Exam 16: Auditing Operations and Completing the Audit

Exam 1: The Role of the Public Accountant in the American Economy45 Questions

Exam 2: Professional Standards62 Questions

Exam 3: Professional Ethics62 Questions

Exam 4: Legal Liability of Cpas56 Questions

Exam 5: Audit Evidence and Documentation82 Questions

Exam 6: Planning the Audit; Linking Audit Procedures to Risk78 Questions

Exam 7: Internal Control92 Questions

Exam 8: Consideration of Internal Control in an Information Technology Environment63 Questions

Exam 9: Audit Sampling83 Questions

Exam 10: Cash and Financial Investments61 Questions

Exam 11: Accounts Receivable, Notes Receivable, and Revenue64 Questions

Exam 12: Inventories and Cost of Goods Sold59 Questions

Exam 13: Property, Plant, and Equipment: Depreciation and Depletion39 Questions

Exam 14: Accounts Payable and Other Liabilities50 Questions

Exam 15: Debt and Equity Capital40 Questions

Exam 16: Auditing Operations and Completing the Audit69 Questions

Exam 17: Auditors Report62 Questions

Exam 18: Integrated Audits of Public Companies43 Questions

Exam 19: Additional Assurance Services: Historical Financial Information60 Questions

Exam 20: Additional Assurance Services: Other Information51 Questions

Exam 21: Internal, Operational, and Compliance Auditing48 Questions

Select questions type

The auditors' primary means of obtaining corroboration of management's information concerning litigation is a:

(Multiple Choice)

4.9/5  (40)

(40)

A common audit procedure in the audit of payroll transactions involves tracing selected items from the payroll journal to employee time cards that have been approved by supervisory personnel. This procedure is designed to provide evidence in support of the audit proposition that:

(Multiple Choice)

4.8/5  (33)

(33)

The review of audit working papers by the audit partner is normally completed:

(Multiple Choice)

4.9/5  (39)

(39)

In the course of the audit of financial statements for the purpose of expressing an opinion thereon, the auditors will normally prepare a schedule of unadjusted differences for which the auditors did not propose adjustments when they were identified. What is the primary purpose served by this schedule?

(Multiple Choice)

4.9/5  (41)

(41)

The audit of which of the following balance sheet accounts does not normally result in verification of an income statement account?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following is not a procedure that auditors typically perform to search for significant events during the period after year-end but prior to the audit report date?

(Multiple Choice)

4.7/5  (31)

(31)

Subsequent events that provide additional evidence as to conditions that existed at the balance sheet date may result in adjusting journal entries.

(True/False)

4.8/5  (34)

(34)

The Miscellaneous Revenue account should only be analyzed if it is material in amount.

(True/False)

4.8/5  (33)

(33)

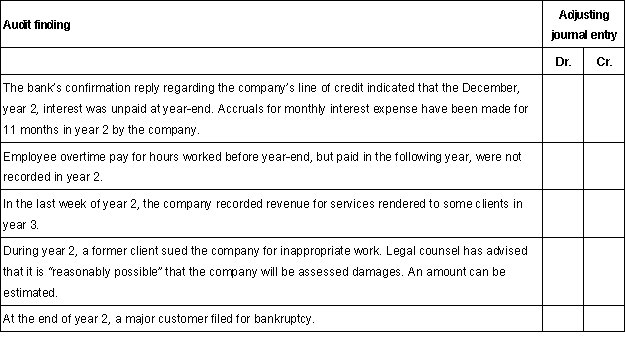

During the course of the year 2 audit of Smithsone Company, the auditor discovered the following situations that may or may not require an adjusting journal entry. Each audit finding is independent of any of the other findings. Select the account or accounts that would comprise the adjusting journal entry, if required, to correct the audit finding. Accounts may be used once, more than once, or not at all.  Selection list for amount Cash Accrued liabilities Interest expense Accounts receivable Common stock Other income Other current assets Revenues Accumulated depreciation Property and equipment Allowance for doubttul accounts Disclosure but no entry required Accounts payable Operating expenses No entry or disclosure required

Selection list for amount Cash Accrued liabilities Interest expense Accounts receivable Common stock Other income Other current assets Revenues Accumulated depreciation Property and equipment Allowance for doubttul accounts Disclosure but no entry required Accounts payable Operating expenses No entry or disclosure required

(Essay)

4.7/5  (33)

(33)

Auditors are concerned with the existence of loss contingencies that may affect the client's financial statements. One way that the auditors obtain evidence about existing loss contingencies is through the lawyer's letter.

a. Describe the information that the auditors wish to obtain about the litigation being handled by a lawyer.

b. Describe three other procedures that are used by auditors to discover existing loss contingencies.

(Essay)

4.8/5  (41)

(41)

Auditors must be concerned with events that occur subsequent to the balance sheet date, because the events may need to be reflected in the financial statements.

a. Describe the two general types of subsequent events.

b. What is the auditors' responsibility with respect to detecting subsequent events?

c. List three audit procedures that are used by the auditors to search for subsequent events.

(Essay)

4.9/5  (39)

(39)

In evaluating whether there is a sufficiently low probability of material misstatement in the financial statements, the auditors accumulate:

(Multiple Choice)

4.7/5  (34)

(34)

Which of the following procedures would an auditor most likely perform while evaluating audit findings at the conclusion of an audit?

(Multiple Choice)

4.8/5  (40)

(40)

Management estimates the company's allowance for doubtful accounts as $200,000, and the auditors develop an estimate that suggests that the amount should be between $230,000 and $250,000. The likely misstatement in this situation is:

(Multiple Choice)

4.7/5  (31)

(31)

Authorization of which of the following is least likely to be found during a review of the minutes of the board of directors?

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following audit procedures is aimed at determining whether every name on the company payroll is an employee actually on the job?

(Multiple Choice)

4.9/5  (37)

(37)

Internal control over payroll is enhanced when the personnel department distributes payroll checks.

(True/False)

4.8/5  (40)

(40)

Which of the following statements ordinarily is not included among the written client representations made by the chief executive officer and the chief financial officer?

(Multiple Choice)

4.8/5  (33)

(33)

A client's previous two years of financial statements understated estimated warranty payable by $30,000 and $50,000 respectively, both immaterial amounts. This year, the auditors estimate that the accrual is understated by an additional $60,000. In this year's audit, $100,000 represents a material amount. Assuming that the entire understatement is to be recorded based on SEC SAB 108, the decrease in this year's income due to these understatements is:

(Multiple Choice)

4.8/5  (34)

(34)

To minimize the opportunities for fraud, unclaimed cash payroll should be:

(Multiple Choice)

4.7/5  (39)

(39)

Showing 21 - 40 of 69

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)