Exam 13: Corporations: Organization, Stock Transactions, and Dividends

Exam 1: Introduction to Accounting and Business191 Questions

Exam 2: Analyzing Transactions226 Questions

Exam 3: The Adjusting Process180 Questions

Exam 4: Completing the Accounting Cycle195 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses218 Questions

Exam 7: Inventories169 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash177 Questions

Exam 9: Receivables151 Questions

Exam 10: Fixed Assets and Intangible Assets172 Questions

Exam 11: Current Liabilities and Payroll171 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies192 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends171 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes188 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows165 Questions

Exam 17: Financial Statement Analysis186 Questions

Select questions type

Under the Internal Revenue Code, corporations are required to pay federal income taxes.

(True/False)

4.7/5  (36)

(36)

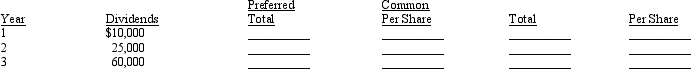

A company had stock outstanding as follows during each of its first three years of operations: 2,500 shares of $10, $100 par, cumulative preferred stock and 50,000 shares of $10 par common stock. The amounts distributed as dividends are presented below. Determine the total and per share dividends for each class of stock for each year by completing the schedule.

(Essay)

4.9/5  (41)

(41)

Preferred stockholders must receive their current year dividends before the common stockholders can receive any dividends.

(True/False)

4.8/5  (34)

(34)

On April 10, a company acquired land in exchange for 1,000 shares of $20 par common stock with a current market price of $73. Journalize this transaction.

(Essay)

4.9/5  (45)

(45)

A large retained earnings account means that there is cash available to pay dividends.

(True/False)

4.9/5  (34)

(34)

Match the following descriptions to stockholders equity concepts

Correct Answer:

Premises:

Responses:

(Matching)

4.7/5  (34)

(34)

A company with 100,000 authorized shares of $4 par common stock issued 40,000 shares at $8. Subsequently, the company declared a 4% stock dividend on a date when the market price was $12 a share. What is the amount transferred from the Retained Earnings account to Paid-in Capital accounts as a result of the stock dividend?

(Multiple Choice)

4.8/5  (41)

(41)

A restriction/appropriation of retained earnings establishes cash assets that are set aside for a specific purpose.

(True/False)

4.9/5  (43)

(43)

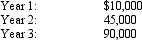

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

(Essay)

4.9/5  (40)

(40)

For accounting purposes, stated value is treated the same way as par value.

(True/False)

4.8/5  (46)

(46)

Which of the following is the appropriate general journal entry to record the declaration of a cash dividends?

(Multiple Choice)

4.7/5  (39)

(39)

While some businesses have been granted charters under state laws, most businesses receive their charters under federal laws.

(True/False)

4.9/5  (39)

(39)

A corporation purchases 10,000 shares of its own $10 par common stock for $35 per share, recording it at cost. What will be the effect on total stockholders' equity?

(Multiple Choice)

4.7/5  (33)

(33)

A company with 100,000 authorized shares of $4 par common stock issued 40,000 shares at $8. Subsequently, the company declared a 2% stock dividend on a date when the market price was $11 a share. What is the amount transferred from the retained earnings account to paid-in capital accounts as a result of the stock dividend?

(Multiple Choice)

4.8/5  (34)

(34)

When the board of director's declares a cash or stock dividend, this action decreases retained earnings.

(True/False)

4.9/5  (36)

(36)

On April 10, Maranda Corporation issued for cash 11,000 shares of no-par common stock at $25. On May 5, Maranda issued at par 1,000 shares of 4%, $50 par preferred stock for cash. On May 25, Maranda issued for cash 15,000 shares of 4%, $50 par preferred stock at $55.

Journalize the entries to record the April 10, May 5, and May 25 transactions.

(Essay)

4.9/5  (44)

(44)

Which of the following is not a prerequisite to paying a cash dividend?

(Multiple Choice)

4.8/5  (36)

(36)

On May 10, a company issued for cash 1,500 shares of no-par common stock (with a stated value of $2) at $14, and on May 15, it issued for cash 2,000 shares of $15 par preferred stock at $58.

Journalize the entries for May 10 and 15, assuming that the common stock is to be credited with the stated value.

(Essay)

4.9/5  (38)

(38)

Showing 81 - 100 of 171

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)