Exam 4: Completing the Accounting Cycle

Exam 1: Introduction to Accounting and Business194 Questions

Exam 2: Analyzing Transactions222 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle196 Questions

Exam 5: Accounting for Merchandising Businesses221 Questions

Exam 6: Inventories167 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash174 Questions

Exam 8: Receivables147 Questions

Exam 9: Fixed Assets and Intangible Assets175 Questions

Exam 10: Current Liabilities and Payroll172 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends168 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 13: Investments and Fair Value Accounting137 Questions

Exam 14: Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis184 Questions

Select questions type

The work sheet at the end of July has $5,350 in the Balance Sheet credit column for Accumulated Depreciation. The work sheet at the end of August has $6,700 in the Balance Sheet credit column for Accumulated Depreciation. What was the amount of the depreciation expense adjustment for the month of August?

(Multiple Choice)

4.8/5  (36)

(36)

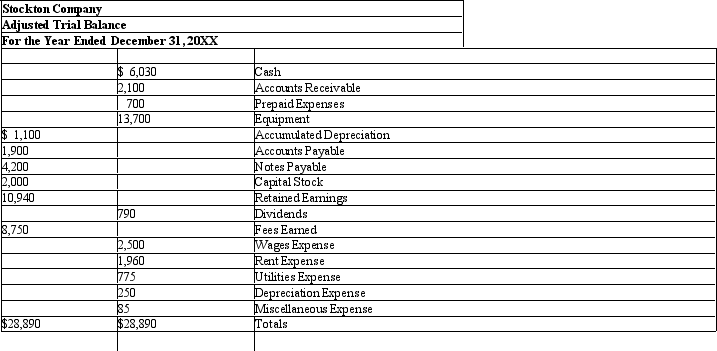

Use the information in the adjusted trial balance for Stockton Company to answer the questions that follow.  Determine the total liabilities for the period.

Determine the total liabilities for the period.

(Multiple Choice)

4.8/5  (42)

(42)

During the closing process, some balance sheet accounts are closed and end the period with a zero balance.

(True/False)

4.8/5  (32)

(32)

Since the adjustments are entered on the work sheet, it is necessary to record them in the journal or post them to the ledger.

(True/False)

4.7/5  (29)

(29)

The following are steps in the accounting cycle. Of the following, which would be prepared last?

(Multiple Choice)

4.8/5  (39)

(39)

Identify which of the following accounts should be closed to Income Summary at the end of the fiscal year. Record next to each account:

a (Y) for YES, it should be closed to Income Summary; OR

an (N) for NO, it would not be closed to Income Summary.

1. Utilities Payable

2. Utilities Expense

3. Supplies

4. Supplies Expense

5. Fees Earned

6. Unearned Fees

7. Accounts Receivable

8. Dividends

9. Retained Earnings

10. Accumulated Depreciation - Equipment

11. Depreciation Expense - Equipment

12. Equipment

13. Prepaid Insurance

14. Insurance Expense

(Essay)

4.8/5  (37)

(37)

After net income is entered on the work sheet, the Balance Sheet Debit and Credit columns must

(Multiple Choice)

4.7/5  (38)

(38)

The totals of the Adjusted Trial Balance columns on a work sheet will always be the sum of the Trial Balance column totals and the Adjustments column totals.

(True/False)

4.9/5  (40)

(40)

After all of the account balances have been extended to the Balance Sheet columns of the work sheet, the totals of the debit and credit columns show debits of $36,678 and the credits of $41,101. This indicates that

(Multiple Choice)

4.9/5  (41)

(41)

The end-of-period spreadsheet (work sheet) for the current year for Jamal Company shows Balance Sheet columns with a debit total of $630,430 and a credit total of $614,210. This is before the amount for net income or net loss has been included. In preparing the income statement from work sheet, what is the amount of net income or net loss?

(Short Answer)

4.9/5  (40)

(40)

The following are all the steps in the accounting cycle. List them in the order in which they should be done.

- Closing entries are journalized and posted to the ledger.

- An unadjusted trial balance is prepared.

- An optional end-of-period spreadsheet (work sheet) is prepared.

- A post-closing trial balance is prepared.

- Adjusting entries are journalized and posted to the ledger.

- Transactions are analyzed and recorded in the journal.

- Adjustment data are assembled and analyzed.

- Financial statements are prepared.

- An adjusted trial balance is prepared.

- Transactions are posted to the ledger.

(Essay)

4.8/5  (35)

(35)

The post-closing trial balance differs from the adjusted trial balance in that it

(Multiple Choice)

5.0/5  (36)

(36)

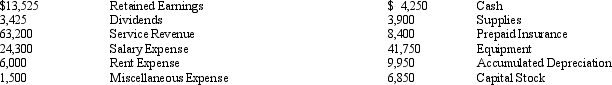

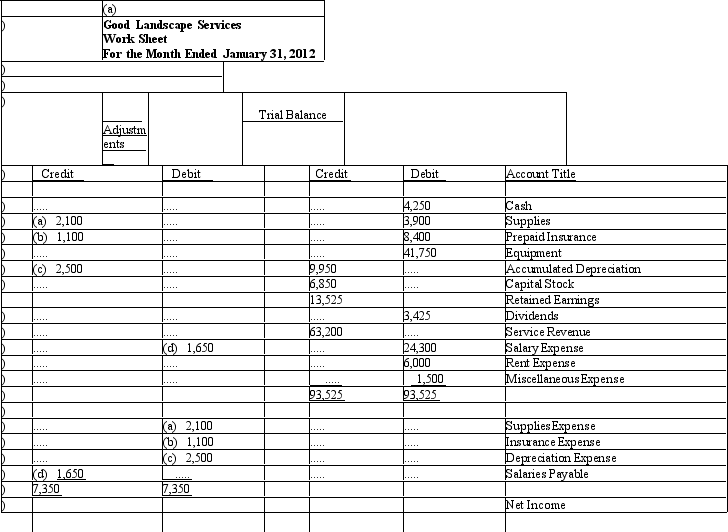

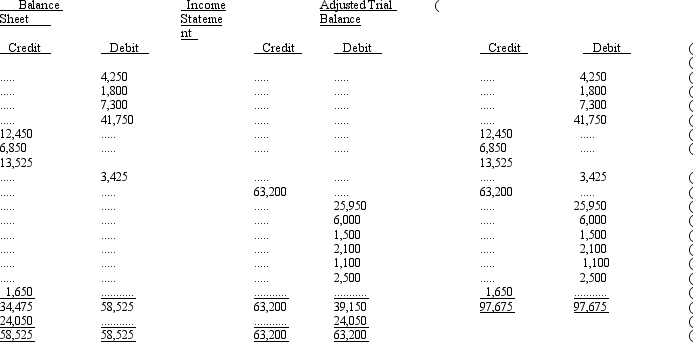

The balances in the ledger of Good Landscape Services as of January 31, 2012 before adjustments are as follows:

Adjustment data are as follows: supplies on hand, January 31, $1,800; insurance expired for January, $1,100; depreciation on equipment for January, $2,500; salaries accrued, January 31, $1,650.

Adjustment data are as follows: supplies on hand, January 31, $1,800; insurance expired for January, $1,100; depreciation on equipment for January, $2,500; salaries accrued, January 31, $1,650.

(Essay)

5.0/5  (34)

(34)

Round tripping is a fraudulent scheme where business A artificially inflates revenue by lending money to customer B who uses that money to buy products from

A.

(True/False)

4.9/5  (37)

(37)

Which account would not appear in the Balance Sheet columns of the work sheet?

(Multiple Choice)

4.9/5  (38)

(38)

Explain how net income or loss is determined by using the work sheet.

(Essay)

4.9/5  (43)

(43)

There is really benefit in preparing financial statements in any particular order.

(True/False)

4.9/5  (41)

(41)

Showing 101 - 120 of 196

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)