Exam 4: Consolidated Statements on Date of Acquisition

Exam 1: A Survey of International Accounting38 Questions

Exam 2: Investments in Equity Securities58 Questions

Exam 3: Business Combinations73 Questions

Exam 4: Consolidated Statements on Date of Acquisition52 Questions

Exam 5: Consolidation Subsequent to Acquisition Date61 Questions

Exam 6: Intercompany Inventory and Land Profits59 Questions

Exam 7: Aintercompany Profits in Depreciable Assets62 Questions

Exam 8: Consolidated Cash Flows and Ownership Issues58 Questions

Exam 9: Other Consolidated Reporting Issues75 Questions

Exam 10: Foreign Currency Transactions62 Questions

Exam 11: Translation and Consolidation of the Financial Statements of Foreign Operations56 Questions

Exam 12: Accounting for Not-For-Profit Organizations and Governments37 Questions

Select questions type

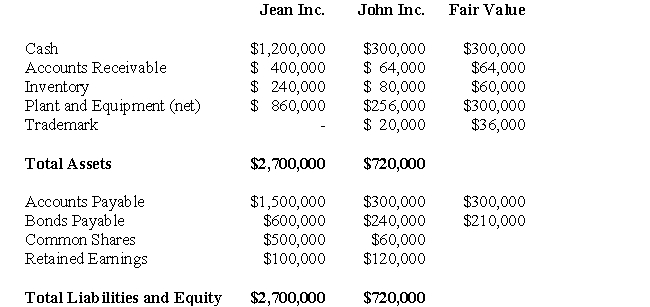

The following data pertains to Questions

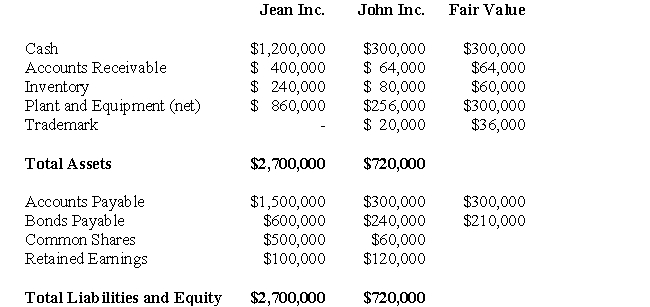

Jean and John Inc had the following balance sheets on August 31,2007:  On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.

-Prepare Jean Inc's consolidated Balance Sheet on the date of acquisition using the Proprietary Theory.

On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.

-Prepare Jean Inc's consolidated Balance Sheet on the date of acquisition using the Proprietary Theory.

Free

(Essay)

4.8/5  (40)

(40)

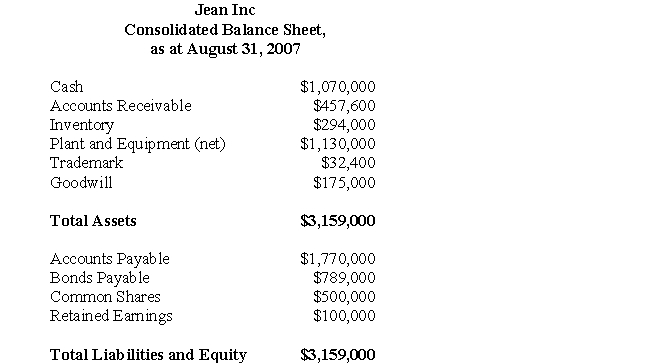

Correct Answer:

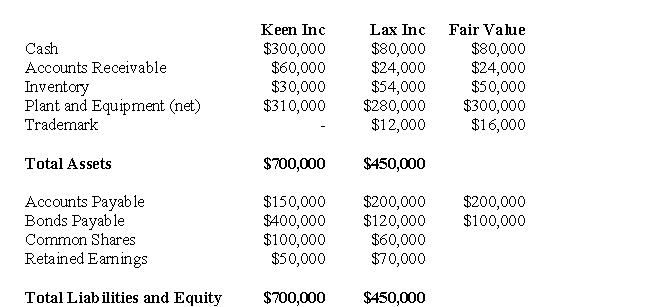

The following data pertains to Questions

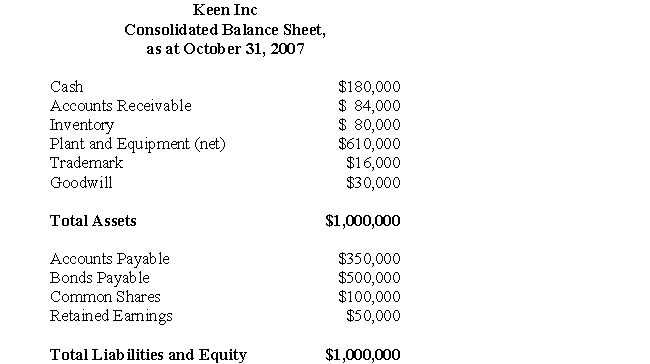

Keen and Lax Inc had the following balance sheets on October 31,2007:  -Assuming that Keen Inc.purchases 100% of Lax Inc.for $200,000,prepare the Consolidated Balance Sheet on the Date of Acquisition.

-Assuming that Keen Inc.purchases 100% of Lax Inc.for $200,000,prepare the Consolidated Balance Sheet on the Date of Acquisition.

Free

(Essay)

4.8/5  (25)

(25)

Correct Answer:

HRN Enterprises Inc purchases 80% of the outstanding voting shares of NHR Inc on January 1,2009.On that date,

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

B

The focus of the Consolidated Financial Statements on the shareholders of the parent company is characteristic of:

(Multiple Choice)

4.7/5  (37)

(37)

On the date of acquisition,consolidated shareholder equity is equal to:

(Multiple Choice)

5.0/5  (41)

(41)

Company A owns all of the outstanding common voting shares of Company B,which is said to have 500,000 shares.However,Company B's bondholders have a conversion option,which,if exercised would be convertible to 600,000 voting shares.50% of Company B's current Board Members are Company A Executives.How should Company A account for its investment in Company B?

(Essay)

4.9/5  (38)

(38)

When the Non-Controlling Interest's share of the subsidiary's goodwill is not reliably determined the method used to prepare consolidated financial statements is:

(Multiple Choice)

4.8/5  (39)

(39)

Discuss the disclosure requirements for long term investments including accounting policies and NCI.

(Essay)

4.8/5  (35)

(35)

The following data pertains to Questions

Jean and John Inc had the following balance sheets on August 31,2007:  On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.

-Prepare Jean Inc's consolidated Balance Sheet on the date of acquisition using the Entity Theory.

On August 31,2007,Jean's date of acquisition,Jean Inc.purchased 90% of John Inc for $400,000.

-Prepare Jean Inc's consolidated Balance Sheet on the date of acquisition using the Entity Theory.

(Essay)

4.8/5  (36)

(36)

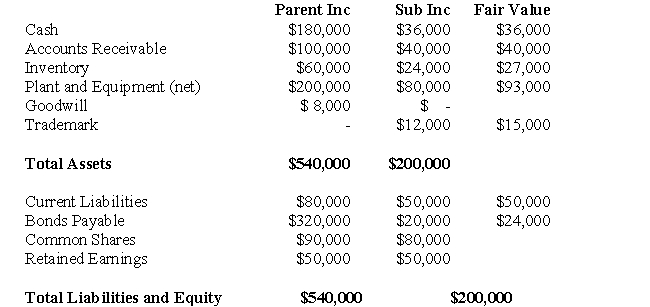

The following data pertains to questions

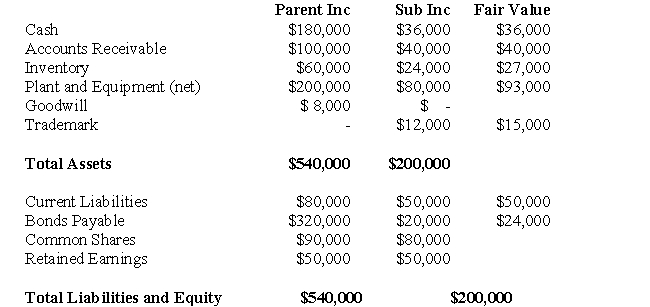

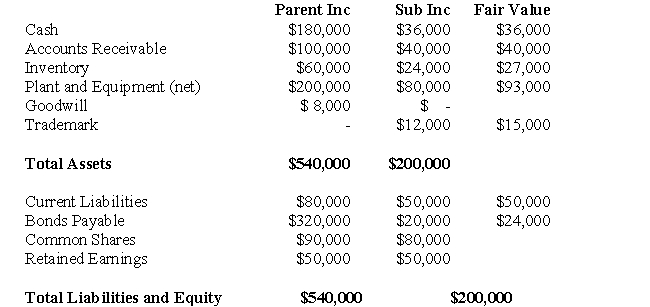

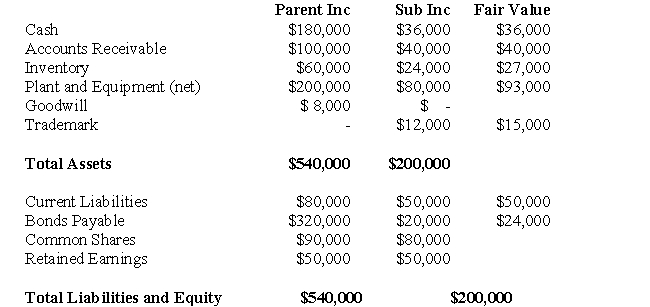

Parent and Sub Inc had the following balance sheets on July 31,2007:  The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

-Assume that Parent Inc.decides to prepare an Income Statement for the combined entity on the date of acquisition.Assuming that Parent acquires 100% of Sub Inc.on that date,what would be the net income reported for the combined entity?

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

-Assume that Parent Inc.decides to prepare an Income Statement for the combined entity on the date of acquisition.Assuming that Parent acquires 100% of Sub Inc.on that date,what would be the net income reported for the combined entity?

(Multiple Choice)

4.8/5  (37)

(37)

On the date of acquisition,the parent's investment (in subsidiary account)is:

(Multiple Choice)

4.8/5  (40)

(40)

Assume the same facts as Question 62 except that Company B's Bondholders had a conversion option which,if exercised,would be convertible to 2,000,000 common voting shares.Would this change your response? Explain.

(Essay)

4.9/5  (32)

(32)

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007:  The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

-The Shareholder Equity section of Parent's Consolidated Balance Sheet on the date of acquisition would total what amount under the Entity Method?

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

-The Shareholder Equity section of Parent's Consolidated Balance Sheet on the date of acquisition would total what amount under the Entity Method?

(Multiple Choice)

4.8/5  (38)

(38)

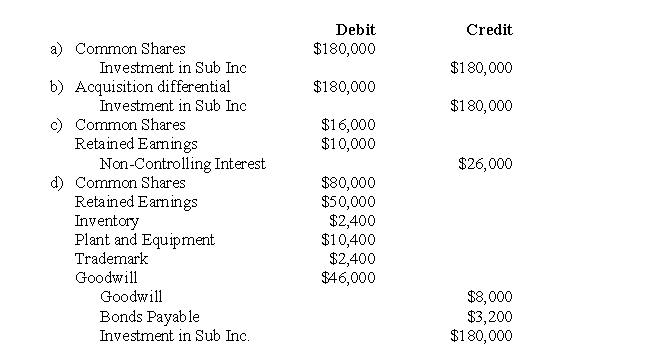

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007:  The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

-Assuming that Parent Inc.purchased 80% of Sub's voting shares on the date of acquisition for $180,000,what would be the journal entry to clear out the Investment in Sub Inc.account assuming any Acquisition differential is to be allocated to the identifiable assets and liabilities of Sub Inc if the Proprietary Method were used?

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

-Assuming that Parent Inc.purchased 80% of Sub's voting shares on the date of acquisition for $180,000,what would be the journal entry to clear out the Investment in Sub Inc.account assuming any Acquisition differential is to be allocated to the identifiable assets and liabilities of Sub Inc if the Proprietary Method were used?

(Short Answer)

4.9/5  (34)

(34)

Under the Parent Company Theory,which of the following pertaining to Consolidated Financial Statements is correct?

(Multiple Choice)

4.9/5  (35)

(35)

Under "push-down" accounting,a subsidiary's assets and liabilities are revalued using:

(Multiple Choice)

4.9/5  (36)

(36)

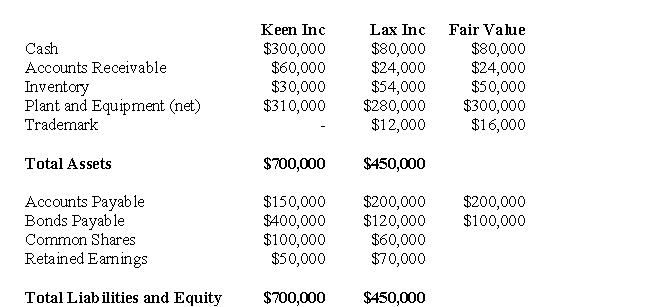

The following data pertains to Questions

Keen and Lax Inc had the following balance sheets on October 31,2007:  -Assuming that Keen Inc.purchases 100% of Lax Inc.for $200,000,prepare any journal entries you feel are necessary on the date of acquisition prior to the preparation of Consolidated Financial Statements.

-Assuming that Keen Inc.purchases 100% of Lax Inc.for $200,000,prepare any journal entries you feel are necessary on the date of acquisition prior to the preparation of Consolidated Financial Statements.

(Essay)

4.8/5  (27)

(27)

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007:  The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

-What would be the amount of Non-Controlling Interest appearing on the Consolidated Balance Sheet on the date of acquisition,assuming once again that Parent purchased 80% of Sub Inc.for $180,000 under current GAAP?

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

-What would be the amount of Non-Controlling Interest appearing on the Consolidated Balance Sheet on the date of acquisition,assuming once again that Parent purchased 80% of Sub Inc.for $180,000 under current GAAP?

(Multiple Choice)

4.7/5  (37)

(37)

Showing 1 - 20 of 52

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)