Exam 7: Activity-Based Costing and Management

Exam 1: The Role of Ethical Accounting Information in Management Decision Making116 Questions

Exam 2: Cost Concepts, Behaviour, and Estimation171 Questions

Exam 3: Cost-Volume-Profit Analysis185 Questions

Exam 4: Relevant Information for Decision Making165 Questions

Exam 5: Job Costing168 Questions

Exam 6: Process Costing143 Questions

Exam 7: Activity-Based Costing and Management183 Questions

Exam 8: Measuring and Assigning Support Department Costs139 Questions

Exam 9: Joint Product and By-Product Costing142 Questions

Exam 10: Static and Flexible Budgets164 Questions

Exam 11: Standard Costs and Variance Analysis166 Questions

Exam 12: Strategic Investment Decisions136 Questions

Exam 13: Pricing Decisions127 Questions

Exam 14: Strategic Management of Costs101 Questions

Exam 15: Measuring and Assigning Costs for Income Statements158 Questions

Exam 16: Performance Evaluation and Compensation77 Questions

Exam 17: Strategic Performance Measurement138 Questions

Exam 18: Sustainability Management74 Questions

Select questions type

Outdoor Amusement Fun is an amusement park located in Vancouver, British Columbia. It is organized into 6 departments: arcades and shows, food and beverage, rides, communications, human resources, and maintenance. Outdoor Amusement Fun is implementing an ABC system to allocate the costs of the service activities (communications, human resources, and maintenance)to product-line departments (arcades and shows, food and beverage, and rides). Thus, the product-line departments are the cost objects. The total costs and cost drivers for each service activity are:

Activity Total Cost Cost Driver

Communication $16,000 Number of department-specific memos prepared and distributed

Human resources 21,000 Number of employees

Maintenance 18,000 Square metres

Information regarding cost drivers and allocation bases is as follows:

Number of Department-

Number Square Specific Memos

of Employees Metres Prepared & Distributed

Arcades & shows 20 5,000 6

Food & beverage 50 7,000 4

Rides 30 6,000 6

Communications 10 1,000 4

Human resources 10 1,000 3

Maintenance 30 1,000 1

Direct costs and revenues for each product-line department are as follows:

Revenues Direct Costs

Arcades & shows $50,000 $8,000

Food & beverage 125,000 6,000

Rides 150,000 4,000

a)Calculate the allocation rate for each service activity.

b)Interpret the allocation rate for each service activity (i.e., explain what it means).

c)Calculate the total service activity costs allocated to each product-line department.

d)Calculate the operating profit (revenues - direct costs - allocated costs)for each product-line department.

[Note to Professors: The data in exercise #4 is the same as the data in multiple choice questions #27-31. However, the exercise questions differ from the multiple choice questions.]

(Essay)

4.8/5  (29)

(29)

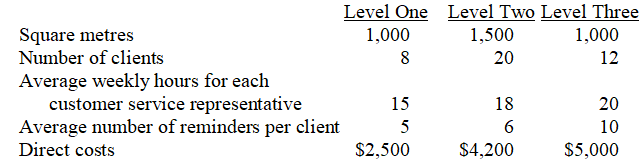

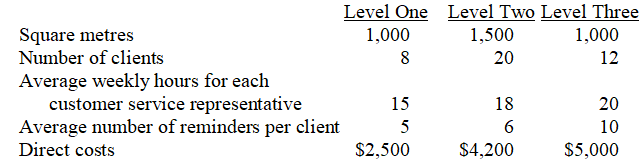

Reliable Reminders Inc. is a personal service firm located in Calgary, Alberta. The firm collects lists of birthdays, anniversaries and other memorable dates from its clients, and offers 3 levels of service. Level One clients receive an e-mail reminder of their important dates at least a week in advance. Level Two clients receive both an e-mail reminder and an appropriate greeting card. Level Three clients receive an e-mail reminder, an appropriate greeting card, and a recommended gift. Level One clients arrange their services through 3 customer service representatives. Reliable also employs 4 customer service representatives for Level Two clients, and 2 representatives for Level Three clients.

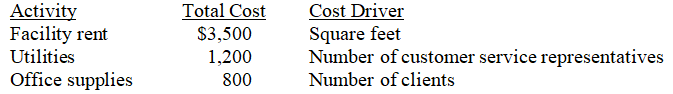

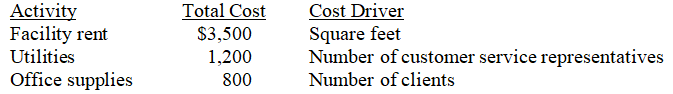

Reliable Reminders incurs the following costs as part of its operations, and it uses the following cost drivers. Management wants to calculate the cost of each level of service.

You may find the following information helpful:

Based on the preceding information, match each numbered item with the most appropriate lettered item.Each numbered item has only one correct answer. Each lettered item may be used once, more than once, or not at all. Round all unit and total costs to the nearest dollar.

Reliable Reminders incurs the following costs as part of its operations, and it uses the following cost drivers. Management wants to calculate the cost of each level of service.

You may find the following information helpful:

Based on the preceding information, match each numbered item with the most appropriate lettered item.Each numbered item has only one correct answer. Each lettered item may be used once, more than once, or not at all. Round all unit and total costs to the nearest dollar.

Correct Answer:

Premises:

Responses:

(Matching)

5.0/5  (40)

(40)

Activity Based Costing can be used for

I. Allocating manufacturing overhead

II. Allocating non-manufacturing department costs

III. Determining customer related costs

(Multiple Choice)

4.7/5  (34)

(34)

Caring Change Medical Practice specializes in plastic surgery. Which of the following costs is most likely to be a committed cost in its operations?

(Multiple Choice)

4.8/5  (38)

(38)

Which method(s)do traditional accounting systems use to assign the following costs to cost objects (departments or units)? Direct Costs Overhead Costs

(Multiple Choice)

4.7/5  (34)

(34)

All organizations that use activity-based costing also use activity-based management.

(True/False)

4.9/5  (48)

(48)

Unlike activity-based costing, traditional costing systems never use multiple cost pools for overhead allocation.

(True/False)

4.7/5  (37)

(37)

Accountants normally can determine cost drivers for all cost pools on their own, without consulting other employees in the organization.

(True/False)

4.9/5  (39)

(39)

List two advantages and two disadvantages of implementing an ABC system compared to traditional costing.

(Essay)

4.9/5  (37)

(37)

Tutors-R-Us provides academic enrichment and review activities for high school students in 4 subject areas: English, mathematics, science, and history. In November 20x1, the firm's information system produced the following data: Number of Number of Percent of Direct

Tutors Students Faculty Costs

English 4 20 10% $ 6,000

Mathematics 3 24 25 8,000

Science 5 15 50 12,000

History 2 8 15 3,000

Regardless of subject area, clients pay $50 per hour for tutoring services. Costs associated with the Tutors-R-Us operations for November 20x1 included:

Facility rent $2,500

Custodial services 1,800

Utilities 600

Computer equipment amortization 800

Advertising 400

Which of the following is the most logical allocation base for facility rent if the relevant cost object is a subject area (product line)?

(Multiple Choice)

5.0/5  (33)

(33)

Both activity-based costing and traditional costing allocate overhead costs to cost objects.

(True/False)

4.9/5  (29)

(29)

For small manufacturing firms, ABC systems are best with: Number of Number of

Activities Cost Drivers

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following do managers use in choosing activities and cost drivers to include in an ABC system?

(Multiple Choice)

4.9/5  (30)

(30)

For small manufacturing firms, ABC systems are best with: Number of Number of

Activities Cost Drivers

(Multiple Choice)

4.9/5  (30)

(30)

Franklin Fireplace Inserts manufactures two premium models of fireplace inserts that provide more BTUs of heat per cord of wood than any other wood burning fireplace insert or stove. One model, the Heatilator, sells for $1,800, and the Heat Queen, a new model that sells for $1,200. Franklin's marketing department suggested that the company should concentrate on the new Heat Queen model and begin to phase out the Heatilator model.

Franklin currently uses a traditional costing system. The following cost information has been used as a basis for pricing decisions over the past year.

Per-Unit Data Heatilator Heat Queen

Direct materials $200 $280

Direct labor hours 1.5 1.5

Machine hours 5.0 4.0

Units produced 11,000 4,000

Direct labor cost is $20 per hour, and the machine usage cost is $18 per hour. Manufacturing overhead costs were estimated at $4,800,000 and were allocated on the basis of machine hours.

Gwen Freely, the new company controller, suggested that an activity-based costing analysis first be performed to obtain a better picture of the true manufacturing cost. The following data were collected:

Activity Center Cost Driver Traceable Costs

Soldering Number of solder joints $ 942,000

Shipments Number of shipments 860,000

Quality control Number of inspections 1,240,000

Purchase orders Number of orders 950,400

Machining Machine hours 57,600

Machine setups Number of setups 750,000

Total traceable costs $4,800,000

Number of Events during the year:

Activity Heatilator Heat Queen Total

Soldering 296,250 96,250 392,500

Shipments 4,050 950 5,000

Quality control 14,050 5,325 19,375

Purchase orders 20,025 27,495 47,520

Machining 44,000 4,000 48,000

Machine setups 4,000 3,500 7,500

Selling, general, and administrative costs per unit sold are $175.00 for Heatilator and $125 for Heat Queen.

a)Calculate the manufacturing cost per unit for Heatilator and Heat Queen under:

1. A traditional costing system

2. The ABC system

b)Which system would most likely do a better job of measuring costs for this product emphasis/keep or drop decision? Explain.

c)Franklin's controller points out that the ABC information could also be used to identify and eliminate non-value added activities. Explain how ABC and ABM can be used for this purpose.

(Essay)

4.8/5  (33)

(33)

Caring Change Medical Practice specializes in plastic surgery. Which of the following is least likely to be a committed cost in its operations?

(Multiple Choice)

4.7/5  (48)

(48)

Lookin' for a Home is an animal shelter in Saskatoon, Saskatchewan. The shelter relies on government grants and private donations for funding. It takes in homeless dogs and cats and keeps them until they are adopted by qualified individuals. One of the shelter's cost pools is animal recordkeeping, which involves maintaining a database with details about each animal in the shelter. Which of the following is the most appropriate cost driver for the animal recordkeeping cost pool?

(Multiple Choice)

4.9/5  (43)

(43)

The costs of designing and implementing an ABC system include employee time and training.

(True/False)

4.8/5  (38)

(38)

The availability of activity costs is inversely related to the cost of implementing an ABC system.

(True/False)

4.8/5  (30)

(30)

Showing 141 - 160 of 183

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)