Exam 13: Corporations: Organization, Stock Transactions, and Dividends

Exam 1: Introduction to Accounting and Business191 Questions

Exam 2: Analyzing Transactions226 Questions

Exam 3: The Adjusting Process180 Questions

Exam 4: Completing the Accounting Cycle195 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses218 Questions

Exam 7: Inventories169 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash177 Questions

Exam 9: Receivables151 Questions

Exam 10: Fixed Assets and Intangible Assets172 Questions

Exam 11: Current Liabilities and Payroll171 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies192 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends171 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes188 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows165 Questions

Exam 17: Financial Statement Analysis186 Questions

Select questions type

The cost of treasury stock is deducted from total paid-in capital and retained earnings in determining total stockholders' equity.

(True/False)

4.8/5  (39)

(39)

Vincent Corporation has 100,000 share of $100 par common stock outstanding. On June 30, Vincent Corporation declared a 5% stock dividend to be issued on July 30 to stockholders of record July 15. The market price of the stock was $132 a share on June 30. Journalize the entries required on June 30, July 15 and July 30.

(Essay)

4.8/5  (38)

(38)

Match the following stockholder's equity concepts to the best answer.

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (27)

(27)

If 50,000 shares are authorized, 41,000 shares are issued, and 2,000 shares are reacquired, the number of outstanding shares is 43,000.

(True/False)

4.9/5  (39)

(39)

The balance in Retained Earnings at the end of the period is created by closing entries.

(True/False)

4.9/5  (35)

(35)

Before a stock dividend can be declared or paid, there must be sufficient cash.

(True/False)

4.9/5  (42)

(42)

The retained earnings statement may be combined with the income statement.

(True/False)

4.8/5  (35)

(35)

If common stock is issued for an amount greater than par value, the excess should be credited to

(Multiple Choice)

4.9/5  (43)

(43)

The state charter allows a corporation to issue only a certain number of shares of each class of stock. This amount of stock is called

(Multiple Choice)

4.7/5  (38)

(38)

A corporation issues 2,500 shares of common stock for $ 45,000. The stock has a stated value of $10 per share. The journal entry to record the stock issuance would include a credit to Common Stock for

(Multiple Choice)

4.9/5  (36)

(36)

The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 45,000 shares were originally issued and 5,000 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2 per share dividend is declared?

(Multiple Choice)

4.9/5  (34)

(34)

The entry to record the issuance of common stock at a price above par includes a debit to

(Multiple Choice)

4.9/5  (34)

(34)

A large public corporation normally uses registrars and transfer agents to maintain records of the stockholders.

(True/False)

4.8/5  (39)

(39)

A corporation has 50,000 shares of $25 par value stock outstanding that has a current market value of $150. If the corporation issues a 5-for-1 stock split, the market value of the stock after the split will be approximately:

(Multiple Choice)

4.8/5  (26)

(26)

The stock dividends distributable account is listed in the current liability section of the balance sheet.

(True/False)

4.8/5  (33)

(33)

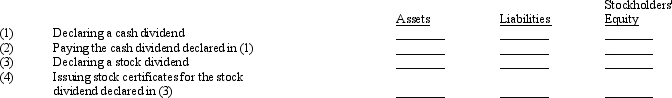

Indicate whether the following actions would (+) increase, (-) decrease, or (0) not affect a company's total assets, liabilities, and stockholders' equity.

(Essay)

4.9/5  (30)

(30)

The declaration of a stock dividend decreases a corporation's stockholders' equity and increases its liabilities.

(True/False)

4.8/5  (37)

(37)

Showing 41 - 60 of 171

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)