Exam 10: Fixed Assets and Intangible Assets

Exam 1: Introduction to Accounting and Business191 Questions

Exam 2: Analyzing Transactions226 Questions

Exam 3: The Adjusting Process180 Questions

Exam 4: Completing the Accounting Cycle195 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses218 Questions

Exam 7: Inventories169 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash177 Questions

Exam 9: Receivables151 Questions

Exam 10: Fixed Assets and Intangible Assets172 Questions

Exam 11: Current Liabilities and Payroll171 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies192 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends171 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes188 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows165 Questions

Exam 17: Financial Statement Analysis186 Questions

Select questions type

An estimate of the amount which an asset can be sold at the end of its useful life is called residual value.

(True/False)

4.8/5  (30)

(30)

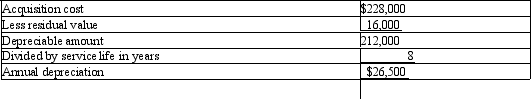

On July 1st, Harding Construction purchases a bulldozer for $228,000. The equipment has a 8 year life with a residual value of $16,000. Harding uses straight-line depreciation.

(a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b) Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c) Calculate the last year's depreciation expense and provide the journal entry for the last year.

Annual depreciation is:

(Essay)

4.7/5  (31)

(31)

On December 31, Strike Company has decided to sell one of its batting cages. The initial cost of the equipment was $310,000 with an accumulated depreciation of $260,000. Depreciation has been taken up to the end of the year. The company found a company that is willing to buy the equipment for $55,000. What is the amount of the gain or loss on this transaction?

(Multiple Choice)

4.8/5  (45)

(45)

A machine with a cost of $120,000 has an estimated residual value of $15,000 and an estimated life of 5 years or 15,000 hours. It is to be depreciated by the units-of-production method. What is the amount of depreciation for the second full year, during which the machine was used 5,000 hours?

(Multiple Choice)

4.8/5  (41)

(41)

An exchange is said to have commercial substance if future cash flows remain the same as a result of the exchange.

(True/False)

4.9/5  (38)

(38)

When a company discards machinery that is fully depreciated, this transaction would be recorded with the following entry

(Multiple Choice)

4.9/5  (39)

(39)

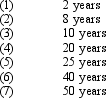

Convert each of the following estimates of useful life to a straight-line depreciation rate, stated as a percentage.

(Essay)

4.9/5  (29)

(29)

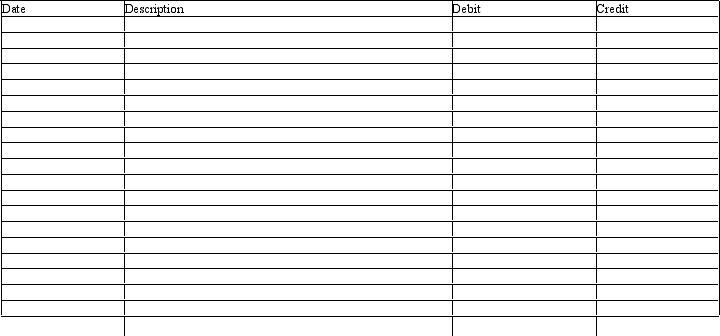

Clanton Company engaged in the following transactions during 2011. Record each in the general journal below:

1) On January 3, 2011, Clanton purchased a copyright from Dalton Company with a cost of $250,000 with a remaining useful life of 25 years.

2) On January 10, 2011, Clanton purchased a trademark from Felton Company with a cost of $700,000.

3) On July 1, 2011, Clanton purchased a patent from Garrison Company at a cost of $80,000. The remaining legal life of the patent is 15 years and the expected useful life is 11 years.

4) On July 2, 2011, Clanton paid $30,000 in legal fees to defend the patent protection purchased on July 1, 2011.

5) Recorded the appropriate amortization for the intangible assets for 2011.

6) Clanton Company includes an asset in its ledger recorded when Clanton purchased a computer service business at a price in excess of the fair value of the assets of the company in the amount of $400,000. At December 31, 2011, $100,000 of this asset has become impaired.

(Essay)

4.9/5  (45)

(45)

When selling a piece of equipment for cash, a loss will result when the proceeds of the sale are less than the book value of the asset.

(True/False)

4.8/5  (39)

(39)

On April 15, Compton Co. paid $2,800 to upgrade a delivery truck and $125 for an oil change. Journalize the entries for the upgrade to delivery truck and oil change expenditures.

(Essay)

4.8/5  (42)

(42)

When a company sells machinery at a price equal to its book value, this transaction would be recorded with an entry that would include the following:

(Multiple Choice)

4.8/5  (32)

(32)

For income tax purposes most companies use an accelerated deprecation method called double declining balance.

(True/False)

4.9/5  (43)

(43)

The depreciation method that does not use residual value in calculating the first year's depreciation expense is

(Multiple Choice)

4.9/5  (44)

(44)

During construction of a building, the cost of interest on a construction loan should be charged to an expense account.

(True/False)

4.9/5  (37)

(37)

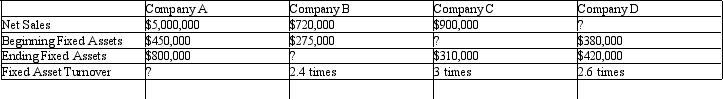

Fill in the missing numbers using the formula for Fixed Asset Turnover:

(Essay)

4.9/5  (41)

(41)

It is necessary for a company to use the same depreciation method for financial statements and for determining income taxes.

(True/False)

4.9/5  (32)

(32)

Showing 101 - 120 of 172

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)