Exam 5: The Accounting Cycle: Reporting Financial Results

Exam 1: Accounting: Information for Decision Making138 Questions

Exam 2: Basic Financial Statements130 Questions

Exam 3: The Accounting Cycle: Capturing Economic Events133 Questions

Exam 4: The Accounting Cycle: Accruals and Deferrals127 Questions

Exam 5: The Accounting Cycle: Reporting Financial Results109 Questions

Exam 6: Merchandising Activities117 Questions

Exam 7: Financial Assets201 Questions

Exam 8: Inventories and the Cost of Goods Sold159 Questions

Exam 9: Property, Plant, and Equipment, Intangible Assets and Natural Resources147 Questions

Exam 10: Liabilities213 Questions

Exam 12: Profit and Changes in Retained Earnings122 Questions

Exam 13: Statement of Cash Flows174 Questions

Exam 14: Financial Statement Analysis135 Questions

Exam 15: Global Business and Accounting68 Questions

Select questions type

Adjustments and closing process-basic entries

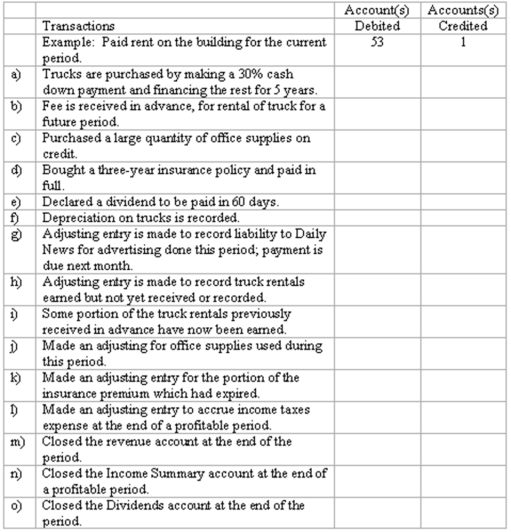

Selected ledger accounts used by Speedy Truck Rentals Limited, are listed along with identifying numbers. Following this list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited.

1 Cash 22 Notes Payable 41 Truck Rental Revenue 2 Accounts Receivable 23 Dividends Payable 51 Advertising Expense 3 Office Supplies 24 Income Taxes Pay. 52 Office Supplies Expense 4 Unexpired Insurance 30 Unearned Revenue 53 Rent Expense 5 Trucks 31 Share capital 54 Insurance Expense 6 Accumlated Depr. 32 Retained Earnings 55 Depreciation Expense: Trucks 33 Dividends Trucks 21 Accounts Payable 35 Income Summary 56 Income Taxes Expense

(Essay)

4.7/5  (41)

(41)

Refer to the above data. The entry to close the Service Fees Earned account will:

(Multiple Choice)

4.7/5  (42)

(42)

Which of the following accounts will be closed to Income Summary?

(Multiple Choice)

4.8/5  (31)

(31)

Refer to the above data. Income Summary will have what balance before it is closed?

(Multiple Choice)

5.0/5  (48)

(48)

In regard to disclosures that are required to be contained in annual reports, the FASB has no well-defined list of items that must be included.

(True/False)

4.7/5  (47)

(47)

An annual report filed with the Securities and Exchange Commission must include a section called "Management's Predictions of Future Earnings".

(True/False)

4.9/5  (33)

(33)

Under the Sarbanes-Oxley Act, CFOs and high-ranking corporate officers are now

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following is true regarding a worksheet prepared at year-end?

(Multiple Choice)

4.9/5  (35)

(35)

Which account will not appear on an after-closing trial balance?

(Multiple Choice)

4.8/5  (34)

(34)

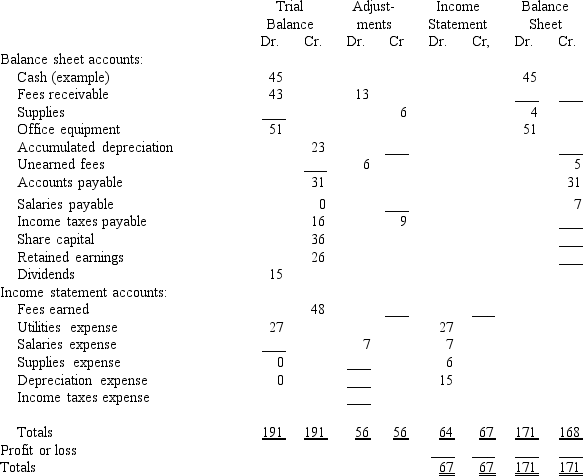

Completion of worksheet--missing data

Certain data are given on the worksheet below, and certain missing data are indicated by the blank boxes. Sufficient information is included to fill in the missing data. Each account has a debit or credit balance characteristically normal for that kind of account. Note that the dollar amounts have been reduced to figures of not more than three digits to simplify the arithmetic.

Insert the figures necessary to complete the worksheet in the blanks indicated by an underline. The boxes cover both debit and credit columns; be sure to insert the missing figures in the correct column of the box. If no figure should appear in a column within a box, indicate this by placing a "0" in one or more columns of the box (see sample box opposite Cash).

(Essay)

4.8/5  (37)

(37)

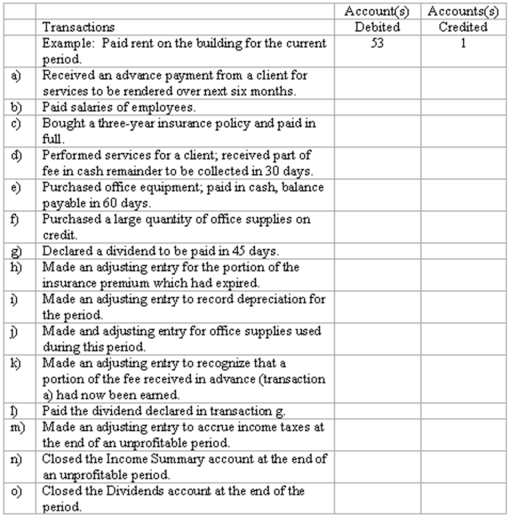

Adjustments and closing process--basic entries

Selected ledger accounts used by Goldstone Advertising Limited, are listed along with identifying numbers. Following this list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited.

1 Cash 22 Accounts Payable 41 Fees Earned 2 Accounts Receivable 23 Income Taxes Payable 51 Salaries Expense 3 Office Supplies 24 Unearned Fees 52 Office Supplies Expense 4 Unexpired Insurance 30 Share capital 53 Rent Expense 5 Office Equipment 31 Retained Earnings 54 Insurance Expense 6 Accumlated Depr. 32 Dividends 55 Depreciation Expense: Office Equip 35 Income Summary Office Equip. 21 Dividends Payable 56 Income Taxes Expense

(Essay)

4.9/5  (40)

(40)

Showing 21 - 40 of 109

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)