Exam 4: Completing the Accounting Cycle

Exam 1: Introduction to Accounting and Business185 Questions

Exam 2: Analyzing Transactions212 Questions

Exam 3: The Adjusting Process169 Questions

Exam 4: Completing the Accounting Cycle193 Questions

Exam 5: Accounting for Merchandising Businesses219 Questions

Exam 6: Inventories163 Questions

Exam 7: Sarbanes-Oxley, internal Control, and Cash175 Questions

Exam 8: Receivables145 Questions

Exam 9: Fixed Assets and Intangible Assets174 Questions

Exam 10: Current Liabilities and Payroll171 Questions

Exam 11: Corporations: Organization, stock Transactions, and Dividends169 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes183 Questions

Exam 13: Investments and Fair Value Accounting127 Questions

Exam 14: Statement of Cash Flows160 Questions

Exam 15: Financial Statement Analysis183 Questions

Select questions type

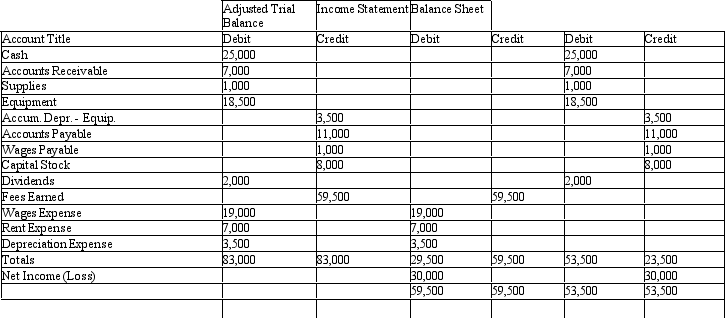

Marcus Enterprises began in 2011 when Damien Marcus invested $8,000 in exchange for capital stock.The following is the work sheet for the company at the end of the first year in business.

Marcus Enterprises

Work Sheet

For the Year Ended December 31,2011

Prepare an income statement,retained earnings statement,and classified balance sheet for Marcus Enterprises for the year ended December 31,2011.

Prepare an income statement,retained earnings statement,and classified balance sheet for Marcus Enterprises for the year ended December 31,2011.

(Essay)

5.0/5  (42)

(42)

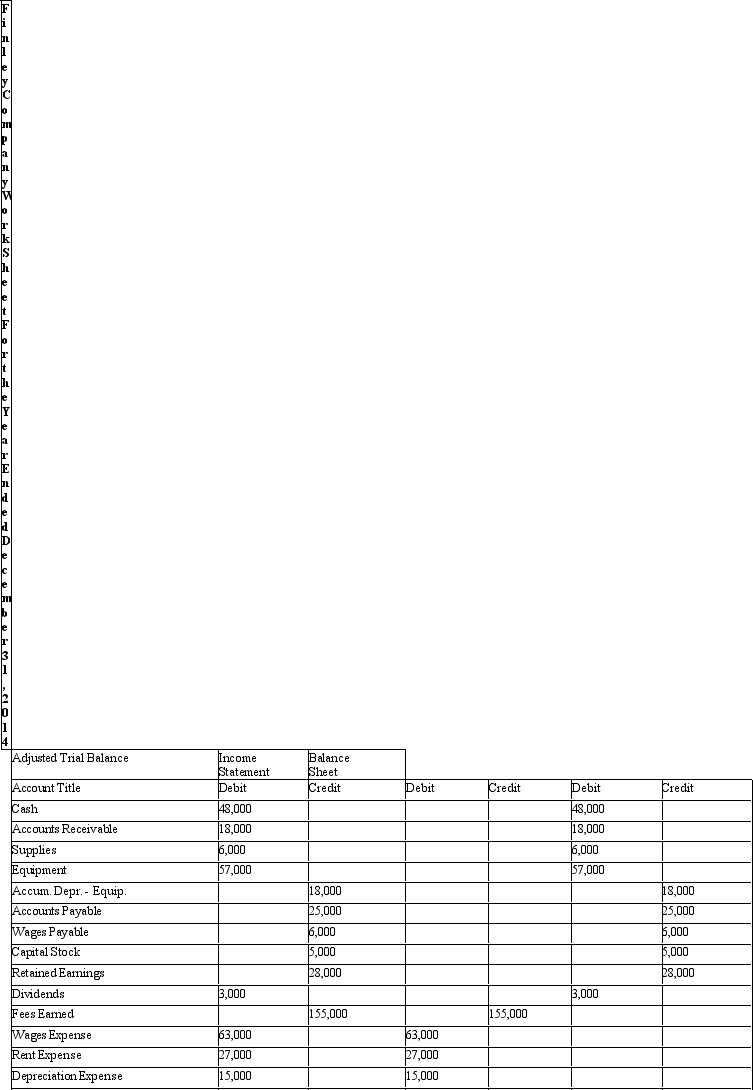

Use the work sheet for Finley Company to answer the questions that follow.

The entry to close expenses would be

The entry to close expenses would be

(Multiple Choice)

4.8/5  (39)

(39)

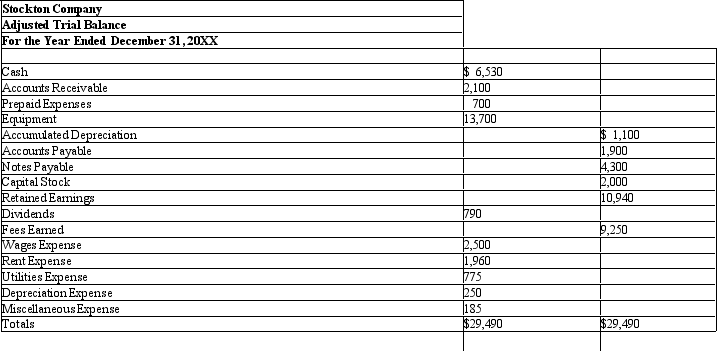

Use the information in the adjusted trial balance for Stockton Company to answer the questions that follow.

Determine the net income (loss)for the period.

Determine the net income (loss)for the period.

(Multiple Choice)

4.7/5  (31)

(31)

The post-closing trial balance differs from the adjusted trial balance in that it

(Multiple Choice)

4.9/5  (39)

(39)

After all of the account balances have been extended to the Balance Sheet columns of the work sheet,the totals of the debit and credit columns show debits of $37,686 and the credits of $41,101.This indicates that

(Multiple Choice)

4.7/5  (49)

(49)

A post-closing trial balance contains only asset and liability accounts.

(True/False)

4.9/5  (39)

(39)

Unearned revenues that will be earned in a relatively short period of time are listed on the balance sheet as current assets.

(True/False)

4.9/5  (41)

(41)

The amount of the net income for a period appears on both the income statement and the balance sheet for that period.

(True/False)

4.8/5  (26)

(26)

Amir Designs purchased a one-year liability insurance policy on March 1st of this year for $7,200 and recorded it as a prepaid expense.Which of the following amounts would be recorded for insurance expense during the adjusting process at the end of Amir's first month of operations on March 31st?

(Multiple Choice)

4.9/5  (25)

(25)

The income statement is prepared from the adjusted trial balance or the income statement columns on the work sheet.

(True/False)

4.9/5  (45)

(45)

Which of the following accounts will not be closed to Income Summary at the end of the fiscal year?

(Multiple Choice)

4.9/5  (36)

(36)

When preparing the retained earnings statement,the beginning retained earnings balance can always be found

(Multiple Choice)

4.8/5  (33)

(33)

A fiscal year that ends when business activities have reached their lowest point is called the natural business year.

(True/False)

4.8/5  (48)

(48)

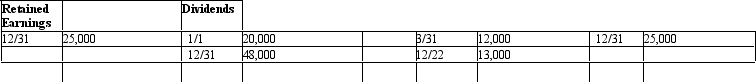

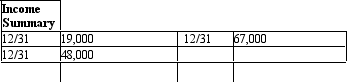

Selected ledger accounts appear below for Fulton Surveying Services for 2014.

Prepare a retained earnings statement.

Prepare a retained earnings statement.

(Essay)

4.9/5  (35)

(35)

Showing 81 - 100 of 193

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)