Exam 6: Inventories

Exam 1: Introduction to Accounting and Business194 Questions

Exam 2: Analyzing Transactions222 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle196 Questions

Exam 5: Accounting for Merchandising Businesses221 Questions

Exam 6: Inventories167 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash174 Questions

Exam 8: Receivables147 Questions

Exam 9: Fixed Assets and Intangible Assets175 Questions

Exam 10: Current Liabilities and Payroll172 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends168 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 13: Investments and Fair Value Accounting137 Questions

Exam 14: Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis184 Questions

Select questions type

If Beginning Inventory (BI) + Purchases (P) - Ending Inventory (EI) = Cost of Goods Sold (COGS), an equivalent equation can be written as?

(Multiple Choice)

4.8/5  (37)

(37)

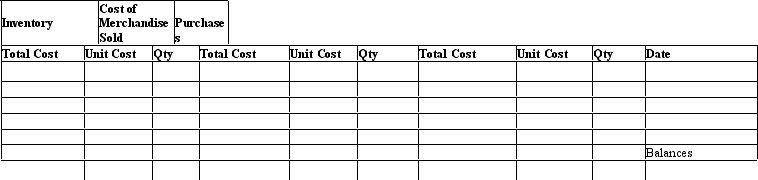

Beginning inventory, purchases and sales data for widgets are as follows:

Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of merchandise sold and ending inventory using FIFO.

Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of merchandise sold and ending inventory using FIFO.

(Essay)

4.8/5  (33)

(33)

A consignor who has goods out on consignment with an agent should include the goods in ending inventory even though they are in the possession of the consignor.

(True/False)

5.0/5  (49)

(49)

Generally, the lower the number of days' sales in inventory, the better.

(True/False)

4.9/5  (34)

(34)

The average cost inventory method is the rarely used with a perpetual inventory system.

(True/False)

4.7/5  (34)

(34)

Which of the following is not an example for safeguarding inventory?

(Multiple Choice)

4.7/5  (39)

(39)

Garrison Company uses the retail method of inventory costing. They started the year with an inventory that had a retail cost of $45,000. During the year they purchased an inventory with a retail cost of $300,000. After performing a physical inventory, they calculated their inventory cost at retail to be $80,000. The mark up is 100% of cost. Determine the ending inventory at its estimated cost.

(Multiple Choice)

4.8/5  (36)

(36)

When using the FIFO inventory costing method, the most recent costs are assigned to the cost of goods sold.

(True/False)

4.9/5  (36)

(36)

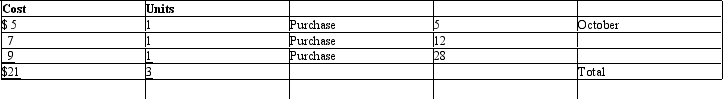

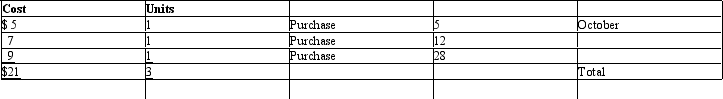

Assume that three identical units of merchandise are purchased during October, as follows:

Assume one unit is sold on October 31 for $15. Determine Cost of Merchandise Sold, Gross Profit, and Ending Inventory under the LIFO method.

Assume one unit is sold on October 31 for $15. Determine Cost of Merchandise Sold, Gross Profit, and Ending Inventory under the LIFO method.

(Essay)

4.7/5  (43)

(43)

Inventory errors, if not discovered, will self-correct in two years.

(True/False)

4.9/5  (34)

(34)

Merchandise inventory at the end of the year is overstated. Which of the following statements correctly states the effect of the error?

(Multiple Choice)

4.9/5  (43)

(43)

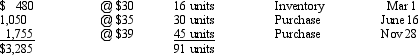

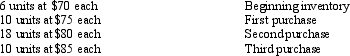

The units of Manganese Plus available for sale during the year were as follows:

There are 15 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the difference in gross profit between the LIFO and FIFO inventory cost systems.

There are 15 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the difference in gross profit between the LIFO and FIFO inventory cost systems.

(Essay)

4.8/5  (30)

(30)

The three inventory costing methods will normally each yield different amounts of net income.

(True/False)

4.9/5  (35)

(35)

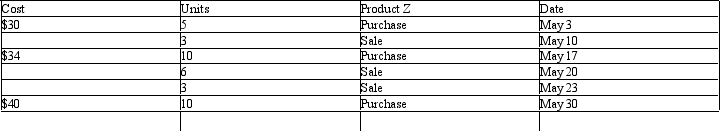

Use the following information to answer the following questions. The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

Assuming that the company uses the perpetual inventory system, determine the Gross Profit for the month of May using the LIFO cost method.

Assuming that the company uses the perpetual inventory system, determine the Gross Profit for the month of May using the LIFO cost method.

(Multiple Choice)

4.9/5  (39)

(39)

Assume that three identical units of merchandise are purchased during October, as follows:

Assume one unit is sold on October 31 for $15. Determine Cost of Merchandise Sold, Gross profit, and Ending Inventory under the FIFO method.

Assume one unit is sold on October 31 for $15. Determine Cost of Merchandise Sold, Gross profit, and Ending Inventory under the FIFO method.

(Essay)

4.9/5  (43)

(43)

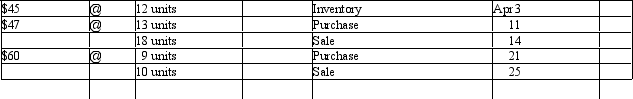

The beginning inventory and purchases of an item for the period were as follows:

The company uses the periodic system, and there were 15 units in the inventory at the end of the period. Determine the cost of the 15 units in the inventory by each of the following methods, presenting details of your computations: (a) first-in, first-out; (b) last-in, first-out; (c) average cost.

The company uses the periodic system, and there were 15 units in the inventory at the end of the period. Determine the cost of the 15 units in the inventory by each of the following methods, presenting details of your computations: (a) first-in, first-out; (b) last-in, first-out; (c) average cost.

(Essay)

4.7/5  (24)

(24)

When using a perpetual inventory system, the journal entry to record the cost of merchandise sold is:

(Multiple Choice)

4.8/5  (30)

(30)

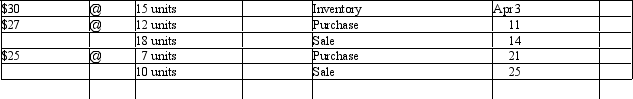

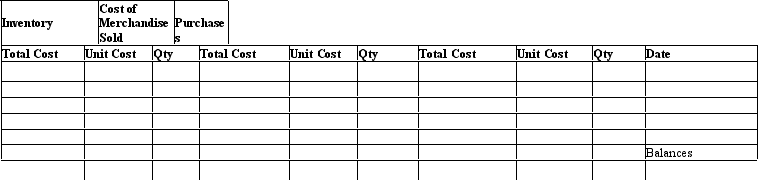

Beginning inventory, purchases and sales data for tennis rackets are as follows:

Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of merchandise sold and ending inventory using FIFO.

Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of merchandise sold and ending inventory using FIFO.

(Essay)

4.9/5  (34)

(34)

During the taking of its physical inventory on December 31, 2010, Barry's Bike Shop incorrectly counted its inventory as $270,000 instead of the correct amount of $190,000. The effect on the balance sheet and income statement would be as follows:

(Multiple Choice)

4.9/5  (32)

(32)

One of the two internal control procedures over inventory is to properly report inventory on the financial statements.

(True/False)

5.0/5  (38)

(38)

Showing 41 - 60 of 167

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)