Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk

Exam 1: The Equity Method of Accounting for Investments119 Questions

Exam 2: Consolidation of Financial Information118 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition121 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership116 Questions

Exam 5: Consolidated Financial Statements - Intercompany Asset Transactions127 Questions

Exam 6: Intercompany Debt, Consolidated Statement of Cash Flows, and Other Issues114 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes117 Questions

Exam 8: Segment and Interim Reporting113 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 10: Translation of Foreign Currency Financial Statements97 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards60 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations83 Questions

Exam 14: Partnerships: Formation and Operation88 Questions

Exam 15: Partnerships: Termination and Liquidation70 Questions

Exam 16: Accounting for State and Local Governments78 Questions

Exam 17: Accounting for State and Local Governments51 Questions

Exam 18: Accounting for Not-For-Profit Organizations64 Questions

Exam 19: Accounting for Estates and Trusts80 Questions

Select questions type

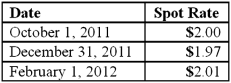

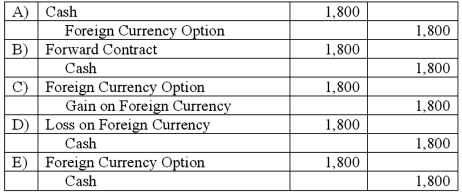

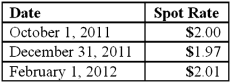

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:  What journal entry should Eagle prepare on October 1, 2011?

What journal entry should Eagle prepare on October 1, 2011?

(Multiple Choice)

4.8/5  (36)

(36)

A U.S. company sells merchandise to a foreign company denominated in the foreign currency. Which of the following statements is true?

(Multiple Choice)

4.8/5  (38)

(38)

Williams, Inc., a U.S. company, has a Japanese yen account receivable resulting from an export sale on March 1 to a customer in Japan. The exporter signed a forward contract on March 1 to sell yen and designated it as a cash flow hedge of a recognized receivable. The spot rate was $.0094, and the forward rate was $.0095. Which of the following did the U.S. exporter report in net income?

(Multiple Choice)

4.8/5  (44)

(44)

On October 1, 2011, Jarvis Co. sold inventory to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection is expected in four months. On October 1, 2011, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2012) and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows:  The company's borrowing rate is 12%. The present value factor for one month is .9901.

Any discount or premium on the contract is amortized using the straight-line method.

Assuming this is a cash flow hedge; prepare journal entries for this sales transaction and forward contract.

The company's borrowing rate is 12%. The present value factor for one month is .9901.

Any discount or premium on the contract is amortized using the straight-line method.

Assuming this is a cash flow hedge; prepare journal entries for this sales transaction and forward contract.

(Essay)

4.9/5  (43)

(43)

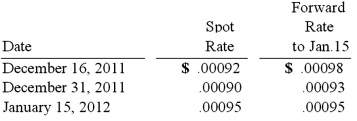

Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2011, with payment of 10 million Korean won to be received on January 15, 2012. The following exchange rates applied:  Assuming a forward contract was entered into, what would be the net impact on Car Corp.'s 2011 income statement related to this transaction? Assume an annual interest rate of 12% and a fair value hedge. The present value for one month at 12% is .9901.

Assuming a forward contract was entered into, what would be the net impact on Car Corp.'s 2011 income statement related to this transaction? Assume an annual interest rate of 12% and a fair value hedge. The present value for one month at 12% is .9901.

(Multiple Choice)

4.8/5  (38)

(38)

For each of the following situations, select the best answer concerning accounting for foreign currency transactions:

(G) Results in a foreign exchange gain.

(L) Results in a foreign exchange loss.

(N) No foreign exchange gain or loss.

_____1. Export sale by a U.S. company denominated in dollars, foreign currency of buyer appreciates.

_____2. Export sale by a U.S. company denominated in foreign currency, foreign currency of buyer appreciates.

_____3. Import purchase by a U.S. company denominated in foreign currency, foreign currency of buyer appreciates.

_____4. Import purchase by a U.S. company denominated in dollars, foreign currency of buyer appreciates.

_____5. Import purchase by a U.S. company denominated in foreign currency, foreign currency of buyer depreciates.

_____6. Import purchase by a U.S. company denominated in dollars, foreign currency of buyer depreciates.

_____7. Export sale by a U.S. company denominated in dollars, foreign currency of buyer depreciates.

_____8. Export sale by a U.S. company denominated in foreign currency, foreign currency of buyer depreciates.

(Short Answer)

4.8/5  (31)

(31)

Which of the following statements is true concerning hedge accounting?

(Multiple Choice)

4.7/5  (35)

(35)

Which of the following approaches is used in the United States in accounting for foreign currency transactions?

(Multiple Choice)

4.8/5  (43)

(43)

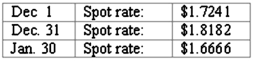

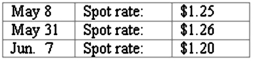

Norton Co., a U.S. corporation, sold inventory on December 1, 2011, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:  For what amount should Sales be credited on December 1?

For what amount should Sales be credited on December 1?

(Multiple Choice)

4.8/5  (33)

(33)

A company has a discount on a forward contract for a foreign currency denominated asset. How is the discount recognized over the life of the contract under fair value hedge accounting?

(Multiple Choice)

4.8/5  (26)

(26)

A U.S. company buys merchandise from a foreign company denominated in the foreign currency. Which of the following statements is true?

(Multiple Choice)

4.9/5  (33)

(33)

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of Adjustment to Accumulated Other Comprehensive Income for 2012 from these transactions?

What is the amount of Adjustment to Accumulated Other Comprehensive Income for 2012 from these transactions?

(Multiple Choice)

4.9/5  (35)

(35)

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of option expense for 2012 from these transactions?

What is the amount of option expense for 2012 from these transactions?

(Multiple Choice)

4.7/5  (31)

(31)

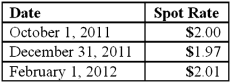

Brisco Bricks purchases raw material from its foreign supplier, Bolivian Clay, on May 8. Payment of 2,000,000 foreign currency units (FC) is due in 30 days. May 31 is Brisco's fiscal year-end. The pertinent exchange rates were as follows:  How much Foreign Exchange Gain or Loss should Brisco record on May 31?

How much Foreign Exchange Gain or Loss should Brisco record on May 31?

(Multiple Choice)

4.8/5  (36)

(36)

A U.S. company sells merchandise to a foreign company denominated in U.S. dollars. Which of the following statements is true?

(Multiple Choice)

4.8/5  (40)

(40)

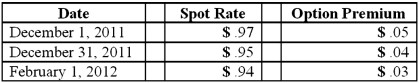

On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD). Collection of the receivable is due on February 1, 2012. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2011. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:  Compute the U.S. dollars received on February 1, 2012.

Compute the U.S. dollars received on February 1, 2012.

(Multiple Choice)

4.8/5  (35)

(35)

When a U.S. company purchases parts from a foreign company, which of the following will result in zero foreign exchange gain or loss?

(Multiple Choice)

4.7/5  (36)

(36)

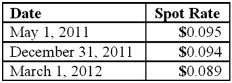

On May 1, 2011, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2012. On May 1, 2011, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2012 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2011. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

(Multiple Choice)

4.9/5  (29)

(29)

Showing 41 - 60 of 93

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)