Exam 15: Accounts Receivable and Uncollectible Accounts

Exam 1: Accounting: the Language of Business77 Questions

Exam 2: Analyzing Business Transactions90 Questions

Exam 3: Analyzing Business Transactions Using T Accounts105 Questions

Exam 4: The General Journal and the General Ledger85 Questions

Exam 5: Adjustments and the Worksheet85 Questions

Exam 6: Closing Entries and the Postclosing Trial Balance83 Questions

Exam 7: Accounting for Sales and Accounts Receivable83 Questions

Exam 8: Accounting for Purchases and Accounts Payable85 Questions

Exam 9: Cash Receipts, Cash Payments, and Banking Procedures85 Questions

Exam 10: Payroll Computations, Records, and Payment82 Questions

Exam 11: Payroll Taxes, Deposits, and Reports82 Questions

Exam 12: Accruals, Deferrals, and the Worksheet85 Questions

Exam 13: Financial Statements and Closing Procedures84 Questions

Exam 14: Accounting Principles and Reporting Standards85 Questions

Exam 15: Accounts Receivable and Uncollectible Accounts85 Questions

Select questions type

The collection of an account previously written off is recorded in the cash receipts journal only.

(True/False)

4.8/5  (41)

(41)

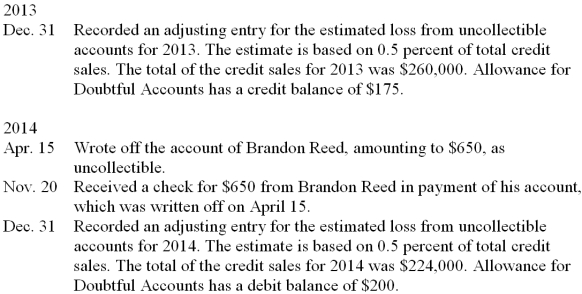

The Travel-Right Company uses the allowance method to provide for losses from uncollectible accounts. Record the following selected transactions on page 5 of a general journal, assuming the company also uses a cash receipts journal. Omit descriptions.

(Essay)

4.9/5  (38)

(38)

On December 31, prior to adjustments, the balance of Accounts Receivable is $32,000 and Allowance for Doubtful Accounts has a credit balance of $190. The firm estimates its losses from uncollectible accounts to be 5% of accounts receivable at the end of the year. The adjusting entry needed to record the estimated losses from uncollectible accounts is made for

(Multiple Choice)

4.9/5  (40)

(40)

The entry to record the write-off of a specific uncollectible account using the allowance method includes a ____________________ to Allowance for Doubtful Accounts.

(Short Answer)

4.8/5  (30)

(30)

The difference between the balance of the Accounts Receivable account and the balance of Allowance for Doubtful Accounts is the ____________________ value of accounts receivable.

(Short Answer)

4.9/5  (31)

(31)

The adjusting entry to record estimated losses from uncollectible accounts consists of a debit to Allowance for Doubtful Accounts.

(True/False)

4.8/5  (32)

(32)

On December 31, prior to adjustment, Allowance for Doubtful Accounts has a credit balance of $200. An aging Analyze of the accounts receivable produces an estimate of $1,000 of probable losses from uncollectible accounts. The adjusting entry needed to record the estimated losses from uncollectible accounts is made for

(Multiple Choice)

4.9/5  (44)

(44)

Allowance for Doubtful Accounts may, at times, have a debit balance.

(True/False)

4.8/5  (42)

(42)

When the allowance method of recognizing losses from uncollectible accounts is used, the net value of accounts receivable on the balance sheet will more nearly reflect the amount that will ultimately be collected.

(True/False)

4.9/5  (44)

(44)

At the end of 2014, the trial balance of Bryant Paint Store included the accounts and balances shown below. Credit sales were $145,000. Returns and allowances on these sales were $2,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.3 percent of net credit sales. Accounts Receivable \ 18,000 Allowance for Doubtful Accounts 500 1. What is the estimated loss from uncollectible accounts for 2014?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts for 2014?

(Short Answer)

4.8/5  (32)

(32)

When the estimate of the losses from uncollectible accounts is based on the aging method, the primary concern is proper valuation of the accounts receivable on the balance sheet.

(True/False)

4.7/5  (32)

(32)

On April 22, 2014, Raymond Repair Services Company received a check for $220 from Caroline Smith, whose $380 account was written off on January 15. In the accompanying letter, Smith apologized and said she probably would be unable to pay any of the remaining balance. Prepare the general journal entry necessary. (Assume the firm uses the direct charge-off method. Also assume that the entry in the cash receipts journal has already been made.)

(Essay)

4.7/5  (36)

(36)

The estimated loss from uncollectible accounts for the first year of operations will be __________________ if the balance of Accounts Receivable is $60,000 and the firm bases its estimate of loss on 5 percent of accounts receivable.

(Short Answer)

4.9/5  (41)

(41)

At the end of the current year, the trial balance of Carlton's Auto Sales included the accounts and balances shown below. Credit sales were $9,200,000. Returns and allowances on these sales were $55,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.3 percent of net credit sales. Accounts Receivable \ 1,300,000 Allowance for Doubtful Accounts 9,000 Sales 14,000,000 Sales Returns and Allowances 110,000. 1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

(Short Answer)

4.9/5  (43)

(43)

A firm reported sales of $600,000 during the year and has a balance of $40,000 in its Accounts Receivable account at year-end. Prior to adjustment, Allowance for Doubtful Accounts has a credit balance of $600. The firm estimated its losses from uncollectible accounts to be one-half of 1 percent of sales. The entry to record the estimated losses from uncollectible accounts will include a credit to Allowance for Doubtful Accounts for

(Multiple Choice)

4.8/5  (27)

(27)

On December 31, prior to adjustments, the balance of Accounts Receivable is $16,000 and Allowance for Doubtful Accounts has a credit balance of $95. The firm estimates its losses from uncollectible accounts to be 5% of accounts receivable at the end of the year. The adjusting entry needed to record the estimated losses from uncollectible accounts is made for

(Multiple Choice)

4.9/5  (42)

(42)

When losses from uncollectible accounts are provided for in advance, the entry to record the write-off of a particular customer's account includes a debit to Uncollectible Accounts Expense.

(True/False)

4.9/5  (39)

(39)

The practice of estimating losses from uncollectible accounts before specific accounts become uncollectible is referred to as the ____________________ method.

(Short Answer)

4.8/5  (29)

(29)

A firm reported sales of $300,000 during the year and has a balance of $20,000 in its Accounts Receivable account at year-end. Prior to adjustment, Allowance for Doubtful Accounts has a credit balance of $300. The firm estimated its losses from uncollectible accounts to be one-half of 1 percent of sales. The entry to record the estimated losses from uncollectible accounts will include a credit to Allowance for Doubtful Accounts for

(Multiple Choice)

4.8/5  (42)

(42)

The totals from the Savoy Company's Schedule of Accounts Receivable by Age as of the end of the current year are shown below. Account Balance Current 1-30 31-60 Over 60 Totals \ 11,800 \ 9,200 \ 1,500 \ 600 \ 500

As of the end of the current year, there is a debit balance of $75 in the Allowance for Doubtful Accounts.

1. Compute the estimated uncollectible accounts using the following rates. Current 1\% 1-30 days past due 5\% 31-60 days past due 15\% Over 60 days past due 40\% 2. Compute the amount of the adjusting entry for uncollectible accounts expense.

(Essay)

4.9/5  (42)

(42)

Showing 21 - 40 of 85

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)