Exam 21: The Statement of Cash Flows Revisited

Exam 1: Environment and Theoretical Structure of Financial Accounting181 Questions

Exam 2: Review of the Accounting Process 139 Questions

Exam 3: The Balance Sheet and Financial Disclosures168 Questions

Exam 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows178 Questions

Exam 5: Revenue Recognition316 Questions

Exam 6: Time Value of Money Concepts126 Questions

Exam 7: Cash and Receivables187 Questions

Exam 8: Inventories: Measurement182 Questions

Exam 9: Inventories: Additional Issues153 Questions

Exam 10: Property, Plant, and Equipment and Intangible Assets: Acquisition149 Questions

Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Disposition223 Questions

Exam 12: Investments183 Questions

Exam 13: Current Liabilities and Contingencies155 Questions

Exam 14: Bonds and Long-Term Notes256 Questions

Exam 15: Leases262 Questions

Exam 16: Accounting for Income Taxes176 Questions

Exam 17: Pensions and Other Postretirement Benefits246 Questions

Exam 20: Accounting Changes and Error Corrections152 Questions

Exam 21: The Statement of Cash Flows Revisited192 Questions

Select questions type

Each year, White Mountain Enterprises (WME) prepares a reconciliation schedule that compares its income statement with its statement of cash flows on both the direct and indirect method bases. In its 2018 income statement, WME reported $58,000 for insurance expense. WME paid $72,000 in insurance premiums during 2018. In its reconciliation schedule, WME should:

(Multiple Choice)

4.8/5  (34)

(34)

Partial balance sheets and additional information are listed below for Sowell Company. Sowell Company

Partial Balance Sheets

as of December 31

Assets 2018 2017 Cash \ 40,000 \ 20,000 Accounts receivable 70,000 85,000 Inventory 40,000 35,000 Liabilities Accounts payable \ 54,000 \ 62,000 Additional information for 2018:

Net income was $88,000.

Depreciation expense was $19,000.

Required:

Prepare the operating activities section of the statement of cash flows for 2018 using the indirect method.

(Essay)

4.9/5  (41)

(41)

A loss on the sale of machinery should be reported in the statement of cash flows as:

(Multiple Choice)

4.7/5  (30)

(30)

In a statement of cash flows in which operating activities are reported by the direct method, which of the following would increase reported cash flows from operating activities?

(Multiple Choice)

4.9/5  (47)

(47)

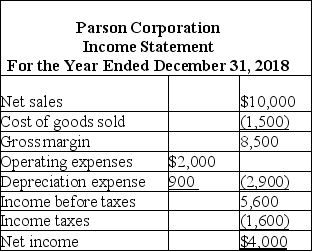

Following are the income statement and some additional information for Parson Corporation for 2018.  All sales were on credit and accounts receivable increased by $600 in 2018 compared to 2017. Merchandise purchases were on credit with an increase in accounts payable of $400 during the year. Ending inventory was $500 larger than beginning inventory. Income taxes payable increased $300 during the year. All operating expenses were paid for in cash.

Required:

Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method.

All sales were on credit and accounts receivable increased by $600 in 2018 compared to 2017. Merchandise purchases were on credit with an increase in accounts payable of $400 during the year. Ending inventory was $500 larger than beginning inventory. Income taxes payable increased $300 during the year. All operating expenses were paid for in cash.

Required:

Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method.

(Essay)

4.8/5  (42)

(42)

Indicate the reporting classification that would apply to each of the following transactions

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (43)

(43)

What activities are included in the statement of cash flows under the section titled "Cash flows from investing activities"?

(Essay)

4.7/5  (35)

(35)

In a statement of cash flows using the indirect method, an increase in the available-for-sale debt securities account due to an increase in the debt's fair value should be reported as:

(Multiple Choice)

4.8/5  (35)

(35)

If bond interest expense is $800,000, bond interest payable increased by $8,000 and bond discount decreased by $2,000, cash paid for bond interest is:

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following is reported as a financing activity in the statement of cash flows?

(Multiple Choice)

4.7/5  (41)

(41)

Each year, White Mountain Enterprises (WME) prepares a reconciliation schedule that compares its income statement with its statement of cash flows on both the direct and indirect method bases. In its 2018 income statement, WME reported a $40,000 loss on the sale of equipment. In its reconciliation schedule, WME should:

(Multiple Choice)

4.9/5  (35)

(35)

Creble Company reported net income for 2018 in the amount of $40,000. The company's financial statements also included the following: Increase in accounts receivable \4 ,000 Decrease in inventory 2,000 Depreciation expense 3,000 Gain on sale of equipment 5,000

In the statement of cash flows what is net cash provided by operating activities under the indirect method?

(Multiple Choice)

4.8/5  (40)

(40)

The accounting records of Westlake Industries provided the data below. Net income \ 200,000 Depreciation expense 15,000 Decrease in inventory 12,000 Increase in accounts receivable 1,400 Increase in interest payable 1,600 Amortization of bond discount 3,000 Increase in accounts payable 7,000 Cash dividends paid 20,000 Required:

Prepare a reconciliation of net income to net cash flows from operating activities.

(Essay)

4.7/5  (34)

(34)

Which of the following is reported as an operating activity in the statement of cash flows?

(Multiple Choice)

4.8/5  (34)

(34)

Charlene Company sold a printer with a cost of $68,000 and accumulated depreciation of $23,000 for $20,000 cash. This transaction would be reported as:

(Multiple Choice)

4.8/5  (26)

(26)

On December 31, 2018, Wellstone Company reported net income of $70,000 and sales of $210,000. The company also reported beginning and ending accounts receivable at $20,000 and $25,000, respectively. Wellstone will report cash collected from customers in its 2018 statement of cash flows (direct method) in the amount of:

(Multiple Choice)

4.9/5  (38)

(38)

In preparing its cash flow statement for the year ended December 31, 2018, Red Co. gathered the following data: Gain on sale of land \1 2,000 Proceeds from sale of land 20,000 Purchase of Blue, Inc., bonds (facevalue \ 200,000 ) 360,000 Amortization of bond discount 4,000 Cash dividends declared 90,000 Cash dividends paid 76,000 Proceeds from sales of Red Co. common stock 150,000

In its December 31, 2018, statement of cash flows, what amount should Red report as net cash outflows from investing activities?

(Multiple Choice)

4.8/5  (36)

(36)

Moon Company owns 56 million shares of stock as a long-term investment in Center Company and Moon does not have significant influence over Center. During 2018, the fair value of those shares increased by $34 million. What effect does this increase have on Moon's 2018 adjustments in the statement of cash flows?

(Multiple Choice)

4.8/5  (42)

(42)

Generally speaking, cash flows from operating activities include the elements of net income reported on a cash basis.

(True/False)

4.9/5  (39)

(39)

Showing 81 - 100 of 192

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)