Exam 11: Service Department and Joint Cost Allocation

Exam 1: Cost Accounting: Information for Decision Making111 Questions

Exam 2: Cost Concepts and Behavior105 Questions

Exam 3: Fundamentals of Cost-Volume-Profit Analysis105 Questions

Exam 4: Fundamentals of Cost Analysis for Decision Making72 Questions

Exam 5: Cost Estimation84 Questions

Exam 6: Fundamentals of Product and Service Costing88 Questions

Exam 7: Job Costing91 Questions

Exam 8: Process Costing91 Questions

Exam 9: Activity-Based Costing87 Questions

Exam 10: Fundamentals of Cost Management106 Questions

Exam 11: Service Department and Joint Cost Allocation99 Questions

Exam 12: Fundamentals of Management Control Systems101 Questions

Exam 13: Planning and Budgeting87 Questions

Exam 14: Business Unit Performance Measurement76 Questions

Exam 15: Transfer Pricing82 Questions

Exam 16: Fundamentals of Variance Analysis90 Questions

Exam 17: Additional Topics in Variance Analysis78 Questions

Exam 18: Performance Measurement to Support Business Strategy91 Questions

Select questions type

Because this allocation method recognizes that service departments often provide each other with inter-departmental service,it is theoretically considered to be the most accurate method for allocating service department costs to production departments.This method is: (CMA adapted)

(Multiple Choice)

4.9/5  (38)

(38)

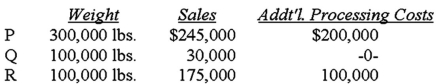

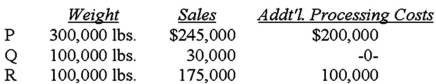

The Moody Company produced three joint products at a joint cost of $100,000.Two of these products were processed further.Production and sales were:  What is the net income of Moody Company if the estimated net realizable value method of joint cost allocation is used?

What is the net income of Moody Company if the estimated net realizable value method of joint cost allocation is used?

(Multiple Choice)

4.9/5  (50)

(50)

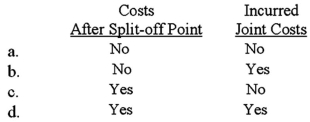

Net realizable value at the split-off point is used to allocate:

(Multiple Choice)

4.8/5  (44)

(44)

If two service departments service the same number of departments,which service department's costs should be allocated first when using the step method?

(Multiple Choice)

4.7/5  (41)

(41)

A management purpose for allocating joint costs of a processing center to the various products produced is to:

(Multiple Choice)

4.9/5  (32)

(32)

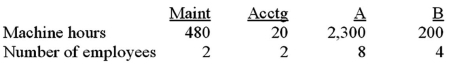

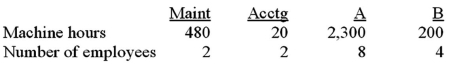

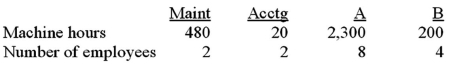

The RAH Manufacturing Company has two service departments: Maintenance and Accounting.The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours.The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department.The direct departmental costs for A and B are $300,000 and $500,000,respectively.  What is the Accounting Department's cost allocated to Department B using the direct method?

What is the Accounting Department's cost allocated to Department B using the direct method?

(Multiple Choice)

4.9/5  (40)

(40)

The Moody Company produced three joint products at a joint cost of $100,000.Two of these products were processed further.Production and sales were:  Assume Q is a by-product and Moody uses the cost reduction method of accounting for by-product cost.If estimated net realizable value is used,how much of the joint costs would be allocated to product R?

Assume Q is a by-product and Moody uses the cost reduction method of accounting for by-product cost.If estimated net realizable value is used,how much of the joint costs would be allocated to product R?

(Multiple Choice)

4.7/5  (41)

(41)

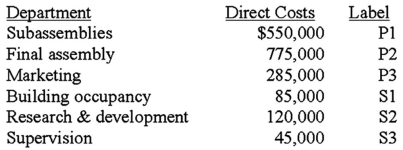

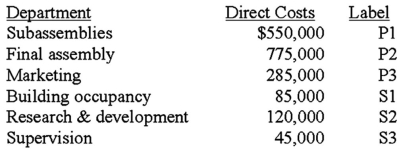

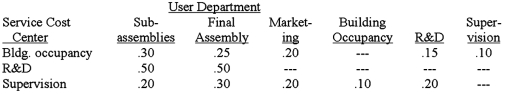

The following set up is a system of simultaneous linear equations to allocate costs using the reciprocal method.Matrix algebra is not required.The following costs were incurred in three operating departments and three service departments in Reality Company.  Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department P1 (subassemblies)is:

The equation for department P1 (subassemblies)is:

(Multiple Choice)

4.7/5  (46)

(46)

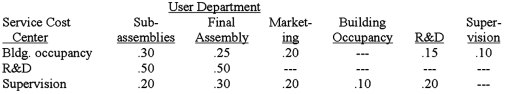

Castle Company has two service departments and two user departments.The number of employees in each department is:  The fixed costs of the Personnel Department are allocated on a basis of the number of employees.If these costs are budgeted at $37,125 during a given period,the amount of cost allocated to the Cafeteria under the step method would be:

The fixed costs of the Personnel Department are allocated on a basis of the number of employees.If these costs are budgeted at $37,125 during a given period,the amount of cost allocated to the Cafeteria under the step method would be:

(Multiple Choice)

4.9/5  (26)

(26)

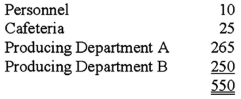

The Emery Construction Company occupies 85,000 square feet for construction of mobile homes.There are two manufacturing departments,finishing and assembly,and four service departments labeled S1,S2,S3,and S4.Information relevant to Emery is as follows:  Rent paid for the area used is $720,000.How much rent is allocable to the assembly department using the direct method of allocation?

Rent paid for the area used is $720,000.How much rent is allocable to the assembly department using the direct method of allocation?

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following statements is true regarding the use of multiple cost-pools?

(Multiple Choice)

4.7/5  (41)

(41)

If a company's two joint products can be sold at the split-off point,there is no reason for allocating the joint costs to the products.Just because they can be sold,doesn't mean that they are all sold.Inventory valuation would still be necessary.

(True/False)

4.9/5  (28)

(28)

Joint products and byproducts are produced simultaneously by a single process or series of processes and:

(Multiple Choice)

4.7/5  (45)

(45)

The RAH Manufacturing Company has two service departments: Maintenance and Accounting.The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours.The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department.The direct departmental costs for A and B are $300,000 and $500,000,respectively.  What is the cost of the Accounting Department's cost allocated to Department A using the step method and assuming the Maintenance Department's costs are allocated first?

What is the cost of the Accounting Department's cost allocated to Department A using the step method and assuming the Maintenance Department's costs are allocated first?

(Multiple Choice)

4.8/5  (40)

(40)

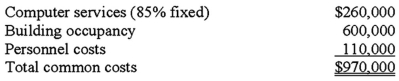

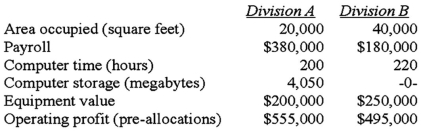

Cincinnati Million,Inc.operates two user divisions as separate cost objects.To determine the costs of each division,the company allocates common costs to the divisions.During the past month,the following common costs were incurred:  The following information is available concerning various activity measures and service usages by each of the divisions:

The following information is available concerning various activity measures and service usages by each of the divisions:  Using the most appropriate allocation basis,what is the personnel cost allocated to Division A?

Using the most appropriate allocation basis,what is the personnel cost allocated to Division A?

(Multiple Choice)

4.7/5  (41)

(41)

The human resource department in a manufacturing company would be considered a service department.Human resources would be considered a support department for the manufacturing activities of the firm,and therefore a service department.

(True/False)

4.7/5  (35)

(35)

The RAH Manufacturing Company has two service departments: Maintenance and Accounting.The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours.The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department.The direct departmental costs for A and B are $300,000 and $500,000,respectively.  What is the Maintenance Department's cost allocated to Department B using the step method and assuming the Maintenance Department's costs are allocated first?

What is the Maintenance Department's cost allocated to Department B using the step method and assuming the Maintenance Department's costs are allocated first?

(Multiple Choice)

4.8/5  (39)

(39)

The following set up is a system of simultaneous linear equations to allocate costs using the reciprocal method.Matrix algebra is not required.The following costs were incurred in three operating departments and three service departments in Reality Company.  Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department S2 (research and development)is:

The equation for department S2 (research and development)is:

(Multiple Choice)

4.8/5  (37)

(37)

Showing 21 - 40 of 99

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)