Exam 12: Reporting and Analyzing Cash Flows

Exam 1: Introducing Accounting in Business262 Questions

Exam 2: Analyzing and Recording Transactions213 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements230 Questions

Exam 4: Accounting for Merchandising Operations195 Questions

Exam 5: Inventories and Cost of Sales199 Questions

Exam 6: Cash and Internal Controls197 Questions

Exam 7: Accounts and Notes Receivable163 Questions

Exam 8: Long-Term Assets202 Questions

Exam 9: Current Liabilities184 Questions

Exam 10: Long-Term Liabilities185 Questions

Exam 11: Corporate Reporting and Analysis209 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing Financial Statements184 Questions

Exam 14: Managerial Accounting Concepts and Principles202 Questions

Exam 15: Job Order Costing and Analysis153 Questions

Exam 16: Process Costing and Analysis185 Questions

Exam 17: Activity-Based Costing and Analysis173 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis177 Questions

Exam 19: Variable Costing and Performance Reporting175 Questions

Exam 20: Master Budgets and Performance Planning158 Questions

Exam 21: Flexible Budgets and Standard Costing177 Questions

Exam 22: Decentralization and Performance Evaluation128 Questions

Exam 23: Relevant Costing for Managerial Decisions136 Questions

Exam 24: Capital Budgeting and Investment Analysis139 Questions

Exam 25: Investments and International Operations168 Questions

Exam 26: Accounting for Partnerships126 Questions

Exam 27 Appendix : Accounting With Special Journals153 Questions

Select questions type

The indirect method reports individual operating cash outflows and cash inflows by activity.

(True/False)

4.9/5  (38)

(38)

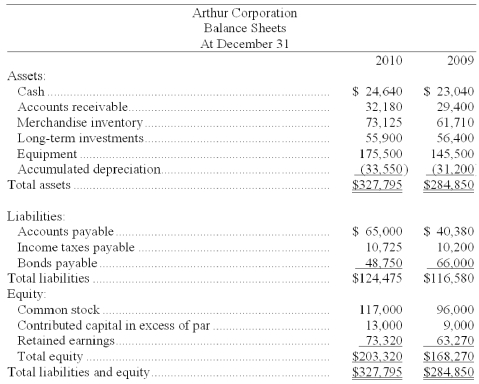

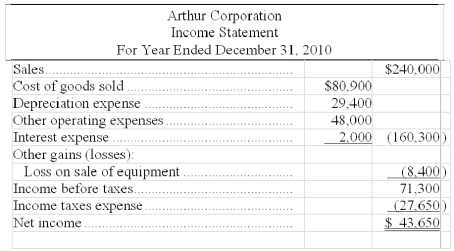

The following information is available for the Arthur Corporation:

Additional Information:

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3) New equipment was purchased for $67,550 cash.

(4) Cash dividends of $33,600 were paid.

(5) Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for the 2009 calendar year using the direct method.

(Essay)

4.8/5  (42)

(42)

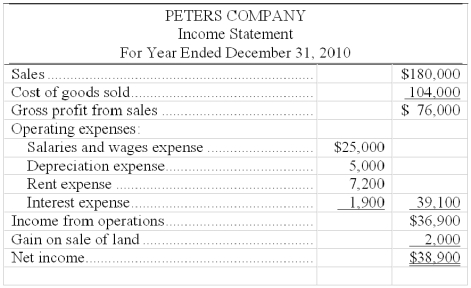

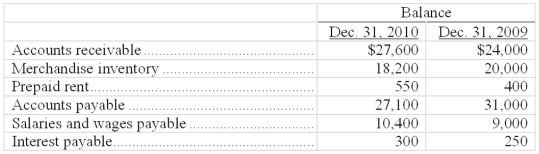

Use the following income statement and information about selected current assets and current liabilities to calculate the net cash provided or used by operating activities using the direct method.

Selected beginning and ending balances of current asset and current liability accounts, all of which relate to operating activities, are as follows:

Selected beginning and ending balances of current asset and current liability accounts, all of which relate to operating activities, are as follows:

(Essay)

4.9/5  (38)

(38)

A main purpose of the statement of cash flows is to report all the major cash ________ and cash _______________.

(Essay)

4.8/5  (41)

(41)

When preparing the operating section of the statement of cash flows using the indirect method, noncash expenses are _____________ net income.

(Short Answer)

4.9/5  (32)

(32)

Terri's accounts receivable increased during the year by $5.9 million. It had a bad debt expense of $1.4 million, and its allowance for uncollectible accounts increased by $2.4 million. What is the amount of cash Terri received from customers during the reporting period if its sales were $45.0 million?

(Short Answer)

4.8/5  (42)

(42)

Cash flow amounts and their timing should be examined when planning and analyzing operating activities.

(True/False)

4.9/5  (38)

(38)

Use the following information to calculate the net cash provided or used by financing activities for the Brooks Corporation:

(a) Net income, $10,000.

(b) Sold common stock for $4,000 cash.

(c) Paid cash dividend of $3,000.

(d) Paid bond payable, $8,000.

(e) Purchased equipment for $12,000 cash.

(Essay)

4.9/5  (35)

(35)

The purchase of long-term assets by issuing a note payable for the entire amount is reported on the statement of cash flows in the:

(Multiple Choice)

4.8/5  (40)

(40)

The FASB requires the reporting of cash flows per share as a measure of earnings performance.

(True/False)

4.7/5  (32)

(32)

The cash flow on total assets ratio is defined as the total cash flows from operations divided by the average total assets.

(True/False)

4.8/5  (32)

(32)

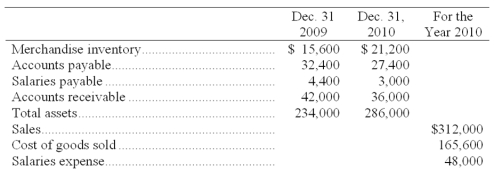

The following selected account balances are taken from a merchandising company's records:

(a) Calculate the cash payments made during 2010 for merchandise. Assume all of the company's accounts payable balances are a result from merchandise purchases.

(b) Calculate the cash receipts from customer sales during 2010.

(c) Calculate the cash payments for salaries during 2010.

(a) Calculate the cash payments made during 2010 for merchandise. Assume all of the company's accounts payable balances are a result from merchandise purchases.

(b) Calculate the cash receipts from customer sales during 2010.

(c) Calculate the cash payments for salaries during 2010.

(Essay)

4.9/5  (36)

(36)

Showing 161 - 172 of 172

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)