Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making

Exam 1: Managerial Accounting and Cost Concepts166 Questions

Exam 2: Cost-Volume-Profit Relationships241 Questions

Exam 3: Job-Order Costing119 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management200 Questions

Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making139 Questions

Exam 6: Differential Analysis: The Key to Decision Making152 Questions

Exam 7: Capital Budgeting Decisions145 Questions

Exam 9: Capital Budgeting Decisions36 Questions

Exam 10: Profit Planning106 Questions

Exam 11: Flexible Budgets and Performance Analysis294 Questions

Exam 12: Standard Costs and Variances179 Questions

Exam 13: Performance Measurement in Decentralized Organizations93 Questions

Exam 14: Managerial Accounting and Cost Concepts22 Questions

Exam 15: Job-Order Costing27 Questions

Exam 16: Activity-Based-Costing: a Tool to Aid Decision Making15 Questions

Exam 17: A Capital Budgeting Decisions12 Questions

Exam 18: Standard Costs and Variances105 Questions

Exam 19: Performance Measurement in Decentralized Organizations21 Questions

Exam 20: Performance Measurement in Decentralized Organizations41 Questions

Exam 21: Profitability Analysis71 Questions

Exam 22: Pricing Products and Services67 Questions

Select questions type

Designing a new product is an example of a:

Free

(Multiple Choice)

4.9/5  (49)

(49)

Correct Answer:

C

Assuming that the company charges $534.11 for the Sparacio wedding cake, what would be the overall margin on the order?

Free

(Multiple Choice)

4.9/5  (39)

(39)

Correct Answer:

D

What is the overhead cost assigned to Product H3 under activity-based costing?

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

D

What is the product margin for Product Q9 under activity-based costing?

(Multiple Choice)

4.8/5  (41)

(41)

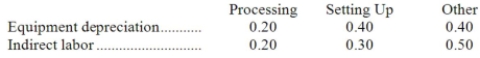

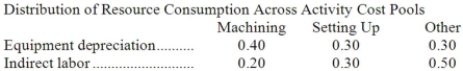

Yentzer Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $72,000 and indirect labor totals $8,000. Data concerning the distribution of resource consumption across activity cost pools appear below:  Required:

Assign overhead costs to activity cost pools using activity-based costing.

Required:

Assign overhead costs to activity cost pools using activity-based costing.

(Essay)

4.8/5  (33)

(33)

How much supervisory wages and factory supplies cost would NOT be assigned to products using the activity-based costing system?

(Multiple Choice)

4.7/5  (30)

(30)

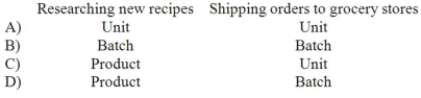

Would the following activities at a manufacturer of canned soup be best classified as unit-level, batch-level, product-level, or organization-sustaining activities?

(Multiple Choice)

4.9/5  (35)

(35)

What is the product margin for Product P3 under activity-based costing?

(Multiple Choice)

4.9/5  (38)

(38)

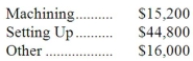

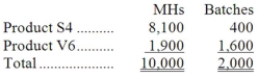

Hugle Corporation's activity-based costing system has three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:  Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

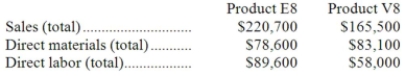

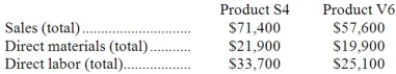

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:  Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:  Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

(Essay)

4.8/5  (44)

(44)

Organization-sustaining activities are activities of the general organization that support specific products.

(True/False)

4.7/5  (44)

(44)

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

Costs classified as batch-level costs should depend on the number of batches processed rather than on the number of units produced, the number of units sold, or other measures of volume.

(True/False)

4.7/5  (33)

(33)

Transaction drivers usually take more effort to record than duration drivers.

(True/False)

4.7/5  (38)

(38)

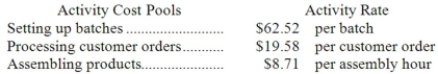

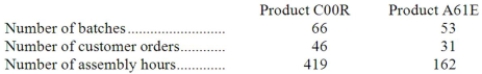

Schmeider Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.  Data concerning two products appear below:

Data concerning two products appear below:  Required:

How much overhead cost would be assigned to each of the two products using the company's activity-based costing system?

Required:

How much overhead cost would be assigned to each of the two products using the company's activity-based costing system?

(Essay)

4.7/5  (39)

(39)

If the materials handling cost is allocated on the basis of material moves, how much of the total materials handling cost would be allocated to the specialty windows? (Round off your answer to the nearest whole dollar.)

(Multiple Choice)

4.8/5  (46)

(46)

The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (27)

(27)

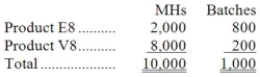

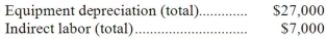

Pressler Corporation's activity-based costing system has three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.  Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:  Required:

a. Assign overhead costs to activity cost pools using activity-based costing.

b. Calculate activity rates for each activity cost pool using activity-based costing.

c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d. Determine the product margins for each product using activity-based costing.

Required:

a. Assign overhead costs to activity cost pools using activity-based costing.

b. Calculate activity rates for each activity cost pool using activity-based costing.

c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d. Determine the product margins for each product using activity-based costing.

(Essay)

4.9/5  (40)

(40)

How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing?

(Multiple Choice)

4.8/5  (31)

(31)

Showing 1 - 20 of 139

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)