Exam 4: Accounting for Merchandising Operations

Exam 1: Introducing Accounting in Business262 Questions

Exam 2: Analyzing and Recording Transactions213 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements230 Questions

Exam 4: Accounting for Merchandising Operations195 Questions

Exam 5: Inventories and Cost of Sales199 Questions

Exam 6: Cash and Internal Controls197 Questions

Exam 7: Accounts and Notes Receivable163 Questions

Exam 8: Long-Term Assets202 Questions

Exam 9: Current Liabilities184 Questions

Exam 10: Long-Term Liabilities185 Questions

Exam 11: Corporate Reporting and Analysis209 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing Financial Statements184 Questions

Exam 14: Managerial Accounting Concepts and Principles202 Questions

Exam 15: Job Order Costing and Analysis153 Questions

Exam 16: Process Costing and Analysis185 Questions

Exam 17: Activity-Based Costing and Analysis173 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis177 Questions

Exam 19: Variable Costing and Performance Reporting175 Questions

Exam 20: Master Budgets and Performance Planning158 Questions

Exam 21: Flexible Budgets and Standard Costing177 Questions

Exam 22: Decentralization and Performance Evaluation128 Questions

Exam 23: Relevant Costing for Managerial Decisions136 Questions

Exam 24: Capital Budgeting and Investment Analysis139 Questions

Exam 25: Investments and International Operations168 Questions

Exam 26: Accounting for Partnerships126 Questions

Exam 27 Appendix : Accounting With Special Journals153 Questions

Select questions type

A journal entry with a debit to cash of $980, a debit to Sales Discounts of $20 and a credit to Accounts Receivable of $1,000 means that a customer has taken a 10% cash discount for early payment.

$20/$1,000 = 2% discount

(True/False)

4.8/5  (34)

(34)

Beginning merchandise inventory plus the net cost of purchases is equal to the merchandise available for sale.

(True/False)

4.8/5  (25)

(25)

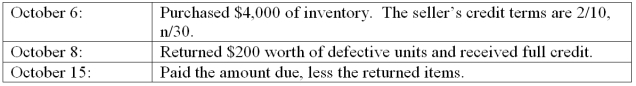

Roller Blade Company uses the perpetual inventory system and had the following transactions during October:

Prepare journal entries to record each of the preceding transactions.

Prepare journal entries to record each of the preceding transactions.

(Essay)

4.7/5  (39)

(39)

Describe the recording process (including costs) for sales of merchandise inventory using a perpetual inventory system.

(Essay)

4.8/5  (38)

(38)

Explain the cost flows and operating activities of a merchandising company.

(Essay)

4.8/5  (42)

(42)

Takita Company had net sales of $500,000 and cost of goods sold of $350,000. Calculate Takita's gross profit.

(Short Answer)

4.8/5  (29)

(29)

The __________________ inventory system continually updates accounting records for merchandise transactions for the amounts of inventory available for sale and inventory sold.

(Short Answer)

4.9/5  (32)

(32)

A seller usually prepares a ____________________ to confirm a buyer's return or allowance, that informs the buyer of the seller's credit to the buyer's Account Receivable on the seller's books.

(Short Answer)

5.0/5  (34)

(34)

A company had expenses other than cost of goods sold of $250,000. Determine sales and gross profit given cost of goods sold was $100,000 and net income was $150,000.

(Multiple Choice)

4.9/5  (40)

(40)

The adjusting entry to reflect inventory shrinkage is a debit to Income Summary and a credit to Inventory Shrinkage Expense.

(True/False)

4.9/5  (34)

(34)

FOB _________________ means the buyer accepts ownership when the goods depart the seller's place of business. The buyer is responsible for paying shipping costs and bears the risk of damage or loss when goods are in transit.

(Short Answer)

4.8/5  (40)

(40)

Which of the following statements are true regarding the closing process of a merchandiser?

(Multiple Choice)

4.8/5  (39)

(39)

A _______________________ is a document the buyer issues to inform the seller of a debit made to the seller's account in the buyer's records.

(Short Answer)

4.9/5  (35)

(35)

A company's gross profit was $83,750 and its net sales were $347,800. Its gross margin ratio equals:

(Multiple Choice)

4.9/5  (31)

(31)

A company that uses the perpetual inventory system purchased $8,500 worth of inventory on September 25. Terms of the purchase were 2/10, n/30. The invoice was paid in full on October 4. Prepare the journal entries to record these merchandise transactions.

(Essay)

4.8/5  (35)

(35)

On July 22, a company purchased merchandise inventory at a cost of $5,250 with credit terms 2/10, net 60. If the company borrows money at 12% to pay for the purchase on the last day of the discount period and pays the loan off on the last day of the credit period, what would be the net savings for the company?

(Multiple Choice)

4.9/5  (34)

(34)

A company had net sales of $340,500, its cost of goods sold was $257,000 and its net income was $13,750. The company's gross margin ratio equals 24.5%.

($340,500 - $257,000)/$340,500 = 24.5%

(True/False)

4.8/5  (36)

(36)

The seller is responsible for paying shipping charges and bears the risk of damage or loss in transit if goods are shipped FOB destination.

(True/False)

4.8/5  (33)

(33)

Showing 61 - 80 of 195

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)