Exam 4: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts166 Questions

Exam 2: Cost-Volume-Profit Relationships241 Questions

Exam 3: Job-Order Costing119 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management200 Questions

Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making139 Questions

Exam 6: Differential Analysis: The Key to Decision Making152 Questions

Exam 7: Capital Budgeting Decisions145 Questions

Exam 9: Capital Budgeting Decisions36 Questions

Exam 10: Profit Planning106 Questions

Exam 11: Flexible Budgets and Performance Analysis294 Questions

Exam 12: Standard Costs and Variances179 Questions

Exam 13: Performance Measurement in Decentralized Organizations93 Questions

Exam 14: Managerial Accounting and Cost Concepts22 Questions

Exam 15: Job-Order Costing27 Questions

Exam 16: Activity-Based-Costing: a Tool to Aid Decision Making15 Questions

Exam 17: A Capital Budgeting Decisions12 Questions

Exam 18: Standard Costs and Variances105 Questions

Exam 19: Performance Measurement in Decentralized Organizations21 Questions

Exam 20: Performance Measurement in Decentralized Organizations41 Questions

Exam 21: Profitability Analysis71 Questions

Exam 22: Pricing Products and Services67 Questions

Select questions type

Only those costs that would disappear over time if a segment were eliminated should be considered traceable costs of the segment.

Free

(True/False)

4.8/5  (36)

(36)

Correct Answer:

True

What is the unit product cost for the month under absorption costing?

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

B

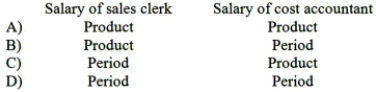

Would the following costs be classified as product or period costs under variable costing at a retail clothing store?

Free

(Multiple Choice)

4.7/5  (30)

(30)

Correct Answer:

D

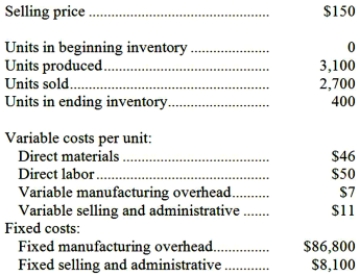

Maga Company, which has only one product, has provided the following data concerning its most recent month of operations:  Required:

a. What is the unit product cost for the month under variable costing?

b. What is the unit product cost for the month under absorption costing?

c. Prepare a contribution format income statement for the month using variable costing.

d. Prepare an income statement for the month using absorption costing.

e. Reconcile the variable costing and absorption costing net operating incomes for the month.

Required:

a. What is the unit product cost for the month under variable costing?

b. What is the unit product cost for the month under absorption costing?

c. Prepare a contribution format income statement for the month using variable costing.

d. Prepare an income statement for the month using absorption costing.

e. Reconcile the variable costing and absorption costing net operating incomes for the month.

(Essay)

4.8/5  (36)

(36)

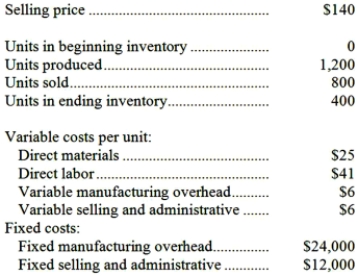

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the net operating income for the month under variable costing?

What is the net operating income for the month under variable costing?

(Multiple Choice)

4.9/5  (28)

(28)

During April, Division D of Carney Company had a segment margin ratio of 15%, a variable expense ratio of 60% of sales, and traceable fixed expenses of $15,000. Division D's sales were closest to:

(Multiple Choice)

4.9/5  (30)

(30)

Gore Corporation has two divisions: the Business Products Division and the Export Products Division. The Business Products Division's divisional segment margin is $55,700 and the Export Products Division's divisional segment margin is $70,600. The total amount of common fixed expenses not traceable to the individual divisions is $107,400. What is the company's net operating income?

(Multiple Choice)

4.9/5  (31)

(31)

What was the absorption costing net operating income last year?

(Multiple Choice)

4.9/5  (30)

(30)

Hansen Company produces a single product. During the last year, Hansen had net operating income under absorption costing that was $5,500 lower than its income under variable costing. The company sold 9,000 units during the year, and its variable costs were $10 per unit, of which $6 was variable selling expense. If fixed production cost is $5 per unit under absorption costing every year, then how many units did the company produce during the year?

(Multiple Choice)

4.8/5  (43)

(43)

What is the net operating income for the month under absorption costing?

(Multiple Choice)

4.8/5  (35)

(35)

What is the unit product cost for the month under absorption costing?

(Multiple Choice)

4.9/5  (35)

(35)

All other things equal, if a division's traceable fixed expenses decrease:

(Multiple Choice)

4.9/5  (25)

(25)

What is the net operating income for the month under variable costing?

(Multiple Choice)

4.9/5  (35)

(35)

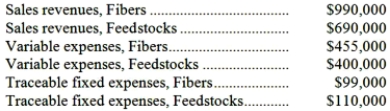

Data for May concerning Dorow Corporation's two major business segments-Fibers and Feedstocks-appear below:  Common fixed expenses totaled $345,000 and were allocated as follows: $186,000 to the Fibers business segment and $159,000 to the Feedstocks business segment.

Required:

Prepare a segmented income statement in the contribution format for the company. Omit percentages; show only dollar amounts.

Common fixed expenses totaled $345,000 and were allocated as follows: $186,000 to the Fibers business segment and $159,000 to the Feedstocks business segment.

Required:

Prepare a segmented income statement in the contribution format for the company. Omit percentages; show only dollar amounts.

(Essay)

4.9/5  (29)

(29)

What is the total period cost for the month under the variable costing approach?

(Multiple Choice)

4.8/5  (36)

(36)

The contribution margin of the Commercial business segment is:

(Multiple Choice)

4.8/5  (40)

(40)

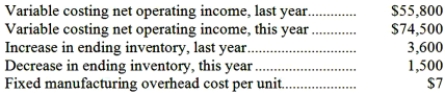

Carvey Corporation manufactures a variety of products. The following data pertain to the company's operations over the last two years:  Required:

a. Determine the absorption costing net operating income for last year. Show your work!

b. Determine the absorption costing net operating income for this year. Show your work!

Required:

a. Determine the absorption costing net operating income for last year. Show your work!

b. Determine the absorption costing net operating income for this year. Show your work!

(Essay)

4.8/5  (35)

(35)

The product line segment margin for Product A for June was:

(Multiple Choice)

4.8/5  (41)

(41)

What is the unit product cost for the month under variable costing?

(Multiple Choice)

4.8/5  (38)

(38)

A segment is any portion or activity of an organization about which a manager seeks revenue, cost, or profit data.

(True/False)

4.8/5  (36)

(36)

Showing 1 - 20 of 200

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)