Multiple Choice)

4.8/5  (42)

(42)

Business strategy is incorporated in budgets through:

I. Proposed changes in product emphasis

II. Revenue forecasts for new products

III. Proposed changes in discretionary expenses such as research and development

(Multiple Choice)

4.9/5  (43)

(43)

Several terms related to budgeting and accompanying definitions are listed below. Match each term with the definition that best describes it. The items in each list may be used only once.

Correct Answer:

Premises:

Responses:

(Matching)

4.7/5  (35)

(35)

(Appendix 10A)Allen, Inc. has the following disbursements: *Variable manufacturing costs are $3 per unit. They are paid 40% in the month of purchase and 60% in the following month. Purchases are made in the month of production.

*Fixed overhead is $2,000, including $500 amortization. Overhead costs are paid as incurred.

*Selling costs are $1,500 per month plus $1 per unit sold and are paid in the month incurred.

*Production for January, February, and March was 3,000, 2,000, and 1,200 units, respectively.

*Sales for the 3 months were 1,000, 2,500, and 1,000 units, respectively.

What is the amount of cash disbursements for February?

(Multiple Choice)

4.8/5  (37)

(37)

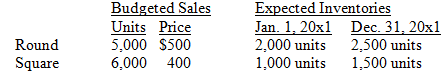

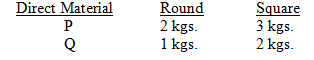

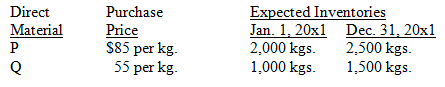

Horton Company produces and sells two products: round and square tables. In August 20x0, the budget projected the following for 20x1:  The tables are manufactured using the following direct materials:

The tables are manufactured using the following direct materials:

Budgeted data for 20x1 direct materials are:

Budgeted data for 20x1 direct materials are:

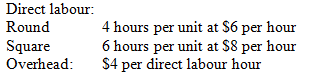

Budgeted data for 20x1 Direct labour and overhead are:

Budgeted data for 20x1 Direct labour and overhead are:

The cost of ending finished goods inventory of round tables for 20x1 is:

The cost of ending finished goods inventory of round tables for 20x1 is:

(Multiple Choice)

5.0/5  (39)

(39)

A firm that manufactures vases has budgeted production for the next four months as follows: Units Produced

October 40,000

November 50,000

December 30,000

January 40,000

Each vase requires 30 grams of silica. The managers desire an ending inventory sufficient to meet 25% of the next month's production. There is no beginning inventory of raw material in October.

Budgeted purchases of silica in grams for November would be:

(Multiple Choice)

4.8/5  (40)

(40)

Kaizen budgeting is designed to improve quality and reduce cost over time.

(True/False)

4.8/5  (37)

(37)

January February March April Sales $26,400 $23,100 $33,000 $25,000

Production in units 990 1,440 1,710 1,200

Sales are 30% cash and 70% on account, and 60% of credit sales are collected in the month of the sale. In the month after the sale, 30% of credit sales are collected. The remainder is collected two months after the sale. It takes 4 kilograms of direct material to produce a finished unit, and direct materials cost $5 per kilogram. All direct materials purchases are on account, and are paid as follows: 40% in the month of the purchase, 50% the following month, and 10% in the second month following the purchase. Ending direct materials inventory for each month is 40% of the next month's production needs. January's beginning materials inventory is 1,080 kilograms. Suppose that both accounts receivable and accounts payable are zero at the beginning of January.

(Appendix 10A)Total cash sales for the January - March quarter are

(Multiple Choice)

4.8/5  (36)

(36)

TFS Corporation, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  Which of the following amounts is irrelevant in the preparation of TFS' budgeted income statement?

Which of the following amounts is irrelevant in the preparation of TFS' budgeted income statement?

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following is prepared periodically, reflecting planning changes for a specific future time frame?

(Multiple Choice)

4.8/5  (29)

(29)

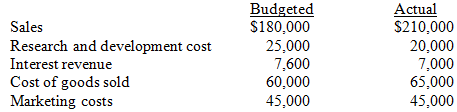

At the end of 20x1, SWP Corporation prepared its master budget for 20x2. Selected amounts from that budget, along with actual results for 20x2, are presented below:  Which items in the table have favourable variances?

Which items in the table have favourable variances?

(Multiple Choice)

4.8/5  (36)

(36)

Budgets provide a mechanism for defining which of the following for individual managers?

I. Decision rights

II. Behaviours

III. Forecasts

(Multiple Choice)

4.7/5  (35)

(35)

BNN Corporation expects to operate at a profit in its next fiscal year. Which of the following statements about its budgeted income statement is true?

(Multiple Choice)

4.8/5  (32)

(32)

The chief financial officer of a large law firm has advocated the use of flexible budgets. Explain the nature of flexible budgets, and present one argument in favour of using them.

(Essay)

4.9/5  (26)

(26)

Showing 21 - 40 of 164

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)