Exam 21: The Statement of Cash Flows Revisited

Exam 1: Environment and Theoretical Structure of Financial Accounting181 Questions

Exam 2: Review of the Accounting Process 139 Questions

Exam 3: The Balance Sheet and Financial Disclosures168 Questions

Exam 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows178 Questions

Exam 5: Revenue Recognition316 Questions

Exam 6: Time Value of Money Concepts126 Questions

Exam 7: Cash and Receivables187 Questions

Exam 8: Inventories: Measurement182 Questions

Exam 9: Inventories: Additional Issues153 Questions

Exam 10: Property, Plant, and Equipment and Intangible Assets: Acquisition149 Questions

Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Disposition223 Questions

Exam 12: Investments183 Questions

Exam 13: Current Liabilities and Contingencies155 Questions

Exam 14: Bonds and Long-Term Notes256 Questions

Exam 15: Leases262 Questions

Exam 16: Accounting for Income Taxes176 Questions

Exam 17: Pensions and Other Postretirement Benefits246 Questions

Exam 20: Accounting Changes and Error Corrections152 Questions

Exam 21: The Statement of Cash Flows Revisited192 Questions

Select questions type

In preparation for developing its statement of cash flows for the year just ended, D-Rose Distributors collected the following information: \ in millions) Purchase of treasury bills (considered a cash equivalent) 6 Sale of preferred stock 150 Gain on sale of land 4 Proceeds from sale of land 25 Issuance of bonds payable for cash 140 Purchase of equipment for cash 30 Purchase of GE stock 35 Declaration of cash dividends 134 Payment of cash dividends declared in previous year 130 Purchase of treasury stock 120 Payment for the early extinguishment of long-term notes (carrying (book) value: \1 00 million) 110 Required:

1. Prepare the investing activities section of D-Rose's statement of cash flows.

2. Prepare the financing activities section of D-Rose's statement of cash flows.

(Essay)

4.8/5  (39)

(39)

Listed below are the reporting classifications for a statement of cash flows using the direct method for reporting operating cash flows. Match the reporting classifications with the transactions described below.

-Financing cash inflow

(Multiple Choice)

4.7/5  (36)

(36)

Do the statement of cash flows and its related disclosure note report only transactions that cause an increase or decrease in cash? Explain.

(Essay)

4.8/5  (45)

(45)

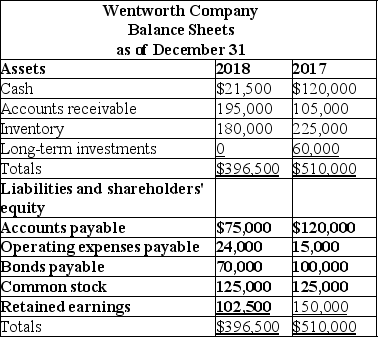

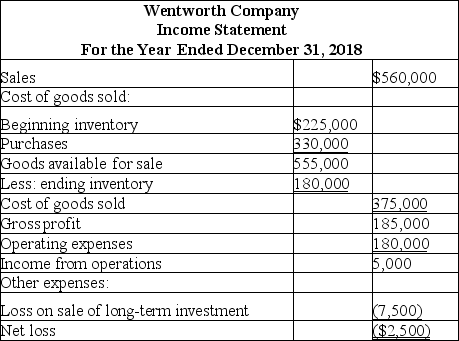

The following are comparative balance sheets and an income statement for Wentworth Company.

Cash dividends of $45,000 were paid in 2018.

Required:

Prepare a statement of cash flows for 2018 using the direct method.

Cash dividends of $45,000 were paid in 2018.

Required:

Prepare a statement of cash flows for 2018 using the direct method.

(Essay)

4.8/5  (32)

(32)

Partial balance sheets and additional information are listed below for Julius Company. Julius Company

Partial Balance Sheets

as of December 31

Assets 2018 2017 Cash \ 20,000 \ 40,000 Accounts receivable 90,000 60,000 Inventory 40,000 25,000 Accounts payable \ 72,000 \ 58,000 Additional information for 2018:

Net income was $70,000.

Depreciation expense was $30,000.

Sales totaled $600,000.

Cost of goods sold totaled $325,000.

Required:

Prepare the summary entry for the amount of cash received from customers during 2018.

(Essay)

4.8/5  (30)

(30)

If sales revenue is $80 million and accounts receivable increased by $12 million, the amount of cash received from customers:

(Multiple Choice)

4.8/5  (39)

(39)

Interest payments on debt are classified as cash outflows from financing activities.

(True/False)

4.8/5  (38)

(38)

Indicate the reporting classification that would apply to each of the following transactions

Correct Answer:

Premises:

Responses:

(Matching)

5.0/5  (29)

(29)

Which of the following is reported as an operating activity in the statement of cash flows?

(Multiple Choice)

4.9/5  (40)

(40)

Sales revenue is $100,000. Accounts receivable increased by $2,000. Cash received from customers is:

(Multiple Choice)

4.9/5  (38)

(38)

An analyst compiled the following information for U Inc. for the year ended December 31, 2018: Net income was $1,700,000.

Depreciation expense was $400,000.

Interest paid was $200,000.

Income taxes paid were $100,000.

Common stock was sold for $200,000.

Preferred stock (8% annual dividend) was sold at par value of $250,000.

Common stock dividends of $50,000 were paid.

Preferred stock dividends of $20,000 were paid.

Equipment with a book value of $100,000 was sold for $200,000.

Using the indirect method, what was U Inc.'s net cash flow from operating activities for the year ended December 31, 2018?

(Multiple Choice)

4.8/5  (31)

(31)

All of the following may qualify as cash equivalents except:

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following would be reported as a cash outflow from investing activities?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following does not represent a cash flow relating to operating activities?

(Multiple Choice)

4.8/5  (38)

(38)

Listed below are reporting classifications for a statement of cash flows using the indirect method for reporting operating cash flows. Match the reporting classifications with the transactions described below.

-Investing cash outflow

(Multiple Choice)

4.7/5  (37)

(37)

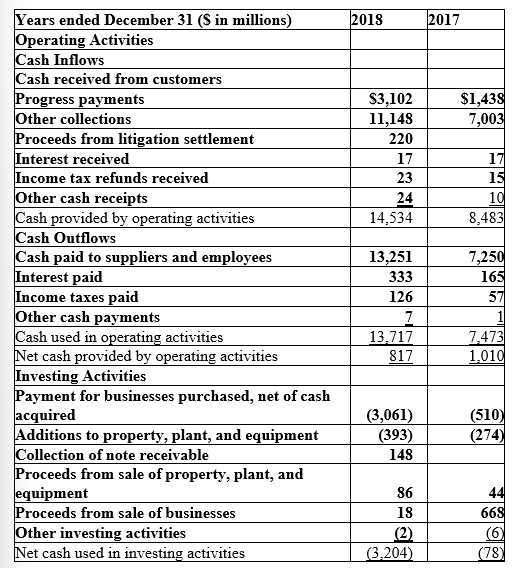

In its 2018 Annual Report to Shareholders, Henchman & Co. provided the following Statement of Cash Flows:

Years ended December 31 (\ in millions) 2018 2017 Financing Activities Proceeds from issuance of long-term debt 1,491 Proceeds from equity security units 690 Borrowings under lines of credit 1,173 Repayment of borrowings under lines of Credit (1,306) (175) Principal payments of long-term debt/lease agreements (119) (485) Proceeds from issuance of stock 825 19 Dividends paid (158) (114) Other financing activities - Net cash provided by (used in) financing activities 2,532 (755) Increase in cash and cash equivalents 145 177 Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year \

-What method (direct or indirect) does Henchman & Co. use to present its Statement of Cash Flows? Explain how you can determine which method is used.

Years ended December 31 (\ in millions) 2018 2017 Financing Activities Proceeds from issuance of long-term debt 1,491 Proceeds from equity security units 690 Borrowings under lines of credit 1,173 Repayment of borrowings under lines of Credit (1,306) (175) Principal payments of long-term debt/lease agreements (119) (485) Proceeds from issuance of stock 825 19 Dividends paid (158) (114) Other financing activities - Net cash provided by (used in) financing activities 2,532 (755) Increase in cash and cash equivalents 145 177 Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year \

-What method (direct or indirect) does Henchman & Co. use to present its Statement of Cash Flows? Explain how you can determine which method is used.

(Essay)

4.9/5  (32)

(32)

Ilene South Company owns 40% of the outstanding common stock of Ilene Wright Company. During the year, South received a $150 million cash dividend from Wright. What effect does this dividend have on South's statement of cash flows for the year?

(Multiple Choice)

4.9/5  (35)

(35)

The net income for Howie Doohan Corporation was $280 million for the year ended December 31, 2018. Related information follows: Sale of common stock for cash, $34 million.

Amortization of trademark, $2 million.

Cash dividends paid, $28 million.

Decrease in salaries payable, $2 million.

Depreciation expense, $40 million.

Increase in accounts payable, $18 million.

Increase in bonds payable, $26 million.

Net cash flows from operating activities during 2018 should be reported as:

(Multiple Choice)

4.7/5  (38)

(38)

Interest payments and interest received must be reported as operating cash flows using:

(Multiple Choice)

4.9/5  (36)

(36)

When one enters a $50,000 credit entry to the Land account in a spreadsheet for the statement of cash flows, it represents a negative change in that account and probably is due to selling such assets.

(True/False)

4.8/5  (31)

(31)

Showing 141 - 160 of 192

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)