Exam 10: Static and Flexible Budgets

Exam 1: The Role of Ethical Accounting Information in Management Decision Making116 Questions

Exam 2: Cost Concepts, Behaviour, and Estimation171 Questions

Exam 3: Cost-Volume-Profit Analysis185 Questions

Exam 4: Relevant Information for Decision Making165 Questions

Exam 5: Job Costing168 Questions

Exam 6: Process Costing143 Questions

Exam 7: Activity-Based Costing and Management183 Questions

Exam 8: Measuring and Assigning Support Department Costs139 Questions

Exam 9: Joint Product and By-Product Costing142 Questions

Exam 10: Static and Flexible Budgets164 Questions

Exam 11: Standard Costs and Variance Analysis166 Questions

Exam 12: Strategic Investment Decisions136 Questions

Exam 13: Pricing Decisions127 Questions

Exam 14: Strategic Management of Costs101 Questions

Exam 15: Measuring and Assigning Costs for Income Statements158 Questions

Exam 16: Performance Evaluation and Compensation77 Questions

Exam 17: Strategic Performance Measurement138 Questions

Exam 18: Sustainability Management74 Questions

Select questions type

Which of the following is a type of budgeting that is used to develop cost and time budgets for information technology projects?

(Multiple Choice)

4.9/5  (39)

(39)

Favourable variances are positive amounts; unfavourable variances are negative amounts.

(True/False)

4.7/5  (43)

(43)

Canton Corp. plans to produce 30,000 units per month during the company year. Sales are projected at 25,000 for January, but will increase 5% per month thereafter. How many units are estimated to be on hand at April 30 if there is no beginning inventory for the year?

(Essay)

4.8/5  (41)

(41)

Planning Systems, Inc. has forecast the following unit sales and production for the next year, by quarter: 1st 2nd 3rd 4th

Production 150 160 140 100

Sales 120 140 150 120

The firm has beginning inventories as follows:

Finished goods 50 units

Direct material A 100

Direct material B 100

A finished unit requires one unit of material A and two units of material B. There should be enough material on hand at the end of each quarter to meet 20% of the next quarter's production needs. There are no work-in-process inventories.

What is the ending inventory for material A for quarter 2?

(Multiple Choice)

4.7/5  (35)

(35)

(Appendix 10A)Snow Blowers produces and sells snow blowers. Production levels are high in the summer and the beginning of fall, and then taper off through the winter. Sales are high in the fall and in early winter, and then taper off in the spring. Explain why preparing a cash budget might be particularly important for Snow Blowers.

(Essay)

4.9/5  (32)

(32)

A budget cycle is a series of steps that organizations follow to develop and use budgets. It typically begins by revisiting and possibly revising the organizational vision and core competencies. The steps in the budgeting cycle are listed below in random order. Number them (1 through 7)according to their usual sequence in the budget cycle.

____ Develop operating plans

____ Evaluate and reward performance

____ Investigate major differences between actual and budgeted results

____ Monitor actual results compared to budget

____ Reassess vision and core competencies

____ Reconsider long-term strategies

____ Translate strategies and operating plans into master budget

(Essay)

4.8/5  (31)

(31)

Budgeting provides a means for defining managers' decision rights.

(True/False)

4.8/5  (38)

(38)

Planning Systems, Inc. has forecast the following unit sales and production for the next year, by quarter: 1st 2nd 3rd 4th

Production 150 160 140 100

Sales 120 140 150 120

The firm has beginning inventories as follows:

Finished goods 50 units

Direct material A 100

Direct material B 100

A finished unit requires one unit of material A and two units of material B. There should be enough material on hand at the end of each quarter to meet 20% of the next quarter's production needs. There are no work-in-process inventories.

What is the ending inventory for material B in quarter 1?

(Multiple Choice)

5.0/5  (44)

(44)

(Appendix 10A)A firm expects credit sales for the week to amount to $3,000, accounts receivable to increase by $200, and accounts payable to decrease by $500. Given this information, what will be the effect on cash?

(Multiple Choice)

5.0/5  (38)

(38)

(Appendix 10A)Gold Company has the following balances at December 31, 20x0: Cash $6,000; accounts receivable $34,000 ($10,000 from November and $24,000 from December); merchandise inventory $40,000; and accounts payable $20,000 (for merchandise purchases only). Budgeted sales follow: January $ 50,000

February 90,000

March 60,000

April 100,000

Other data:

*Sales are 40% cash, 50% collected during the following month, and 10% collected during the second month after sale. A 3% cash discount is given on cash sales

*Cost of goods sold is 40% of sales

*Ending inventory must be 140% of the next month's cost of sales

*Purchases are paid 70% in month of purchase and 30% in the following month

*The selling and administrative cost function is: $6,000 + $0.2 × sales. This includes $1,000 for amortization

*All costs are paid in the month incurred

*Minimum cash balance requirement is $6,000

The cash disbursements for purchases in March are:

(Multiple Choice)

4.8/5  (35)

(35)

The Vegan Wagon is part of a chain of restaurants and has been losing money in past months. Part of the problem has been a decline in sales. However, sales are expected to pick up during the summer months. In March, for example, the loss was $2,250.

Static Budget Actual

Revenue $80,000 $65,000

Costs:

Cost of ingredients 24,000 22,750

Serving personnel 20,000 19,000

Cashier 4,000 4,000

Administration 12,000 14,000

Corporate cost allocation 8,000 6,500

Utilities 1,500 1,000

Income (Loss)$10,500 $ (2,250)

The restaurant purchases ingredients directly from the chain and is charged in direct proportion to the number of meals served. Personnel paid by Vegan prepare and serve the food, tend the cash register, bus and clean tables, and wash dishes. The staffing levels in Vegan are rarely changed - the existing crew can handle modest fluctuations in volume. Administrative costs are largely the salaries of the manager and her staff. The chain allocates corporate costs based on revenue, and the usual charge is 10% of Vegan's revenue. Utilities are the costs of heating and lighting the restaurant during normal operating hours and are relatively unaffected by the amount of food prepared.

a)Develop a flexible budget for Vegan Wagon that could be used to evaluate the performance of the manager.

b)Calculate the variances for Vegan Wagon.

c)Identify the largest variance and list one question that you would ask the manager about that variance.

(Essay)

4.8/5  (36)

(36)

(Appendix 10A)Conner Company is a medium-sized toy distributor. Experience has shown that 30% of sales are collected within the month of sale, 60% is collected the month after the sale, and 10% is collected two months after the sale. Inventory on hand at the end of a month is to be 70% of the next month's budgeted sales. Cost of goods sold is 50% of the selling price. Payment for purchases is made in the month after purchase. All other costs are paid in the month incurred. Budgeted amounts are as follows: March April May June July August

Sales $10,000 $20,000 $30,000 $30,000 $50,000 $40,000

Costs:

Wages 1,500 2,000 2,500 1,500

Rent 500 500 500 500

Other 400 500 600 500

Purchases for the month of May are expected to be:

(Multiple Choice)

4.8/5  (37)

(37)

The cash budget is included in an organization's operating budget.

(True/False)

4.9/5  (42)

(42)

Cost-volume-profit analysis is a simplified version of a flexible budget.

(True/False)

4.9/5  (40)

(40)

Under which of the following types of budgeting must managers justify their budget requests each year as if prior information did not exist?

(Multiple Choice)

4.9/5  (36)

(36)

January February March April Sales $26,400 $23,100 $33,000 $25,000

Production in units 990 1,440 1,710 1,200

Sales are 30% cash and 70% on account, and 60% of credit sales are collected in the month of the sale. In the month after the sale, 30% of credit sales are collected. The remainder is collected two months after the sale. It takes 4 kilograms of direct material to produce a finished unit, and direct materials cost $5 per kilogram. All direct materials purchases are on account, and are paid as follows: 40% in the month of the purchase, 50% the following month, and 10% in the second month following the purchase. Ending direct materials inventory for each month is 40% of the next month's production needs. January's beginning materials inventory is 1,080 kilograms. Suppose that both accounts receivable and accounts payable are zero at the beginning of January.

The ending direct materials inventory for March is:

(Multiple Choice)

4.8/5  (35)

(35)

Kelita, Inc., projects sales for its first three months of operation as follows: October November December

Credit sales $100,000 $150,000 $200,000

Cash sales 40,000 60,000 50,000

Total Sales $140,000 $210,000 $250,000

Inventory on October 1 is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale.

(Appendix 10A)What are the anticipated cash receipts for November?

(Multiple Choice)

4.8/5  (35)

(35)

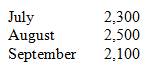

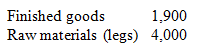

(CMA)Table Top produces tables sold to discount stores. The table tops are manufactured in Canada by Table Top, but the table legs are manufactured in a plant in Nogales, Mexico. The assembly department attaches the four purchased table legs to the table top. It takes 20 minutes of labour to assemble a table. The company follows a policy of producing enough tables to insure that 40% of next month's sales are in the finished goods inventory. Table Top also purchases sufficient raw materials to insure that raw materials inventory is 60% of the following month's scheduled production. Table Top's sales budget in units for the next quarter is as follows:  Table Top's ending inventories in units for June 30, 20x5 are:

Table Top's ending inventories in units for June 30, 20x5 are:

Assume the required production for August and September is 1,600 and 1,800 units, respectively, and the July 31, 20x5 raw materials inventory is 4,200 units. The number of table legs to be purchased in August is:

Assume the required production for August and September is 1,600 and 1,800 units, respectively, and the July 31, 20x5 raw materials inventory is 4,200 units. The number of table legs to be purchased in August is:

(Multiple Choice)

4.8/5  (38)

(38)

The principles of activity-based costing can be applied to the budgeting process.

(True/False)

4.9/5  (42)

(42)

Showing 61 - 80 of 164

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)