Exam 3: Fundamentals of Cost-Volume-Profit Analysis

Exam 1: Cost Accounting: Information for Decision Making111 Questions

Exam 2: Cost Concepts and Behavior105 Questions

Exam 3: Fundamentals of Cost-Volume-Profit Analysis105 Questions

Exam 4: Fundamentals of Cost Analysis for Decision Making72 Questions

Exam 5: Cost Estimation84 Questions

Exam 6: Fundamentals of Product and Service Costing88 Questions

Exam 7: Job Costing91 Questions

Exam 8: Process Costing91 Questions

Exam 9: Activity-Based Costing87 Questions

Exam 10: Fundamentals of Cost Management106 Questions

Exam 11: Service Department and Joint Cost Allocation99 Questions

Exam 12: Fundamentals of Management Control Systems101 Questions

Exam 13: Planning and Budgeting87 Questions

Exam 14: Business Unit Performance Measurement76 Questions

Exam 15: Transfer Pricing82 Questions

Exam 16: Fundamentals of Variance Analysis90 Questions

Exam 17: Additional Topics in Variance Analysis78 Questions

Exam 18: Performance Measurement to Support Business Strategy91 Questions

Select questions type

The total contribution margin is the unit contribution margin multiplied by the number of units minus the fixed component of the total costs (TC).The total contribution margin is the unit contribution margin multiplied by the number of units.

(True/False)

4.8/5  (29)

(29)

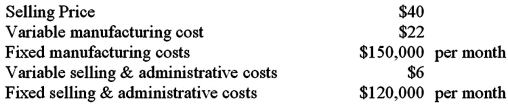

Sanfran has the following data:  How many units must Sanfran produce and sell in order to break even?

How many units must Sanfran produce and sell in order to break even?

(Multiple Choice)

4.9/5  (40)

(40)

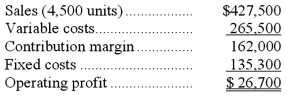

Gaudy Inc.produces and sells a single product.The company has provided its contribution format income statement for May.  If the company sells 4,300 units,its operating profit should be closest to:

If the company sells 4,300 units,its operating profit should be closest to:

(Multiple Choice)

4.9/5  (40)

(40)

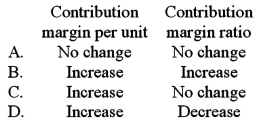

East Company manufactures and sells a single product with a positive contribution margin.If the selling price and the variable cost per unit both increase 5% and fixed costs do not change,what is the effect on the contribution margin per unit and the contribution margin ratio?

(Multiple Choice)

4.8/5  (36)

(36)

An increase in an organization's fixed costs will result in a lower margin of safety,assuming all other costs and sales remain unchanged.This is due to an upward shift in the fixed and total cost curves relative to the revenue curve,driving the break-even point out;thereby,reducing the difference (margin of safety)between break-even and the point of actual performance.

(True/False)

4.8/5  (39)

(39)

Street Company's fixed costs total $150,000,its variable cost ratio is 60% and its variable costs are $4.50 per unit.Based on this information,the break-even point in units is:

(Multiple Choice)

4.8/5  (35)

(35)

Break-even analysis assumes that over the relevant range: (CPA adapted)

(Multiple Choice)

4.9/5  (45)

(45)

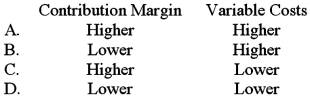

All other things the same,which of the following would be true of the contribution margin and variable costs of a company with high fixed costs and low variable costs as compared to a company with low fixed costs and high variable costs?

(Multiple Choice)

4.8/5  (37)

(37)

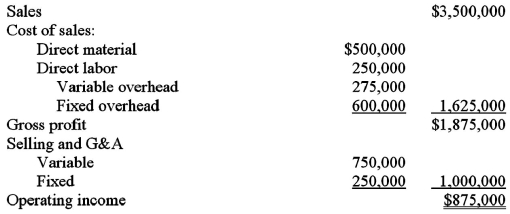

Misa Corporation manufactures circuit boards and is in the process of preparing next year's budget.The pro forma income statement for the current year is presented below.  The break-even point (rounded to the nearest dollar)for Misa Corporation for the current year is:

The break-even point (rounded to the nearest dollar)for Misa Corporation for the current year is:

(Multiple Choice)

4.9/5  (40)

(40)

At the break-even point,the total contribution margin equals total: (CPA adapted)

(Multiple Choice)

4.8/5  (25)

(25)

The break-even point for an organization with a low operating leverage will be relatively higher than the break-even point for an organization with a high operating leverage.A low operating leverage has lower fixed costs and higher variable costs;therefore,the break-even point will be lower.

(True/False)

4.9/5  (32)

(32)

During 2012,Thor Lab supplied hospitals with a comprehensive diagnostic kit for $120.At a volume of 80,000 kits,Thor had fixed costs of $1,000,000 and a profit before income taxes of $200,000.Due to an adverse legal decision,Thor's 2013 liability insurance increased by $1,200,000 over 2012.Assuming the volume and other costs are unchanged,what should the 2013 price be if Thor is to make the same $200,000 profit before income taxes? (CPA adapted)

(Multiple Choice)

4.8/5  (34)

(34)

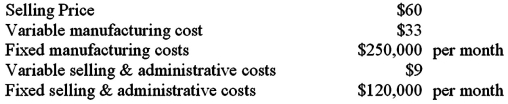

RedTail Manufacturing has the following data:  What dollar sales volume does RedTail need to achieve a $50,000 operating profit per month?

What dollar sales volume does RedTail need to achieve a $50,000 operating profit per month?

(Multiple Choice)

4.9/5  (37)

(37)

Operating leverage refers to the extent to which an organization's cost structure is made up of:

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following would not cause the break-even point to change?

(Multiple Choice)

4.9/5  (41)

(41)

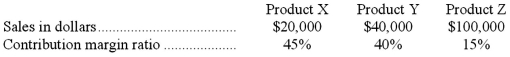

Darth Company sells three products.Sales and contribution margin ratios for the three products follow:  Given these data,the contribution margin ratio for the company as a whole would be:

Given these data,the contribution margin ratio for the company as a whole would be:

(Multiple Choice)

4.8/5  (49)

(49)

Rothe Company manufactures and sells a single product that it sells for $90 per unit and has a contribution margin ratio of 35%.The company's fixed costs are $46,800.If Rothe desires a monthly target operating profit equal to 15% of sales,sales will have to be (rounded):

(Multiple Choice)

4.8/5  (37)

(37)

If Q equals the level of output,P is the selling price per unit,V is the variable cost per unit,and F is the fixed cost,then the break-even point in units is:

(Multiple Choice)

4.8/5  (37)

(37)

Showing 21 - 40 of 105

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)