Exam 5: Inventories and Cost of Sales

Exam 1: Introducing Accounting in Business262 Questions

Exam 2: Analyzing and Recording Transactions213 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements230 Questions

Exam 4: Accounting for Merchandising Operations195 Questions

Exam 5: Inventories and Cost of Sales199 Questions

Exam 6: Cash and Internal Controls197 Questions

Exam 7: Accounts and Notes Receivable163 Questions

Exam 8: Long-Term Assets202 Questions

Exam 9: Current Liabilities184 Questions

Exam 10: Long-Term Liabilities185 Questions

Exam 11: Corporate Reporting and Analysis209 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing Financial Statements184 Questions

Exam 14: Managerial Accounting Concepts and Principles202 Questions

Exam 15: Job Order Costing and Analysis153 Questions

Exam 16: Process Costing and Analysis185 Questions

Exam 17: Activity-Based Costing and Analysis173 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis177 Questions

Exam 19: Variable Costing and Performance Reporting175 Questions

Exam 20: Master Budgets and Performance Planning158 Questions

Exam 21: Flexible Budgets and Standard Costing177 Questions

Exam 22: Decentralization and Performance Evaluation128 Questions

Exam 23: Relevant Costing for Managerial Decisions136 Questions

Exam 24: Capital Budgeting and Investment Analysis139 Questions

Exam 25: Investments and International Operations168 Questions

Exam 26: Accounting for Partnerships126 Questions

Exam 27 Appendix : Accounting With Special Journals153 Questions

Select questions type

The conservatism principle requires that when more than one estimate of the amounts that are to be received or paid in the future exist and these estimates are about equally likely, then the less optimistic amount is used.

(True/False)

4.8/5  (35)

(35)

A company reported the following information regarding its inventory. Beginning inventory: cost is $70,000; retail is $130,000

Net purchases: cost is $65,000; retail is $120,000

Sales at retail: $145,000

The year-end inventory showed $105,000 worth of merchandise available at retail prices. What is the cost of the ending inventory?

(Multiple Choice)

4.8/5  (34)

(34)

On September 30 a company needed to estimate its ending inventory to prepare its third quarter financial statements. The following information is available:

Beginning inventory, July 1: $4,000

Net sales: $40,000

Net purchases: $41,000

The company's gross margin ratio is 15%. Using the gross profit method, the cost of goods sold would be:

(Multiple Choice)

4.8/5  (33)

(33)

When the __________ method is used with a periodic inventory system, cost of goods sold is assigned costs from the most recent purchases for the period.

(Short Answer)

4.7/5  (29)

(29)

An overstatement of ending inventory will cause an overstatement of assets and an understatement of equity on the balance sheet.

(True/False)

4.8/5  (40)

(40)

The four methods of inventory valuation are SIFO, FIFO, LIFO and average cost.

(True/False)

4.9/5  (34)

(34)

A company had the following ending inventory costs:

Product Units Available Cost Market A 10 \ 5 \ 6 B 50 8 7 C 35 10 11

Instructions:

(a) Calculate the lower of cost or market (LCM) value for the inventory as a whole.

(b) Calculate the lower of cost or market (LCM) value for each individual item.

(Essay)

4.7/5  (48)

(48)

Apply the retail method to the following company information to calculate the cost of the ending inventory for the current period.

Cost Retail Beginning inventory \ 20,224 \ 31,600 Net purchases 59,508 97,000 Sales 89,000

(Essay)

4.8/5  (34)

(34)

Errors in the period-end inventory balances only have an impact on the current period's records and financial statements.

(True/False)

4.9/5  (35)

(35)

Goods on consignment are goods that are shipped by the owner, who is referred to as the _______________, to another party referred to as the ______________________.

(Short Answer)

4.9/5  (40)

(40)

Describe the internal controls that must be applied when taking a physical count of inventory.

(Essay)

4.8/5  (35)

(35)

_______________________ is the estimated sales price of damaged goods minus the cost of making the sale.

(Short Answer)

4.8/5  (36)

(36)

A company had gross profit of $134,200 on net sales of $205,000. If ending inventory was $8,000 and average inventory was $7,080, what is the company's inventory turnover?

(Multiple Choice)

4.9/5  (36)

(36)

The matching principle is used by some companies to avoid allocating incidental inventory costs to cost of goods sold.

(True/False)

4.7/5  (33)

(33)

A company has inventory of 10 units at a cost of $10 each on June 1. On June 3, they purchased 20 units at $12 each. 12 units are sold on June 5. Using the FIFO periodic inventory method, what is the cost of the 12 units that were sold?

(Multiple Choice)

4.8/5  (40)

(40)

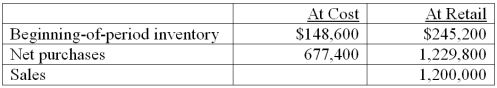

A company uses the retail inventory method and has the following information available concerning its most recent accounting period:

(a) What is the cost-to-retail ratio using the retail method?

(b) What is the estimated cost of the ending inventory?

(a) What is the cost-to-retail ratio using the retail method?

(b) What is the estimated cost of the ending inventory?

(Essay)

4.8/5  (32)

(32)

Given the following information, determine the cost of goods sold at December 31 using the LIFO perpetual inventory method.

December 2: 5 units were purchased at $7 per unit.

December 9: 10 units were purchased at $9.40 per unit.

December 11: 12 units were sold at $35 per unit

December 15: 20 units were purchased at $10.15 per unit

December 22: 18 units were sold at $35 per unit

(Multiple Choice)

4.7/5  (34)

(34)

Using the retail inventory method, if the cost to retail ratio is 60% and ending inventory at retail is $45,000, then estimated ending inventory at cost is $27,000.

(True/False)

4.9/5  (40)

(40)

When taking a physical count of inventory, the use of pre-numbered inventory tickets assists in the control process.

(True/False)

4.9/5  (38)

(38)

When units are purchased at different costs over time, it is simple to determine the cost per unit assigned to inventory.

(True/False)

4.8/5  (38)

(38)

Showing 121 - 140 of 199

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)