Exam 22: Decentralization and Performance Evaluation

Exam 1: Introducing Accounting in Business262 Questions

Exam 2: Analyzing and Recording Transactions213 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements230 Questions

Exam 4: Accounting for Merchandising Operations195 Questions

Exam 5: Inventories and Cost of Sales199 Questions

Exam 6: Cash and Internal Controls197 Questions

Exam 7: Accounts and Notes Receivable163 Questions

Exam 8: Long-Term Assets202 Questions

Exam 9: Current Liabilities184 Questions

Exam 10: Long-Term Liabilities185 Questions

Exam 11: Corporate Reporting and Analysis209 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing Financial Statements184 Questions

Exam 14: Managerial Accounting Concepts and Principles202 Questions

Exam 15: Job Order Costing and Analysis153 Questions

Exam 16: Process Costing and Analysis185 Questions

Exam 17: Activity-Based Costing and Analysis173 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis177 Questions

Exam 19: Variable Costing and Performance Reporting175 Questions

Exam 20: Master Budgets and Performance Planning158 Questions

Exam 21: Flexible Budgets and Standard Costing177 Questions

Exam 22: Decentralization and Performance Evaluation128 Questions

Exam 23: Relevant Costing for Managerial Decisions136 Questions

Exam 24: Capital Budgeting and Investment Analysis139 Questions

Exam 25: Investments and International Operations168 Questions

Exam 26: Accounting for Partnerships126 Questions

Exam 27 Appendix : Accounting With Special Journals153 Questions

Select questions type

What is a transfer price and what methods are used to set its' value?

(Essay)

4.8/5  (33)

(33)

Expenses that are easily traced and assigned to a specific department because they are incurred for the sole benefit of that department are called:

(Multiple Choice)

4.8/5  (38)

(38)

A retail store has three departments, A, B, and C, each of which has four full-time employees. The store does general advertising that benefits all departments. Advertising expense totaled $90,000 for the current year, and departmental sales were: Department A \ 356,250 Department B 641,250 Department C 427,500

How much advertising expense should be allocated to each department?

(Essay)

4.9/5  (38)

(38)

The process of preparing departmental income statements starts with allocating service departments.

(True/False)

4.7/5  (34)

(34)

General Chemical produced 10,000 gallons of Greon and 20,000 gallons of Baron. Joint costs incurred in producing the two products totaled $7,500. At the split-off point, Greon has a market value of $6.00 per gallon and Baron $2.00 per gallon. What portion of the joint costs should be allocated to Greon if the basis is market value at point of separation?

(Multiple Choice)

4.9/5  (36)

(36)

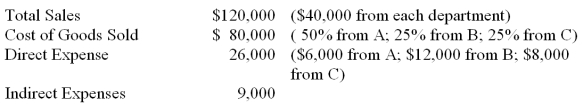

Vaughn Co. operates three separate departments (A, B, C). The data below are provided for the current year:  Required: Prepare an income statement showing the departmental contributions to overhead for the current year.

Required: Prepare an income statement showing the departmental contributions to overhead for the current year.

(Essay)

5.0/5  (38)

(38)

Assume Rock Bottom Golf is divided into four departments which operate as profit centers and that the data below is from the most recent fiscal year.

Golf Clubs Golf Bags Golf Balls Golf Apparel Sales \ 200,000 \ 400,000 \ 800,000 \ 1,600,000 Cost of Goods 90,000 220,000 400,000 960,000 Sold Direct Expenses Salaries 18,000 54,000 90,000 226,000 Insurance 2,000 3,000 6,000 120,000 Utilities 1,000 2,000 3,000 10,000

-Given the information above, which of Rock Bottom Golf's departments has the highest contribution margin as a percent of sales?

(Multiple Choice)

4.8/5  (42)

(42)

Mach Co. operates three manufacturing departments as profit centers. The following information is available for its most recent year:

Cost of Direct Indirect Dept. Sales Goods Sold Expenses Expenses 1 \ 1,000,000 \ 700,000 \ 100,000 \ 80,000 2 400,000 150,000 40,000 100,000 3 700,000 300,000 150,000 20,000

-Which department has the greatest departmental contribution to overhead and what is the amount contributed?

(Multiple Choice)

4.8/5  (31)

(31)

The Footwear Department of Lee's Department Store had sales of $188,000, cost of goods sold of $132,500, indirect expenses of $13,250, and direct expenses of $27,500 for the current period. The Footwear Department's contribution to overhead as a percent of sales is:

(Multiple Choice)

4.9/5  (36)

(36)

A cost center is a unit of a business that incurs costs but does not directly generate revenues. Which of the following would definitely not be considered a cost center?

(Multiple Choice)

4.9/5  (36)

(36)

Joint costs are a group of several costs incurred in producing or purchasing a single product.

(True/False)

4.8/5  (37)

(37)

Which of the following is an example of a performance measure of the customer perspective which would be found in a balanced scorecard?

(Multiple Choice)

4.8/5  (34)

(34)

A company produces two joint products (called 101 and 202) in a single operation that uses one raw material called Casko. Four hundred gallons of Casko were purchased at a cost of $800 and were used to produce 150 gallons of Product 101, selling for $5 per gallon, and 75 gallons of Product 202, selling for $15 per gallon. How much of the $800 cost should be allocated to each product, assuming that the company allocates cost based on sales revenue?

(Essay)

4.8/5  (42)

(42)

A responsibility accounting report that compares actual costs and expenses for a department with the budgeted amounts is called a(n):

(Multiple Choice)

4.7/5  (40)

(40)

In producing oat bran, the joint cost of milling the oats into bran, oatmeal, and animal feed is considered a direct cost to the oat bran, because the oat bran cannot be produced without incurring the joint cost.

(True/False)

4.7/5  (35)

(35)

Regardless of the system used in departmental cost analysis:

(Multiple Choice)

4.8/5  (31)

(31)

Bridgestreet, Inc. has three operating departments: Cutting, Assembling and Finishing. Cutting has 5,000 employees and occupies 15,000 square feet. Assembling has 4,000 employees and occupies 12,000 square feet. Finishing has 1,000 employees and occupies 23,000 square feet. Indirect factory costs for the current period were Administrative, $170,000 and Maintenance, $212,000. Administrative costs are allocated to operating departments based on the number of workers and maintenance costs are allocated to operating departments based on square footage occupied.

-Based on the above data, determine the administrative cost allocated to each operating department of Bridgestreet, Inc.

(A) Cutting: \ 70,666 Assembling: \ 70,666 Finishing: \ 70,666 (B) Cutting: \ 15,000 Assembling: \ 12,000 Finishing: \ 23,000 (C) Cutting: \ 63,600 Assembling: \ 50,880 Finishing: \ 97,520 (D) Cutting: \ 127,333 Assembling: \ 127,333 Finishing: \ 127,333 (E) Cutting: \ 115,000 Assembling: \ 91,680 Finishing: \ 175,720

(Multiple Choice)

4.9/5  (41)

(41)

A company manufactures two products, X and Y, from a single raw material called ZZ. ZZ is purchased in 55-gallon drums, and the contents of one drum are sufficient to produce 30 gallons of X and 15 gallons of Y. X sells for $10.00 per gallon and Y sells for $30.00 per gallon. During the current period, the company used 400 drums of ZZ to manufacture X and Y. The cost of ZZ was $90 per drum.

Required:

(1) If the cost of ZZ is allocated to the X and Y products on the basis of the number of gallons produced, how much of the total cost of the 400 drums should be charged to each product?

(2) If the cost of ZZ is allocated to the X and Y products in proportion to their market values, how much of the total cost of the 400 drums should be charged to each product?

(3) Which basis of allocating the cost is most likely to be used by the company?

Check one and briefly explain.

_______ The relative number of gallons of each product produced.

_______ The relative market values of each product at the point of separation.

(Essay)

5.0/5  (38)

(38)

Showing 81 - 100 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)